- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Is the Antitrust Lawsuit Over Out-of-Network Payments Shifting the Outlook for UnitedHealth (UNH)?

Reviewed by Sasha Jovanovic

- In early October 2025, the American Physical Therapy Association and its private practice partners joined a federal antitrust lawsuit against MultiPlan (Claritev) and major health insurers, including UnitedHealth Group, alleging a conspiracy to underpay physical therapists for out-of-network services.

- This legal action is part of broader challenges facing UnitedHealth Group, which is also contending with rising medical costs, Department of Justice investigations, executive turnover, and major changes to its Medicare Advantage footprint.

- We'll now explore how renewed analyst confidence and decisions to exit less profitable Medicare Advantage plans impact UnitedHealth Group’s investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

UnitedHealth Group Investment Narrative Recap

To own UnitedHealth Group shares, investors must trust in the company’s ability to manage healthcare cost pressures, regulatory scrutiny, and operational changes while maintaining its leadership in insurance and healthcare services. The antitrust lawsuit involving underpayments to physical therapists is unlikely to be material for short-term catalysts like the upcoming quarterly earnings report, but ongoing regulatory and legal risks remain central concerns for the business.

The recent announcement that UnitedHealth will exit more than 100 Medicare Advantage plans stands out, given its potential implications for short-term earnings as well as market share in government-backed health insurance. Amid shifting Medicare risks and regulatory investigations, any operational move that impacts member mix and margins could weigh on near-term performance and investor sentiment.

But before making any decisions, investors should also be aware of recent changes to government reimbursement models that...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group's outlook anticipates $501.1 billion in revenue and $20.0 billion in earnings by 2028. This scenario implies annual revenue growth of 5.8% and an earnings decrease of $1.3 billion from the current level of $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $352.21 fair value, in line with its current price.

Exploring Other Perspectives

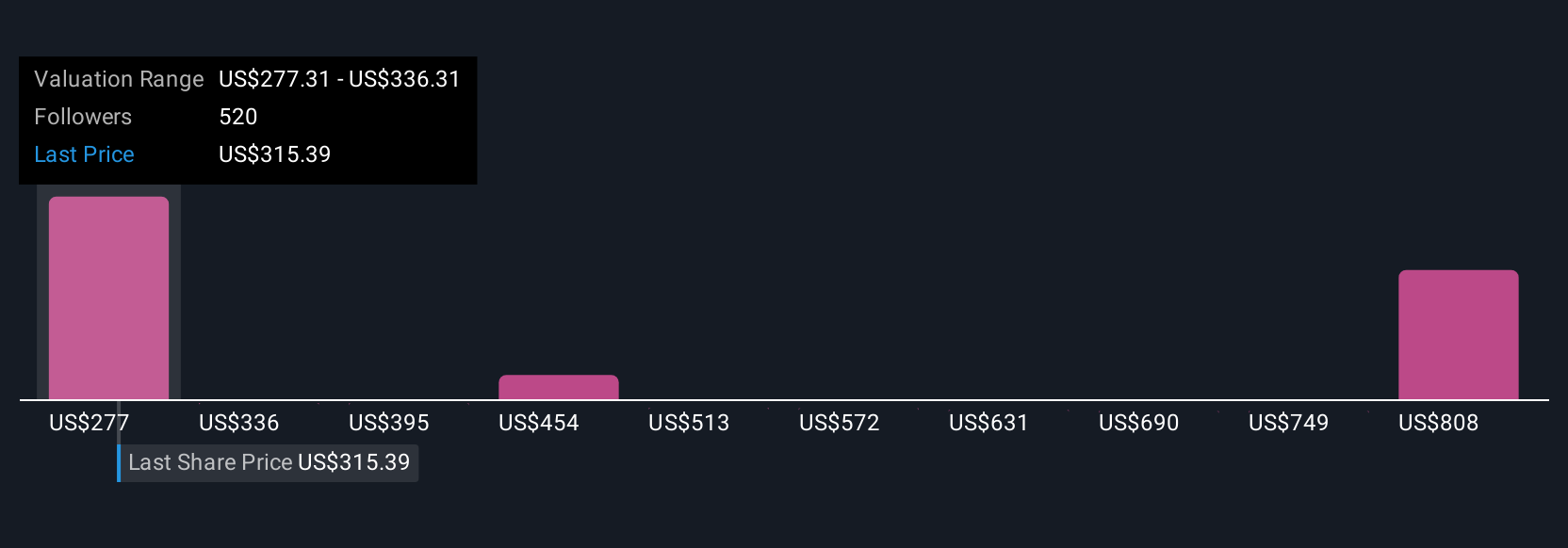

Retail investors in the Simply Wall St Community have set fair value estimates for UnitedHealth Group between US$300 and US$854, based on 86 distinct perspectives. With reimbursement model changes posing challenges for future margins, you can compare these community views to see how expectations align or differ on company performance.

Explore 86 other fair value estimates on UnitedHealth Group - why the stock might be worth over 2x more than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives