- United States

- /

- Medical Equipment

- /

- NYSE:RMD

ResMed (RMD): Is There Value Left After Recent Share Price Gains?

Reviewed by Kshitija Bhandaru

See our latest analysis for ResMed.

ResMed’s share price has cooled off after a brief dip, but the big picture tells a different story. Momentum is clearly building. Even after the recent pullback, the stock is still up more than 21% year-to-date and has delivered a 17.8% total shareholder return over the past twelve months, suggesting that investors remain optimistic about its growth potential.

If you’re interested in what’s happening across the sector, check out the latest medical and healthcare stock movers with our curated screener: See the full list for free.

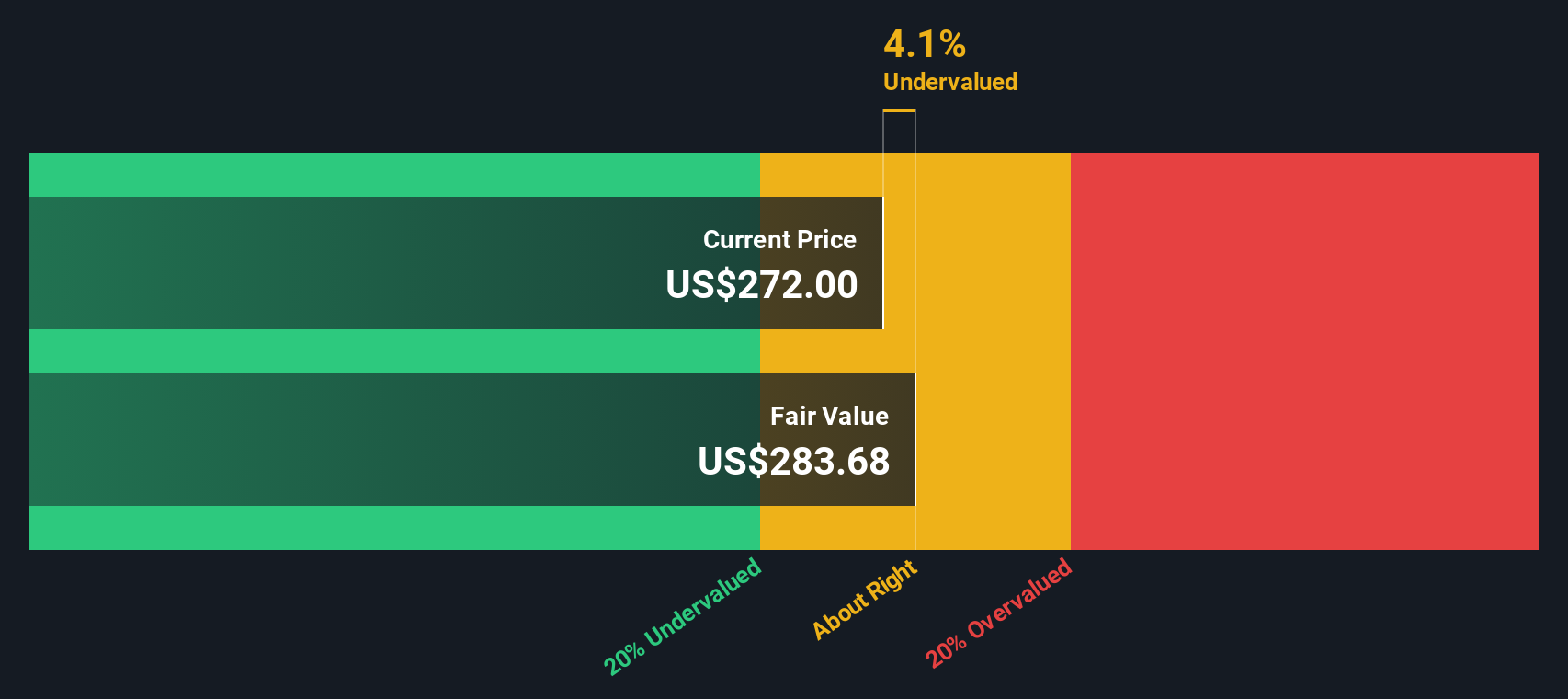

With shares trading just below analyst targets and growth metrics still robust, the question now is whether ResMed is undervalued or if the market has already factored in the company’s strong prospects. Is there still room for investors to benefit, or is future growth already reflected in the current price?

Most Popular Narrative: 4.8% Undervalued

With ResMed trading at $277.88 and the most widely followed narrative putting fair value at $291.86, there is a striking difference between the current price and expected upside. Investors are sizing up whether growth catalysts justify this higher target.

Strategic investments in expanding the diagnosis and treatment funnel, including acquisitions like VirtuOx, Ectosense, and Somnoware, are improving patient flow from screening to therapy. This positions ResMed to capture a larger share of the substantial underpenetrated global sleep apnea and respiratory market and supports long-term revenue growth.

Want to know what powers this premium valuation? The full forecast is built on ambitious growth targets for both earnings and margins, as well as future shareholder returns. Serious projections underpin the narrative. Are you ready to see what is fueling that fair value?

Result: Fair Value of $291.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening reimbursement or tougher competition from new therapies could quickly challenge these bullish projections and limit ResMed’s future earnings growth.

Find out about the key risks to this ResMed narrative.

Another View: SWS DCF Model Offers a Different Take

If you look at the SWS DCF model, the result tells a different story and suggests that ResMed is actually trading above its estimated fair value. This approach takes projected cash flows into account and points to the share price being a little ahead of itself. Could this mean there is downside risk if the growth narrative does not play out as expected?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ResMed for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ResMed Narrative

Feel like crafting a story that better fits your perspective? Dive into the data yourself and build a narrative from scratch in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ResMed.

Looking for More Investment Ideas?

Don’t miss your chance to stay ahead of market trends. Simply Wall Street’s powerful screener highlights stocks and opportunities you may not have considered yet.

- Unlock opportunities among fast-growing companies by checking out these 25 AI penny stocks transforming industries with artificial intelligence innovation.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3% that consistently deliver attractive yields and financial resilience.

- Tap into undervalued gems by using these 890 undervalued stocks based on cash flows to pinpoint stocks trading below their intrinsic worth, ready for a potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026