- United States

- /

- Healthcare Services

- /

- NYSE:SNDA

Sonida Senior Living (NYSE:SNDA) shareholder returns have been splendid, earning 123% in 5 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Sonida Senior Living, Inc. (NYSE:SNDA) share price has soared 123% in the last half decade. Most would be very happy with that. Better yet, the share price has risen 12% in the last week. But this might be partly because the broader market had a good week last week, gaining 5.2%.

Since the stock has added US$46m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Our free stock report includes 2 warning signs investors should be aware of before investing in Sonida Senior Living. Read for free now.Given that Sonida Senior Living didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Sonida Senior Living saw its revenue shrink by 14% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

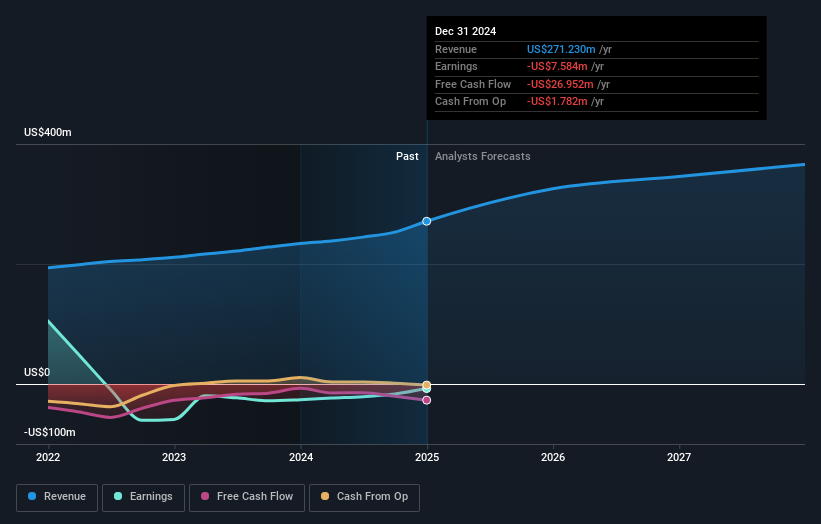

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Sonida Senior Living in this interactive graph of future profit estimates.

A Different Perspective

Sonida Senior Living shareholders are down 26% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 17% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Sonida Senior Living better, we need to consider many other factors. Even so, be aware that Sonida Senior Living is showing 2 warning signs in our investment analysis , you should know about...

Sonida Senior Living is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SNDA

Sonida Senior Living

Owns and operates senior housing communities in the United States.

Very low with concerning outlook.

Similar Companies

Market Insights

Community Narratives