- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (NYSE:MDT) Secures FDA Approval For Innovative OmniaSecure Defibrillation Lead

Reviewed by Simply Wall St

Medtronic (NYSE:MDT) recently announced FDA approval of its OmniaSecure™ defibrillation lead, marking a key advancement in cardiovascular technology, along with results from its LEADR LBBAP study showing a 100% defibrillation success rate. Over the past week, Medtronic's stock price increased by 1.9%, a move that aligned with these positive developments but was modest compared to the broader market's 4.7% rise. While Medtronic's innovative product developments could have added weight to its performance, the broader market's significant upward trend suggests other factors may have had a greater influence during this period.

Buy, Hold or Sell Medtronic? View our complete analysis and fair value estimate and you decide.

The FDA approval of Medtronic's OmniaSecure™ defibrillation lead signals a promising advancement in cardiovascular technologies which could enhance the company's revenue prospects. This development, coupled with impressive study results, aligns well with Medtronic’s focus on expanding its PFA technology and Hugo robotic platform. Notably, while Medtronic's stock price rose by 1.9% following this news, over the past year, the company's total return was 9.11%, indicating a moderate performance in a challenging market environment. In comparison, Medtronic underperformed against the broader US market and matched the US Medical Equipment industry, which had returns of 7.7% and 6.5% respectively over the same period.

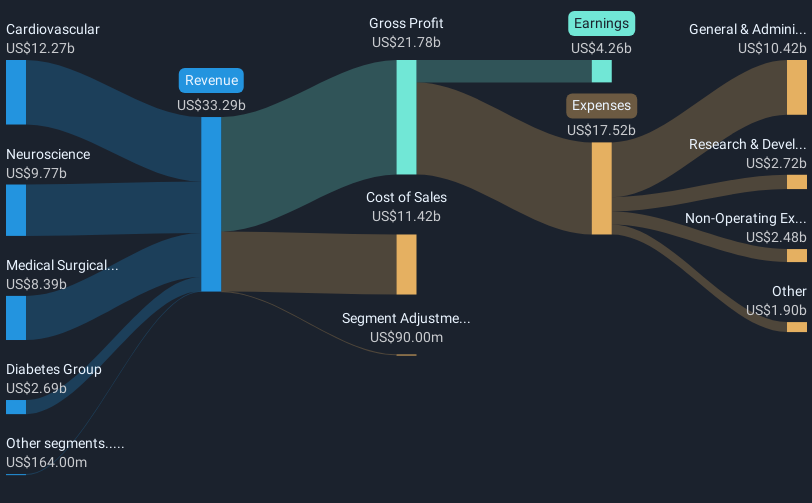

The innovative product launches anticipated in the RDN and robotic surgery sectors have potential to positively impact Medtronic’s revenue and earnings projections, as these areas are expected to drive future growth. Analysts forecast Medtronic's revenue to grow from US$33.20 billion to US$38.20 billion by 2028, with earnings increasing from US$4.26 billion to US$6.1 billion. Despite short-term stock price movements, the price target stands at US$96.83, reflecting a 13.9% potential upside from the current share price of US$83.37. Investors should consider these projections alongside the current share discount when evaluating Medtronic's investment potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives