- United States

- /

- Healthcare Services

- /

- NYSE:LH

What Labcorp Holdings (LH)'s Slowing Growth and Margin Pressure Means For Shareholders

Reviewed by Sasha Jovanovic

- Recent commentary on Labcorp Holdings has highlighted persistently slow organic sales growth, declining adjusted operating margins, and a weaker return on invested capital, raising fresh concerns about its core laboratory and drug development operations.

- These trends suggest Labcorp may need to rethink its cost base and capital allocation, as investors question whether the company is still finding enough high-quality, profitable growth opportunities.

- Next, we’ll examine how concerns over Labcorp’s slowing organic growth and margin pressure reshape the company’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Labcorp Holdings Investment Narrative Recap

To own Labcorp, you need to believe its broad diagnostic and biopharma lab footprint can still translate into healthy, profitable growth despite slower organic sales and thinner margins. The latest commentary reinforces that the key near term catalyst is whether Labcorp can stabilize profitability in its core businesses, while the biggest risk is that persistent cost pressure and weak returns on invested capital signal a more structural profitability issue rather than a temporary setback.

Against that backdrop, Labcorp’s expanded precision oncology and digital pathology efforts, including new ctDNA tests and AI enabled pathology collaborations, look particularly relevant. These announcements speak directly to the push for higher value, complex testing and more efficient trial support, which could help offset slower organic growth elsewhere and support any margin recovery if execution is strong.

Yet, in contrast to the promise of advanced oncology and AI tools, investors should be aware that...

Read the full narrative on Labcorp Holdings (it's free!)

Labcorp Holdings’ narrative projects $15.6 billion revenue and $1.3 billion earnings by 2028. This requires 5.1% yearly revenue growth and an earnings increase of about $0.5 billion from $763.4 million today.

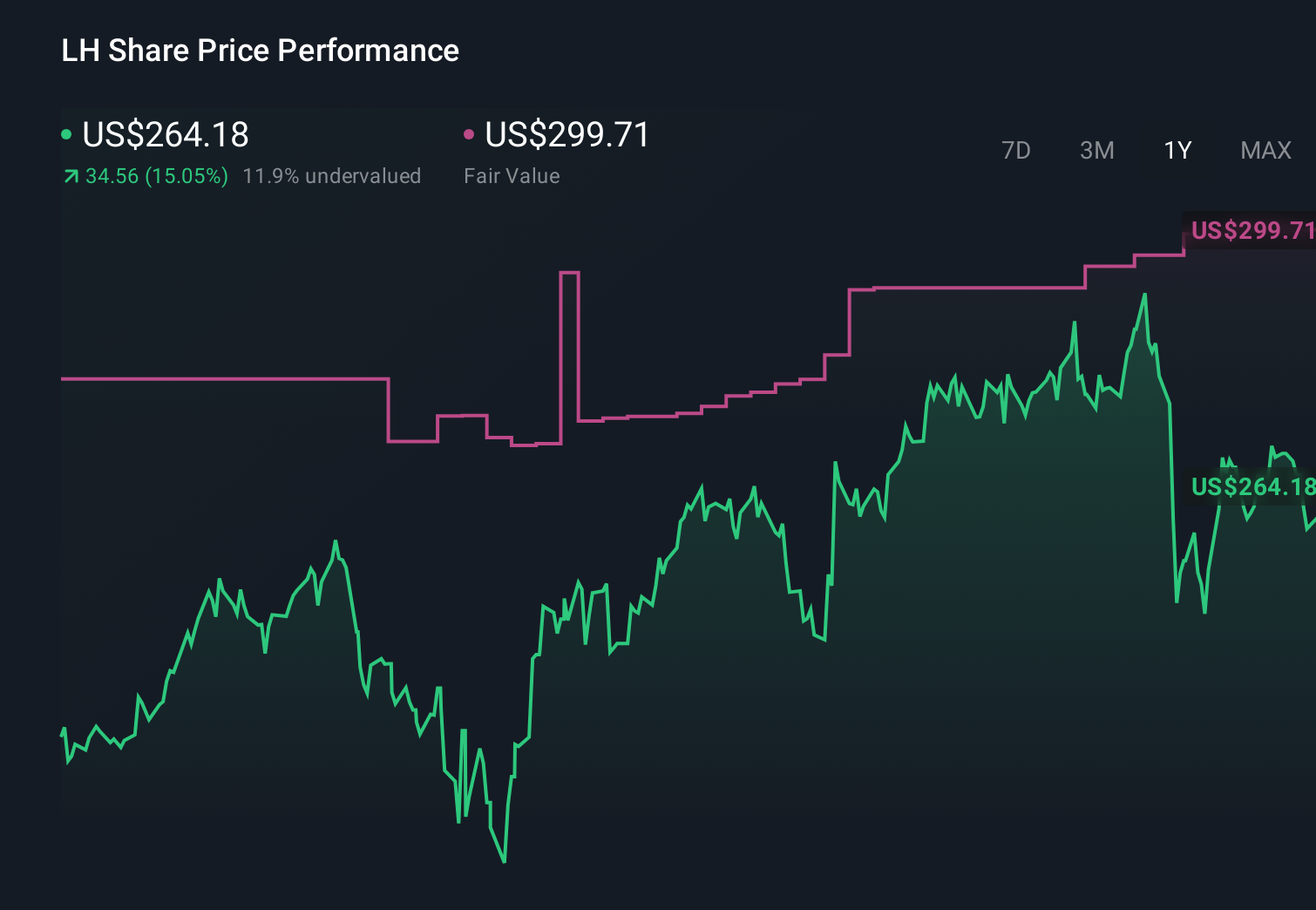

Uncover how Labcorp Holdings' forecasts yield a $299.71 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$200 to about US$574.63, underlining how far apart individual views can be. When you set those against concerns about shrinking adjusted operating margins and weaker returns on invested capital, it becomes even more important to compare different assumptions about how Labcorp’s profitability might evolve.

Explore 4 other fair value estimates on Labcorp Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Labcorp Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Labcorp Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Labcorp Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Labcorp Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LH

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)