- United States

- /

- Medical Equipment

- /

- NYSE:TFX

Teleflex (TFX): Reassessing Valuation After a Quiet 16% One-Month Share Price Rebound

Reviewed by Simply Wall St

Teleflex (TFX) has quietly climbed about 16 % over the past month after a long stretch of weak returns, drawing fresh attention from investors who are wondering whether this rebound signals a genuine shift in sentiment.

See our latest analysis for Teleflex.

That 16.25% 1 month share price return stands in sharp contrast to Teleflex’s weak longer term total shareholder returns, with the 5 year total shareholder return down 66.55%. This suggests the latest move looks more like early momentum than a full trend change.

If Teleflex’s rebound has you rethinking the sector, it could be a good moment to explore other healthcare names. You can use our curated healthcare stocks as a starting point for ideas.

With shares still down sharply over five years, earnings momentum improving, and a price hovering just above analyst targets, investors face a key question: Is Teleflex undervalued today, or is the market already pricing in its recovery?

Most Popular Narrative: 5.1% Overvalued

With Teleflex closing at $130.50 against a narrative fair value of about $124.14, the implied premium hinges on specific long term growth levers.

The recent acquisition of BIOTRONIK's Vascular Intervention business is expected to drive sustainable revenue growth of 6% or better annually beginning in 2026 and provide near term EPS accretion by expanding Teleflex's presence in the high growth interventional cardiology and endovascular procedures market. Improved access to the cath lab and cross selling opportunities are likely to boost topline revenue and margins.

Curious how steady double digit earnings expansion, rising margins, and a lower future earnings multiple can still justify only a modest upside from here? Dig into the full narrative to see which assumptions really carry the valuation.

Result: Fair Value of $124.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent UroLift weakness and integration challenges from the BIOTRONIK deal could undermine the upbeat growth and margin assumptions underpinning this valuation.

Find out about the key risks to this Teleflex narrative.

Another Lens on Value

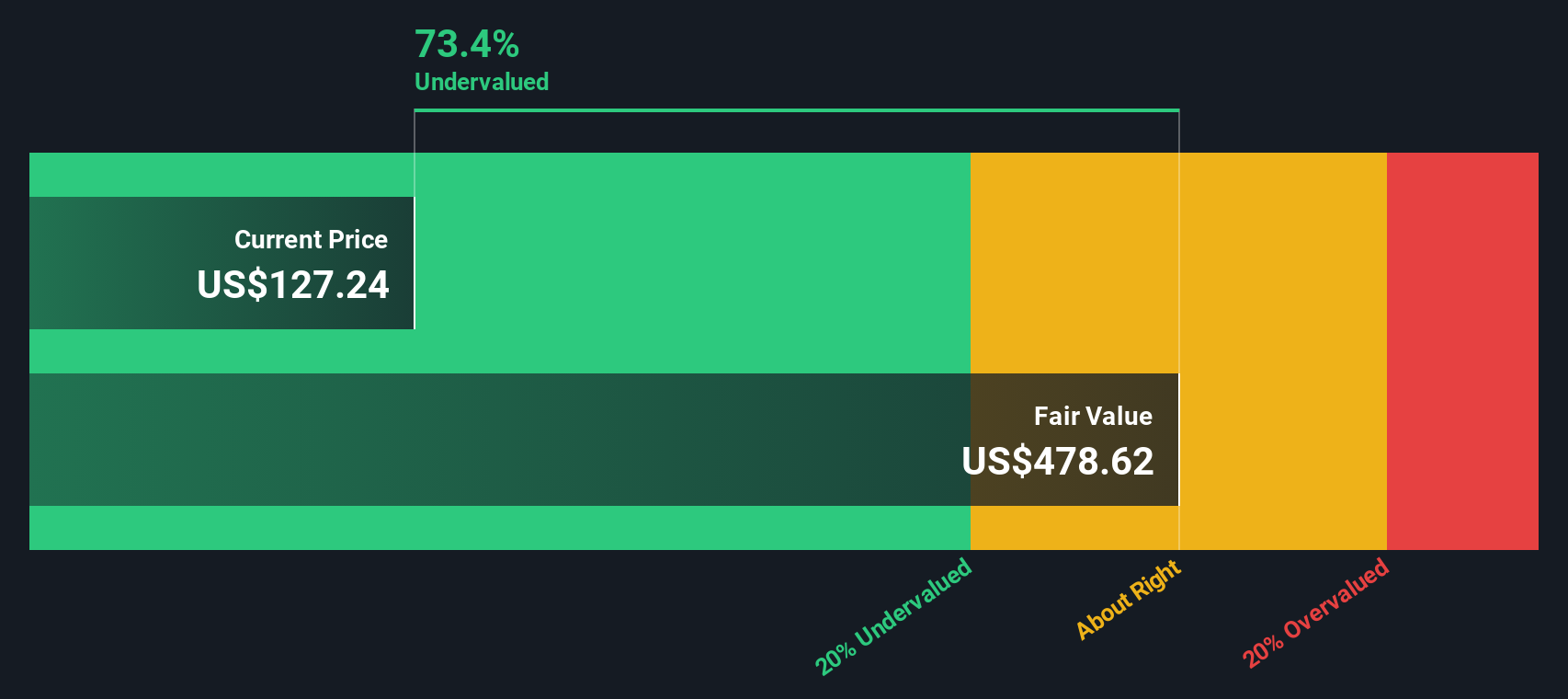

While the consensus narrative pegs Teleflex about 5% above fair value, our SWS DCF model is far more cautious, indicating the shares are significantly overvalued on a cash flow basis. When one model sees a modest premium and another flags a major downside gap, which signal do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teleflex Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Teleflex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using our powerful screener tools to uncover focused opportunities other investors might be overlooking.

- Target income potential with stable cash returns by tracking these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s yield profile.

- Position yourself ahead of the next tech wave by scanning these 26 AI penny stocks shaping developments in automation, data, and intelligent software.

- Refine your search for growth by filtering for these 3602 penny stocks with strong financials that combine smaller size with the financial strength to support expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teleflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFX

Teleflex

Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)