- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Valuation in Focus Following Patent Lawsuit from Nyxoah

Reviewed by Kshitija Bhandaru

If you’re holding or watching Inspire Medical Systems (INSP), the past week likely got your attention. News broke that Nyxoah has filed a lawsuit against Inspire, claiming that its Inspire IV and V devices infringe on three patents. While patent disputes are not uncommon in the medtech world, the call for injunctive relief and damages adds pressure. Possible impacts on Inspire's flagship portfolio are not something investors can easily shrug off.

This lawsuit arrives on the heels of a turbulent year for Inspire. The stock has steadily lost ground, down 64% over the past year, with momentum fading well before this legal challenge surfaced. That’s despite annual revenue and net income climbing at double-digit rates, which signals that fundamentals and share price are moving in different directions. Against this backdrop, the sudden legal risk is just the latest curveball for investors sizing up Inspire’s long-term story.

After a drop like this, is Inspire Medical Systems trading at a discount with too much gloom already in the price, or is the market just waking up to new risks that could weigh on future growth?

Most Popular Narrative: 45.7% Undervalued

The most widely followed valuation narrative sees Inspire Medical Systems as trading at a steep discount to fair value.

Expanded coverage and proposed reimbursement increases for Inspire's procedures, notably the expected 2026 Medicare OPPS rule enhancements and near-complete payer coverage of the new CPT code, are anticipated to reduce patient out-of-pocket costs. This is expected to incentivize additional adoption, supporting both revenue growth and longer-term earnings visibility.

Curious about what’s powering this bold undervaluation call? The narrative points to a future driven by increasing patient demand and a profit outlook typically associated with market standouts. The key factors behind this forecast involve assumptions that may surprise even seasoned industry observers. Want to see which ambitious projections support this target? Explore the full analysis to discover the figures driving this valuation.

Result: Fair Value of $144.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent rollout delays and growing competition could pressure Inspire Medical Systems’ growth outlook. This may challenge the most optimistic valuation scenarios in the months ahead.

Find out about the key risks to this Inspire Medical Systems narrative.Another View: Market Ratio Check Tells a Different Story

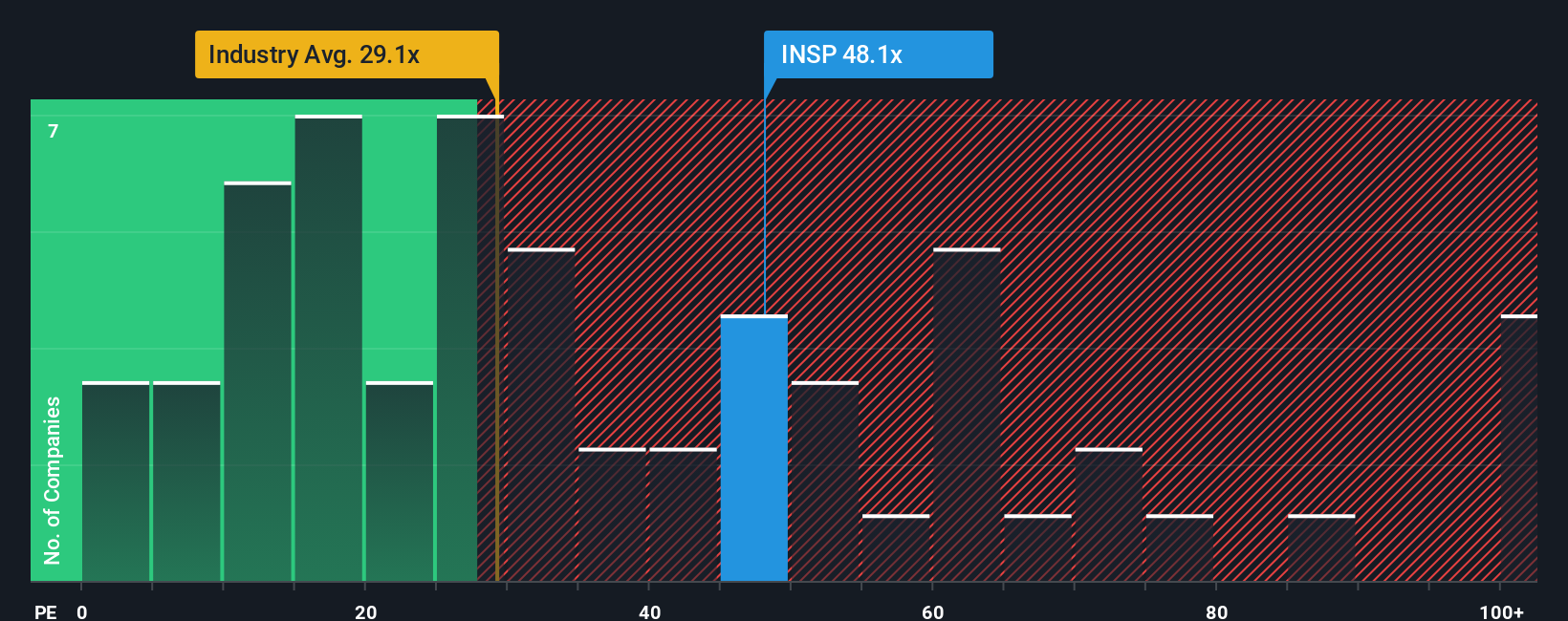

Looking at Inspire Medical Systems through a market earnings ratio lens reveals a less optimistic reading than the first narrative. This approach signals that the shares may actually be expensive compared to the industry. Does this challenge the bullish outlook from earlier?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Inspire Medical Systems to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Inspire Medical Systems Narrative

If you want to dig into the facts or form your own perspective, you're free to piece together your own view in just a few minutes. Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step confidently into your next opportunity by trying these handpicked strategies. Don’t let standout stocks pass you by; your next move could transform your portfolio.

- Tap into rapid tech evolution by checking out the latest breakthroughs and momentum stocks in AI penny stocks.

- Spot hidden value where most investors aren’t looking and give yourself a head start with undervalued stocks based on cash flows.

- Capture stronger income potential from companies with attractive yields. Raise your game with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives