- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (NYSE:MDT) Approves US$0.70 Cash Dividend for Q4 2025

Reviewed by Simply Wall St

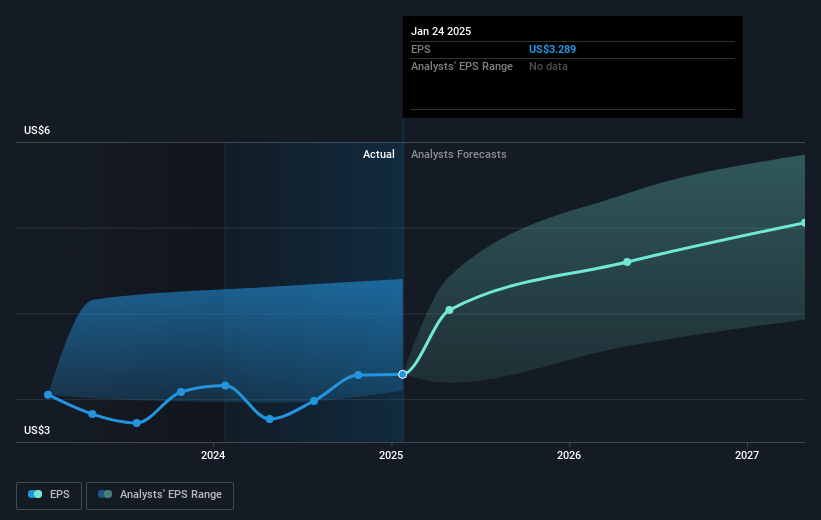

Medtronic (NYSE:MDT) reported a share price increase of 11% in the last quarter, largely reflecting its solid financial standing and strategic decisions. The affirmation of its $0.70 per share dividend showcases the company's focus on shareholder value. Despite mixed earnings results, with an increase in sales to $8,292 million but a slight decrease in quarterly net income, Medtronic's guidance for stable earnings reinforced investor confidence. The FDA approval for the BrainSense™ products has also positioned Medtronic as a leader in innovative healthcare solutions. Moreover, appointing Thierry Piéton as CFO is anticipated to bolster its financial strategies. These developments have been particularly encouraging amidst the broader stock market decline of nearly 3% due to economic concerns. Medtronic's strength amid a challenging economic backdrop is a testament to its balanced approach to growth and stability, contributing significantly to its impressive performance during the period.

Dig deeper into the specifics of Medtronic here with our thorough analysis report.

Over the past five years, Medtronic has achieved a total shareholder return of 27.17%, a reflection of its resilience and strategic decisions amid challenging market conditions. Several factors have contributed to this performance. The COVID-19 response in 2020 was pivotal, as Medtronic ramped up ventilator production and collaborated with partners to address healthcare needs, boosting its reputation and reinforcing its market position. Additionally, consistent dividend increases signaled financial stability, with the quarterly dividend rising from US$0.54 in 2020 to US$0.70 in 2025.

In the past year, Medtronic has outperformed the US Medical Equipment industry’s 5.8% return, highlighting the impact of its initiatives like the largest commercial launch of BrainSense™ technology and ongoing product development. Furthermore, consistent share buybacks—such as the repurchase of 2,879,754 shares worth US$248.41 million in late 2024—have provided ongoing shareholder value, contributing positively to the company's longer-term performance despite slightly declining profits over the five-year period.

- Discover whether Medtronic is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Medtronic's growth trajectory—explore our risk evaluation report.

- Already own Medtronic? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Medtronic, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide.

Established dividend payer and good value.