- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Evaluating McKesson (MCK) After Barclays’ Positive Initiation and Strong Growth Expectations

Reviewed by Simply Wall St

Barclays has just initiated coverage on McKesson (MCK) with a positive stance, putting fresh attention on a stock that has slipped about 3% over the past month despite upbeat earnings and revenue expectations.

See our latest analysis for McKesson.

Zooming out, McKesson’s 14.39% 90 day share price return and hefty 43.73% year to date share price gain, alongside a 41.82% one year total shareholder return, indicate that positive momentum is still very much intact.

If this kind of steady healthcare compounder has your attention, it could be a good moment to explore other potential opportunities across healthcare stocks as well.

Yet with McKesson trading about 15% below average analyst targets and implying a sizable intrinsic discount, investors face a key question: Is this a rare mispricing of a quality compounder, or is the market already baking in years of growth?

Most Popular Narrative Narrative: 12.9% Undervalued

Against McKesson’s last close of $813.80, the most followed narrative anchors on a fair value near $934.79, implying notable upside from today’s level.

Bullish analysts see McKesson's raised long term EPS growth outlook of 13 to 16 percent as a key driver of further multiple expansion and support for price targets approaching or exceeding 900 dollars per share.

North American Pharma and oncology or multispecialty businesses are viewed as the central growth engines, with updated AOI targets above prior US Pharma guidance reinforcing confidence in durable mid single digit to high single digit core AOI growth into fiscal 2026.

Want to see how double digit earnings growth, rising margins, and a still lower future earnings multiple combine to justify that valuation gap? The full narrative unpacks the exact growth runway, profitability shift, and discount rate math behind this target, and shows how much needs to go right for the story to play out.

Result: Fair Value of $934.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressure on drug pricing and accelerating vertical integration across payers and PBMs could compress margins and erode McKesson’s long term growth thesis.

Find out about the key risks to this McKesson narrative.

Another Lens on Valuation

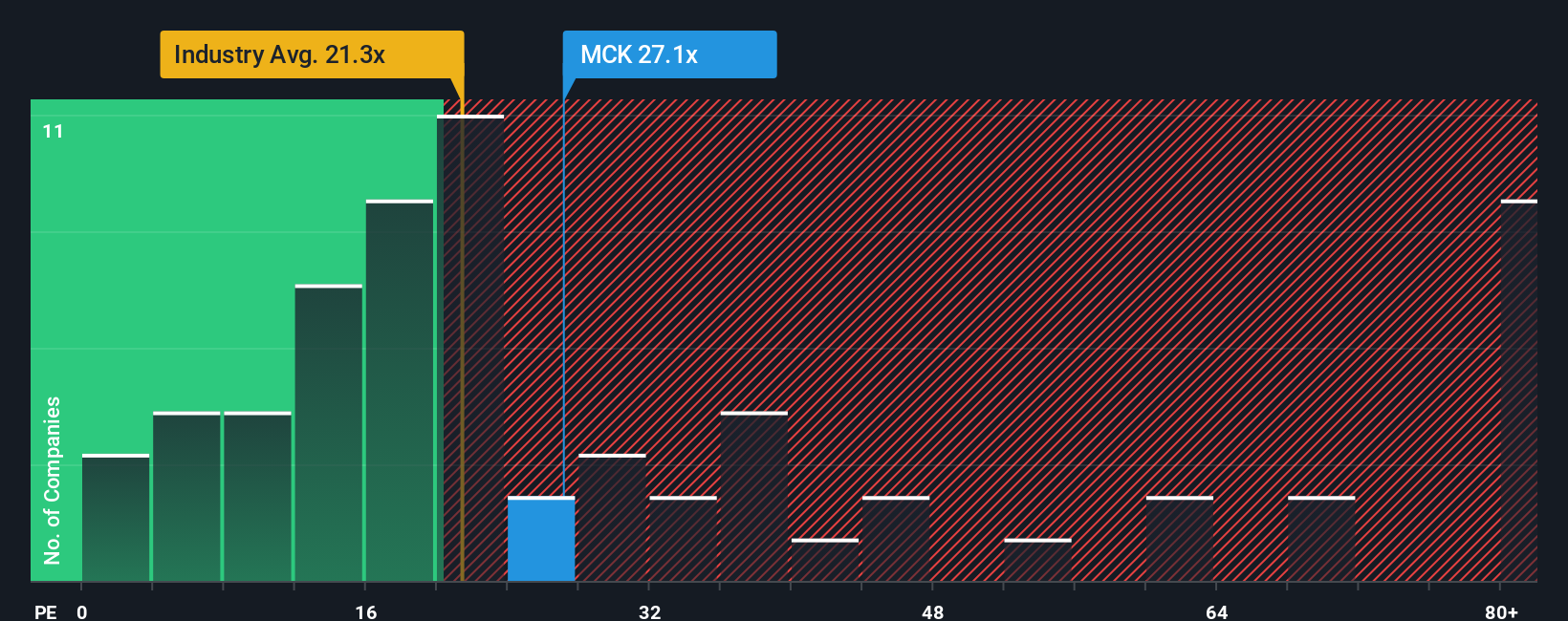

Step away from cash flow models and McKesson does not look obviously cheap. Its price to earnings ratio of 24.9 times sits slightly above the US Healthcare average of 23.7 times, but below peer levels around 28.3 times and a fair ratio closer to 33 times. This hints at both quality and some valuation risk if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McKesson Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete narrative in under three minutes: Do it your way.

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more high impact investment ideas?

If you want to stay ahead of the crowd, use the Simply Wall Street Screener to uncover focused opportunities before they become obvious to everyone else.

- Capitalize on mispriced potential by targeting companies that still look attractive on a cash flow basis through these 903 undervalued stocks based on cash flows.

- Position your portfolio for the AI revolution by zeroing in on innovators powering intelligent software, automation, and infrastructure with these 26 AI penny stocks.

- Strengthen your income stream by pinpointing reliable payers offering meaningful yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)