- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Evaluating Valuation After New Clinical Outcomes Data Highlights Inspire V Progress

Reviewed by Kshitija Bhandaru

Inspire Medical Systems (INSP) released new clinical outcomes data for its Inspire V system, revealing improved safety and patient adherence in both Singapore and the United States. The findings highlight superior therapy outcomes and successful procedures.

See our latest analysis for Inspire Medical Systems.

While Inspire Medical Systems’ new clinical outcomes data is promising, recent stock momentum has not reflected this optimism. After a sharp reset in full-year guidance and ongoing legal investigations tied to their Inspire V launch, the company’s share price has delivered a 2% gain over the last day and 8% for the week, but remains down nearly 57% year-to-date. Total shareholder returns have fared even worse, with a drop of almost 61% over the past year. This signals investor caution as operational execution and regulatory risks continue to weigh on the long-term picture.

If you’re interested in finding more companies at the forefront of healthcare innovation, there’s never been a better time to explore See the full list for free.

With shares trading far below analyst price targets and strong clinical data in hand, the key question for investors is whether Inspire Medical Systems is undervalued at these levels or if the market is fully pricing in future risks and growth.

Most Popular Narrative: 40.7% Undervalued

Inspire Medical Systems closed at $80.14; the most widely followed narrative values the shares far higher, suggesting substantial upside based on future catalysts rather than current headwinds.

The second half of 2025 will see a ramp in marketing and new center expansion following a purposeful pause in H1 amid the Inspire V launch. This resurgence in patient education, awareness campaigns, and provider capacity building should drive higher procedure volumes and top-line acceleration into 2026 and beyond.

How does the narrative justify such a high fair value? The growth assumptions fueling this calculation might surprise you; they go beyond clinical results or market penetration alone. Want to see what bold projections stake this premium? Discover which core metrics are behind these optimistic expectations and how they shape the future outlook.

Result: Fair Value of $135.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow onboarding delays and rising competition could weaken Inspire Medical Systems' recovery. These factors pose tangible risks to the bullish outlook described above.

Find out about the key risks to this Inspire Medical Systems narrative.

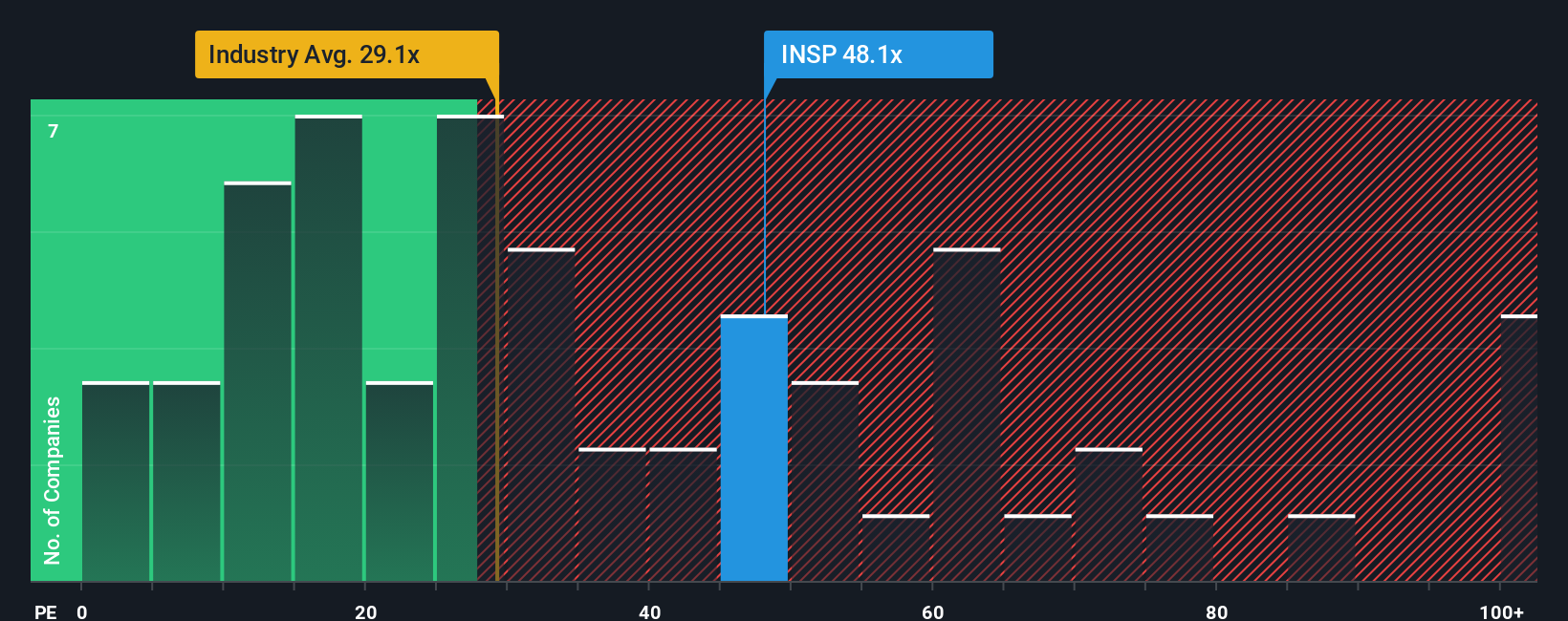

Another View: Multiples Tell a Different Story

While the fair value estimate points to an undervalued opportunity, the market’s price-to-earnings ratio for Inspire Medical Systems sits at 44.6x. This is notably higher than both the industry average of 30.5x and its peer average of 40.1x, and it remains well above the fair ratio of 36.2x.

Such a premium suggests investors are paying up for future growth, but it also amplifies the risk if the company fails to deliver. What might happen to the share price if market sentiment shifts or earnings growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you see potential for a different outcome, or want to analyze the data firsthand, you can quickly build your own perspective in just minutes with Do it your way

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss your chance to power up your portfolio with investment themes making headlines. See what’s moving the markets right now and uncover hidden potential others overlook.

- Capitalize on high-yield potential by checking out these 18 dividend stocks with yields > 3% for companies offering robust dividends and superior financial strength you won’t want to miss.

- See which innovations are transforming medicine and patient care. Dive into breakthrough opportunities with these 32 healthcare AI stocks leading healthcare’s next wave.

- Ride the technology megatrend by scanning these 25 AI penny stocks that are revolutionizing industries with machine learning, automation, and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives