- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

Assessing Integer Holdings (ITGR) Valuation Following Analyst Upgrade and Improving Margins

Reviewed by Kshitija Bhandaru

A recent analyst upgrade has put Integer Holdings (ITGR) back in the spotlight. Improving operational performance and margin expectations have renewed interest in the company’s future direction and potential for earnings growth.

See our latest analysis for Integer Holdings.

Integer Holdings’ share price has slid almost 24% year-to-date and remains under pressure from sector headwinds, including recent trade tensions and supply chain worries that hit many healthcare and medtech names. Momentum is still muted despite this week’s analyst upgrade. The multi-year total shareholder return of nearly 87% over three years reminds investors of what’s possible when sentiment turns and operational improvements persist.

If Integer’s margin-focused turnaround story has you looking for other opportunities, you might want to check out the See the full list for free..

Amid steady margin improvement and an analyst upgrade, the real question is whether Integer Holdings is a bargain waiting to be discovered or if the market has already factored in every ounce of future growth potential.

Most Popular Narrative: 28% Undervalued

The latest narrative sets Integer Holdings’ fair value at $140.88, a sizable premium to the last close of $101.05. This gap has sparked renewed debates about what the market is missing as analyst optimism persists.

Ongoing investments in manufacturing automation and operational excellence initiatives are yielding sequential gross and operating margin improvements, with expectations for further quarterly expansion through the year. These trends are underpinning continued net margin and earnings growth.

What's powering this bullish target? The narrative hints at sustained earnings momentum backed by a fundamental shift in margins. The real question, though: What are the bold assumptions driving this figure? Curious to see which growth levers justify that eye-catching upside? The real details are just a click away.

Result: Fair Value of $140.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some analysts warn that recent outperformance may owe more to timing shifts and customer concentration. This raises concerns about the durability of underlying demand.

Find out about the key risks to this Integer Holdings narrative.

Another View: A Multiples-Based Reality Check

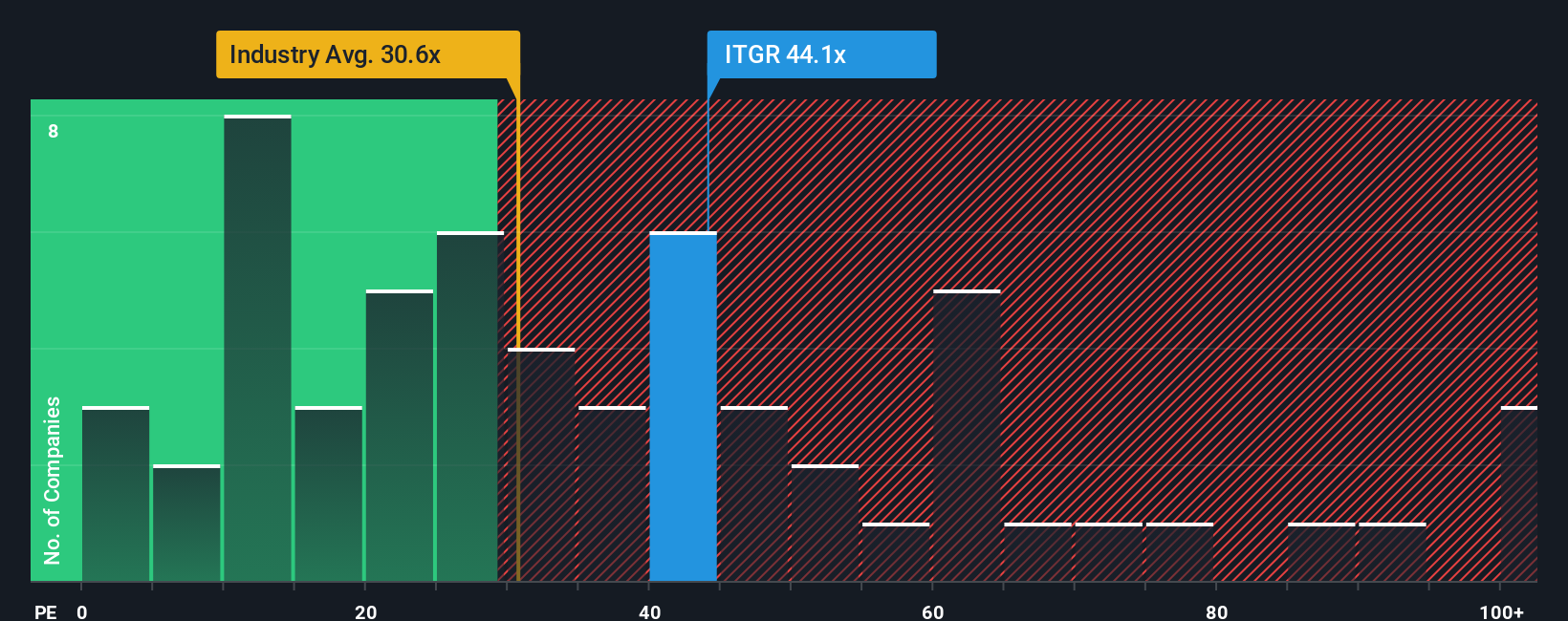

While analyst targets suggest Integer Holdings is undervalued, a closer look at its price-to-earnings ratio presents a more cautious story. Currently, the company trades at 42.2 times earnings, higher than both the US Medical Equipment industry average of 29.5x and its own calculated fair ratio of 35.5x. This gap indicates the stock is priced for high expectations and leaves little room for error if growth stalls. Does this premium provide enough margin for future upside, or does it set the bar too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Integer Holdings Narrative

If you’d rather dig into the numbers personally and build your perspective, you can craft your own Integer Holdings narrative in just minutes: Do it your way.

A great starting point for your Integer Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by targeting stocks with major upside. Simply Wall St's screeners unlock unique opportunities that savvy investors should not overlook.

- Catch the wave of sector disruption when you evaluate opportunities across these 24 AI penny stocks which are changing the landscape through artificial intelligence breakthroughs.

- Build reliable income with confidence as you uncover these 19 dividend stocks with yields > 3% offering attractive yields to strengthen your portfolio's returns.

- Position yourself for maximum value by zeroing in on these 893 undervalued stocks based on cash flows trading below their intrinsic worth, putting growth potential firmly on your side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives