Last Update 21 Nov 25

Fair value Increased 0.017%PEN: Upcoming Clinical Results And Balanced Outlook Will Shape 2025 Performance

Analysts have modestly raised their price target for Penumbra from $306.74 to $306.79, citing incremental improvements in projected revenue growth and a slight decrease in the discount rate as key factors supporting the adjustment.

What's in the News

- Penumbra updated its 2025 guidance, increasing expected total revenue to $1.375 to $1.38 billion, reflecting 15% to 16% growth over 2024, and maintained its gross and operating margin outlook for the year (Corporate Guidance).

- Results from the STORM-PE randomized controlled trial showed that use of computer assisted vacuum thrombectomy (CAVT) in combination with anticoagulation led to significantly better outcomes for patients with acute intermediate-high risk pulmonary embolism, including improved thrombus reduction, early physiological recovery, and greater functional improvement compared to anticoagulation alone (Product-Related Announcement).

- Penumbra completed its $100 million share repurchase plan announced in August 2024, having repurchased 517,763 shares, or 1.33% of outstanding shares. No additional shares were repurchased in the most recent tranche (Buyback Tranche Update).

Valuation Changes

- Consensus Analyst Price Target: Increased slightly from $306.74 to $306.79 per share.

- Discount Rate: Decreased marginally from 7.74% to 7.74%.

- Revenue Growth: Projected growth edged up from 13.71% to 13.73%.

- Net Profit Margin: Slipped slightly from 15.09% to 15.01%.

- Future P/E increased from 53.16x to 53.41x.

Key Takeaways

- New clinical trials and innovative product launches are expected to drive market adoption, improve margins, and accelerate growth in large, underpenetrated therapy areas.

- Expanding globally with an enhanced sales force and continued investment in data and technology supports sustainable earnings, better pricing, and long-term competitive strength.

- Heavy product and geographical dependencies, intensifying competition, and regulatory pressures threaten margins and revenue growth despite ongoing investment in R&D and sales expansion.

Catalysts

About Penumbra- Designs, develops, manufactures, and markets medical devices in the United States and internationally.

- The soon-to-be-released STORM-PE randomized trial is poised to provide Level 1 evidence comparing Penumbra's thrombectomy technology to standard anticoagulation for pulmonary embolism; a positive outcome could expand guideline adoption, significantly accelerate procedure volumes, and drive substantial revenue growth by rapidly increasing penetration in a very underpenetrated, large market.

- Penumbra's new product launches (notably RUBY XL in embolization and the planned Thunderbolt in neurovascular thrombectomy) and the expansion of specialized sales teams are set to improve product adoption and support higher-margin product mix, which should meaningfully impact gross margins and overall earnings as these innovations take share from open surgery and older alternatives.

- As global demographics shift-driven by rising stroke and vascular disease rates and an aging population-Penumbra's focus on minimally invasive therapies addresses a growing clinical need, positioning the company to benefit from secular increases in procedure volumes and supporting sustained, long-term revenue and earnings growth.

- International business is recovering following prior headwinds in China and other markets, and with recent launches of products like Flash 2.0 and Bolt lines abroad, Penumbra expects broader global demand, diversified revenue streams, and increased operating leverage as its expanded sales infrastructure matures.

- Ongoing investment in high-quality clinical data generation and further technology integration enables Penumbra to stay ahead of evolving reimbursement frameworks, which are increasingly favoring advanced, outcome-driven therapies-ultimately supporting premium pricing, improved net margins, and a durable competitive advantage over less-innovative peers.

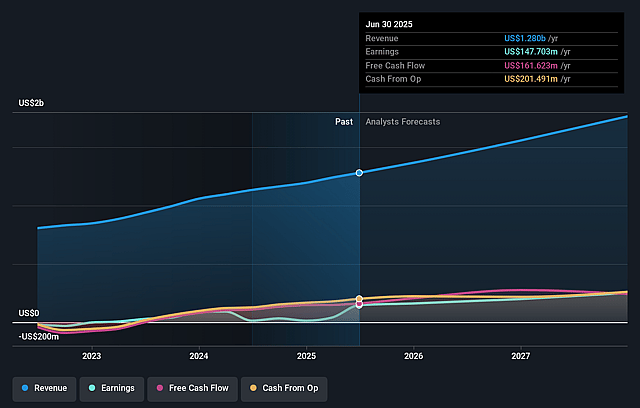

Penumbra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Penumbra's revenue will grow by 13.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 14.6% in 3 years time.

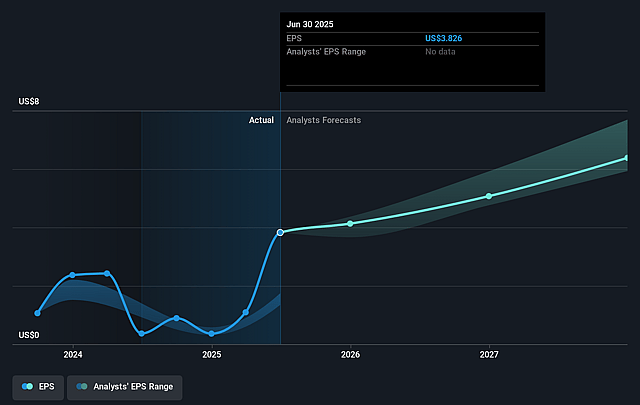

- Analysts expect earnings to reach $274.7 million (and earnings per share of $6.91) by about September 2028, up from $147.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $311.1 million in earnings, and the most bearish expecting $208.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.8x on those 2028 earnings, down from 75.8x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Penumbra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both large medtech companies and agile startups could drive commoditization of thrombectomy and embolization devices, leading to margin compression and limiting Penumbra's pricing power-potentially impacting long-term revenue growth and profitability.

- Heightened product concentration risk is evident, as Penumbra remains heavily reliant on its neurovascular and vascular intervention franchises; any technological innovation by competitors or adverse data from pivotal clinical trials (such as STORM-PE or Thunderbolt) could materially disrupt future revenue streams.

- Increasing international regulatory scrutiny and recent headwinds in China point to ongoing vulnerability in global markets; prolonged approval timelines, trade-related barriers, or recurring regional setbacks could hinder international expansion and suppress revenue growth.

- Elevated SG&A expenses and high ongoing investments in sales force expansion and R&D may pressure operating margins-particularly if anticipated revenue synergies from new hires or product launches (such as RUBY XL and the split Embo/thrombectomy sales teams) are slower to materialize than projected.

- Industry trends toward value-based healthcare and cost-containment may push hospitals and payers to negotiate lower prices and reimbursement for intervention devices, which could erode Penumbra's gross and net margins and limit earnings growth even as procedures increase.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $303.333 for Penumbra based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $186.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $274.7 million, and it would be trading on a PE ratio of 54.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $287.09, the analyst price target of $303.33 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.