- United States

- /

- Healthcare Services

- /

- NYSE:UHS

How Prominence Health’s Medicare Savings Milestone Could Shape Universal Health Services' (UHS) Investment Outlook

Reviewed by Sasha Jovanovic

- In 2024, Prominence Health and its partner clinicians, affiliated with Universal Health Services, drove over US$100 million in Medicare savings, bringing total savings since 2014 to over US$600 million, while several of its physician-led Accountable Care Organizations ranked among the highest in state savings and quality scores.

- This achievement highlights Universal Health Services' operational effectiveness in value-based care programs and underlines its strong position in the evolving healthcare landscape.

- We'll explore how this performance in Medicare savings strengthens Universal Health Services' investment narrative and industry outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Universal Health Services Investment Narrative Recap

To own Universal Health Services (UHS), you need to believe in its ability to balance robust value-based care execution with the challenges of government reimbursement and healthcare labor costs. While Prominence Health’s US$100 million in Medicare savings this year underlines operational strength and aligns with the shift toward value-based care, it doesn't materially move the needle on near-term catalysts such as outpatient expansion or mitigate the chief risk of regulatory pressures on Medicaid supplemental payments. Of recent announcements, Universal Health Services’ ongoing investments in building outpatient behavioral health facilities is most relevant. This supports a core driver of long-term growth, capturing demand as care shifts away from inpatient settings, which complements the value proposition in Medicare savings, but doesn't fully insulate UHS from the revenue pressures that regulatory changes could cause. Yet, in contrast to these efficiency gains, investors should also be aware of the looming structural risk arising if future Medicaid supplemental payments are significantly reduced…

Read the full narrative on Universal Health Services (it's free!)

Universal Health Services is projected to reach $19.0 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a 5.0% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.3 billion.

Uncover how Universal Health Services' forecasts yield a $220.81 fair value, a 8% upside to its current price.

Exploring Other Perspectives

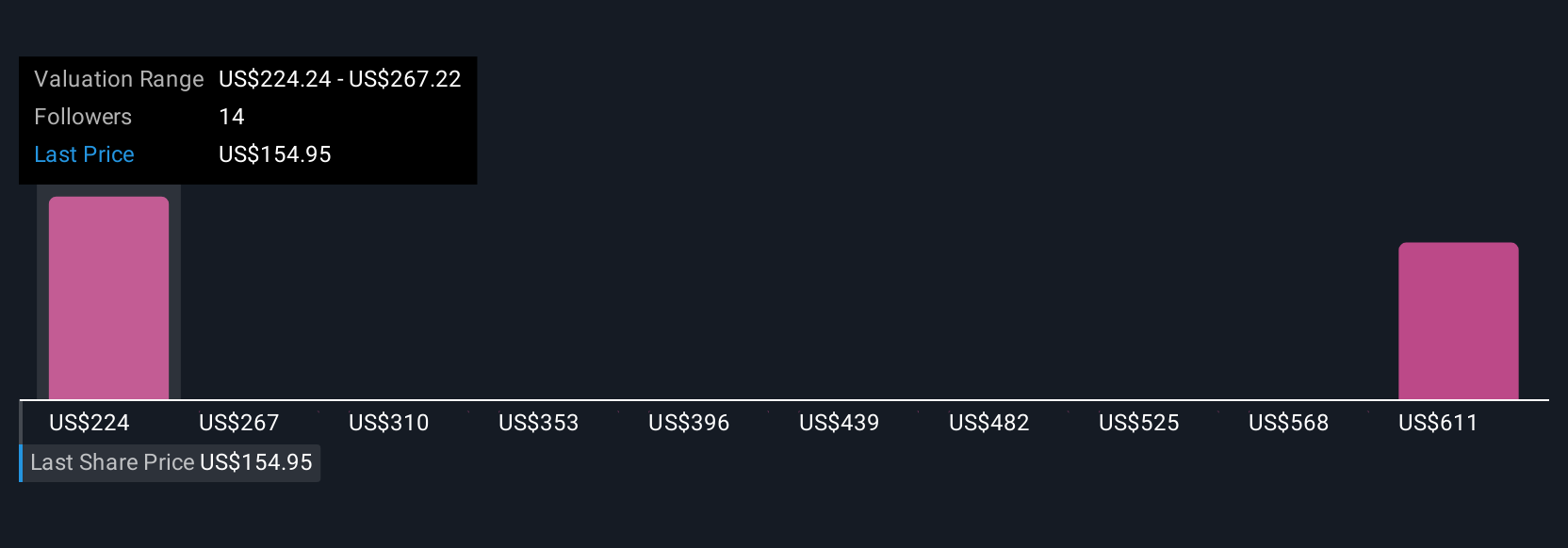

Private investors in the Simply Wall St Community set fair value estimates for UHS between US$220.81 and US$644.04, spanning 3 unique perspectives. Revenue growth drivers like outpatient behavioral health facility expansion highlight why many market participants see opportunity, but viewpoints can differ widely, so explore these alternative analyses before deciding for yourself.

Explore 3 other fair value estimates on Universal Health Services - why the stock might be worth over 3x more than the current price!

Build Your Own Universal Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Health Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Health Services' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHS

Universal Health Services

Through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives