- United States

- /

- Healthcare Services

- /

- NYSE:LH

Labcorp Holdings (NYSE:LH) Launches Labcorp Plasma Complete For Personalized Cancer Treatment

Reviewed by Simply Wall St

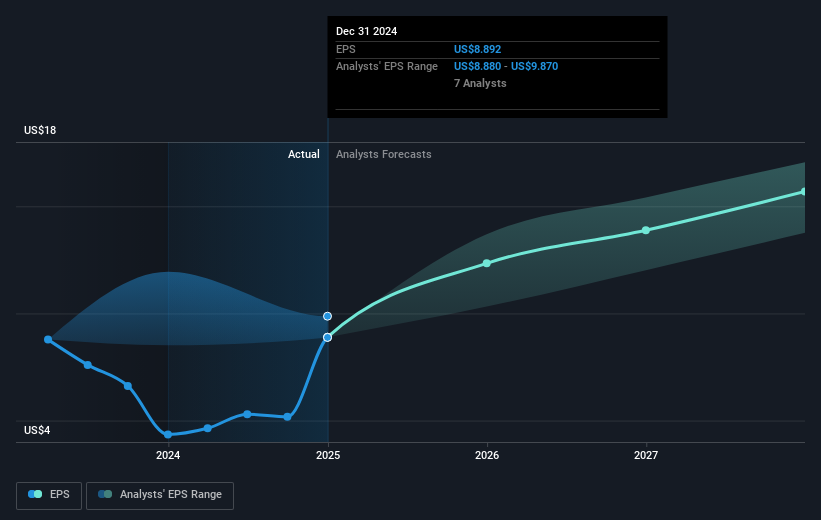

Labcorp Holdings (NYSE:LH) recently experienced a share price increase of 5% over the last quarter, potentially driven by significant corporate developments. The launch of Labcorp® Plasma Complete, a ctDNA-based genomic profiling solution, added a valuable tool to their oncology diagnostics portfolio, offering advanced clinical benefits. This move was complemented by positive financial results, including a jump in full-year net income from $418 million to $746 million, and impressive Q4 earnings. Additionally, Labcorp’s share repurchase program and announced dividend of $0.72 per share may have further buoyed investor sentiment. While the broader market saw a recent downturn with major indexes declining, Labcorp’s robust performance in both financial metrics and innovative product offerings likely helped maintain its positive trajectory against the general market trend. As markets remain volatile with major indices in negative territory for February, Labcorp's targeted developments and financial strength highlight its resilience.

Take a closer look at Labcorp Holdings's potential here.

Labcorp Holdings' total shareholder return, including dividends, amounted to 60.20% over the past five years. Throughout this period, Labcorp has pursued several key initiatives shaping its long-term share performance. The company’s forward momentum is partly attributed to its recent strategic acquisitions aimed at bolstering organic growth. In 2024, the company launched innovative diagnostic solutions such as the H5 bird flu molecular test and the pTau217 test for Alzheimer’s disease diagnosis, expanding its neurology portfolio.

Further strengthening investor confidence, Labcorp engaged in shareholder-friendly activities, including an ongoing share buyback program, which completed nearly 15% of its announced tranche by December 2024. Despite some challenges, such as a Return on Equity perceived as low compared to benchmarks, the company's operational enhancements and market-sensitive product announcements have reinforced its competitive edge, distinguishing its performance within the US Healthcare industry. Impressively, Labcorp's performance even outpaced the healthcare industry's -11.4% one-year return.

- See how Labcorp Holdings measures up with our analysis of its intrinsic value versus market price.

- Understand the uncertainties surrounding Labcorp Holdings' market positioning with our detailed risk analysis report.

- Already own Labcorp Holdings? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LH

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives