- United States

- /

- Healthcare Services

- /

- NYSE:LH

Labcorp Holdings (NYSE:LH) Unveils Plasma Complete Liquid Biopsy Test For Personalized Cancer Care

Reviewed by Simply Wall St

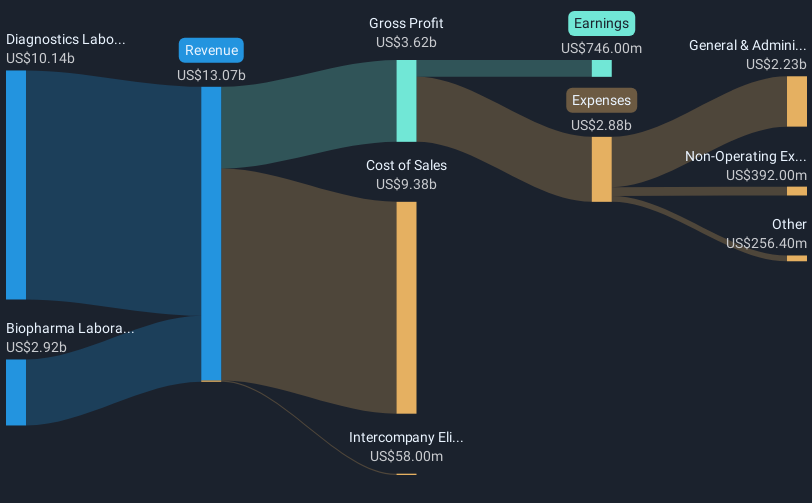

Labcorp Holdings (NYSE:LH) recently introduced the Labcorp® Plasma Complete™, a genomic profiling solution, which is a crucial development in personalized cancer treatment and is likely linked to the company's share price increase of 5% over the last quarter. This product innovation aligns with positive earnings results, as Labcorp reported a jump in sales and significant net income improvement, showcasing robust financial health. Additionally, their announcement of a share buyback program signals confidence in maintaining shareholder value. Meanwhile, market trends show a downturn with major indices like the S&P 500 and Nasdaq declining sharply, influenced by tech stock slides and economic concerns. Labcorp's relative resilience amid these broader market pressures could indicate the market's favorable reception to its strategic advancements in diagnostics and ongoing shareholder initiatives. These developments offer insights into why Labcorp's stock outperformed recently despite a challenging market scenario.

Click here and access our complete analysis report to understand the dynamics of Labcorp Holdings.

Labcorp Holdings has delivered a 61.21% total return over the last five years, reflecting solid performance amidst an evolving healthcare landscape. One significant event was Labcorp's acquisition strategy update in early 2025, which emphasized using strong free cash flow for growth-enhancing acquisitions to boost shareholder returns. Adding to its innovative portfolio was the FDA authorization in August 2024 for the PGDx elio™ Plasma Focus Dx test, a first-of-its-kind genomic profiling solution.

Share repurchase programs also bolstered investor confidence, with 14.92% of shares bought back since December 2021, amounting to US$3.19 billion. Labcorp's earnings announcement in February 2025 highlighted a rebound with sales reaching US$13.01 billion in 2024, up from the previous year. Lastly, declaring consistent quarterly dividends, including a US$0.72 per share payout in January 2025, reinforced a commitment to shareholder value, contributing to its resilient five-year performance in a competitive market.

- See whether Labcorp Holdings' current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Labcorp Holdings' growth trajectory—explore our risk evaluation report.

- Is Labcorp Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LH

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives