- United States

- /

- Medical Equipment

- /

- NYSE:PEN

How Needham’s Upgrade and Thunderbolt Launch Could Impact Penumbra (PEN) Investors

Reviewed by Sasha Jovanovic

- Shares of medical device company Penumbra recently advanced after Needham upgraded its rating, citing expectations for stronger growth driven by upcoming product launches and improved operational prospects.

- A distinctive aspect of this development is that new products like Thunderbolt could meaningfully increase revenue per procedure and support margin expansion, particularly as business conditions improve in China.

- We'll consider how the anticipated launch of Thunderbolt could shape Penumbra's market position and future earnings outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Penumbra Investment Narrative Recap

To be a Penumbra shareholder, you need confidence in the company’s ability to drive growth through medical innovation, particularly with major product launches like Thunderbolt and Ruby XL, while maintaining resilience amid evolving international market dynamics. The recent Needham upgrade highlights excitement about product-driven revenue and margin growth, but ongoing competition and technological shifts remain the biggest risks to this narrative. For now, the news strengthens the case for Thunderbolt as a key short-term catalyst, although global regulatory hurdles still present challenges.

Among recent announcements, the completion of enrollment for the STORM-PE clinical trial stands out, as trial results could further validate Penumbra’s core technology and complement the anticipated Thunderbolt launch. Both events are closely watched by the market for their potential to influence procedure volumes, adoption rates, and competitive positioning in high-growth intervention segments.

However, investors should also be aware that, in contrast to new product optimism, heightened competition and margin pressure could ...

Read the full narrative on Penumbra (it's free!)

Penumbra's outlook anticipates $1.9 billion in revenue and $274.7 million in earnings by 2028. This scenario is based on annual revenue growth of 13.6% and a $127 million increase in earnings from the current $147.7 million.

Uncover how Penumbra's forecasts yield a $303.33 fair value, a 16% upside to its current price.

Exploring Other Perspectives

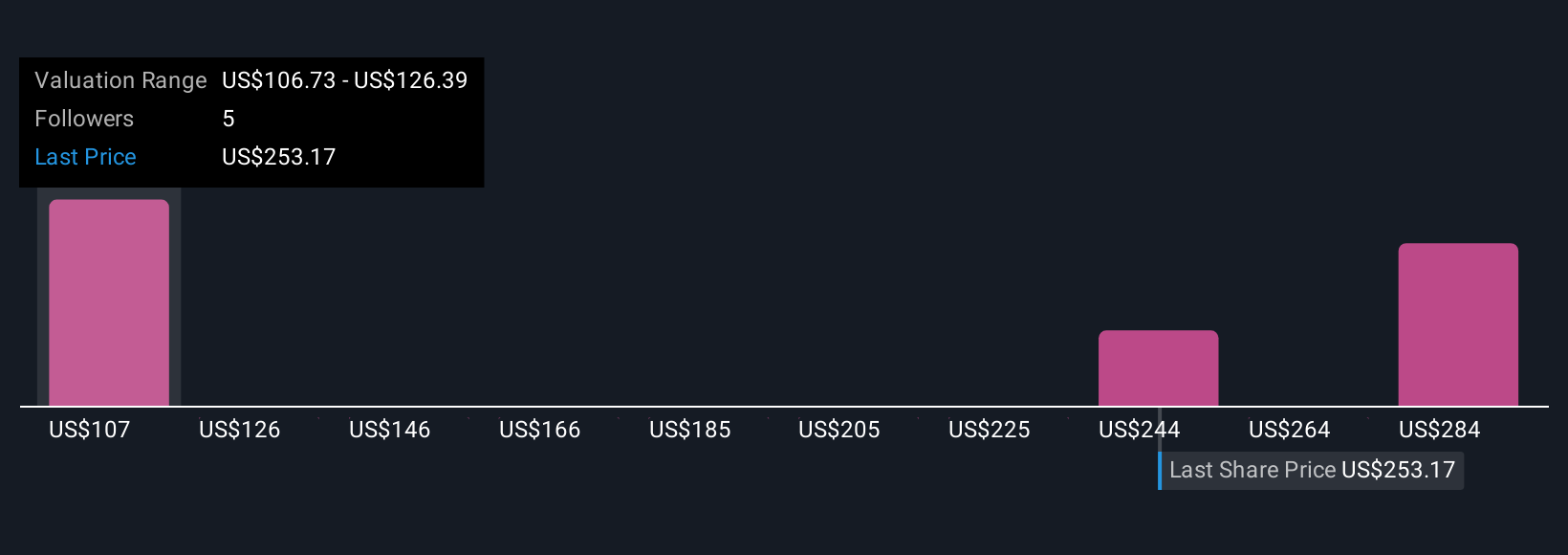

Four Simply Wall St Community fair value estimates for Penumbra range from US$106 to US$303, reflecting a wide variety of investor viewpoints. While several anticipate upside from innovation catalysts like Thunderbolt, fierce industry competition could test these expectations and affect profitability over time.

Explore 4 other fair value estimates on Penumbra - why the stock might be worth as much as 16% more than the current price!

Build Your Own Penumbra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penumbra research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Penumbra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penumbra's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives