- United States

- /

- Medical Equipment

- /

- NYSE:INSP

How Inspire V’s Strong Clinical Results and Efficiency Gains Will Impact Inspire Medical Systems (INSP) Investors

Reviewed by Sasha Jovanovic

- Inspire Medical Systems recently published new clinical outcomes data for its Inspire V system, highlighting superior efficacy, reduced surgical times, and strong safety in a Singapore study, alongside successful results from a limited US market release involving 101 patients at 10 centers.

- The company reported a 20% reduction in surgical times and a higher rate of successful procedures versus its previous-generation device, with all US trial participants continuing therapy and no serious adverse events observed.

- We'll examine how these improved clinical outcomes and workflow efficiencies with Inspire V could influence Inspire Medical Systems' investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Inspire Medical Systems Investment Narrative Recap

To be a shareholder in Inspire Medical Systems, you need to believe in the sustained demand for implantable sleep apnea solutions and the company’s ability to deliver clinical innovation while navigating operational and reimbursement hurdles. The recent Inspire V clinical outcomes data, which showed improved efficacy, reduced surgery times, and strong safety, support the company’s path to reaccelerate procedure volumes, but do not materially change the biggest short-term catalyst: the speed of onboarding and training new centers. Execution risk around the Inspire V rollout and maintaining smooth center adoption remains the primary concern.

Among Inspire’s recent announcements, the proposed 2026 Medicare reimbursement changes tied directly to Inspire V are most relevant. These evolving reimbursement levels could further incentivize adoption, working in tandem with clinical advances to support volume growth, making the link between payer dynamics and real-world uptake a central theme for the business in the coming quarters.

By contrast, investors should also be aware of the lingering risk from delays in onboarding and training new centers if Inspire V’s wider rollout continues to...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems is projected to reach $1.3 billion in revenue and $103.6 million in earnings by 2028. This outlook is based on analysts forecasting annual revenue growth of 14.5% and an increase in earnings of $50.5 million from the current $53.1 million level.

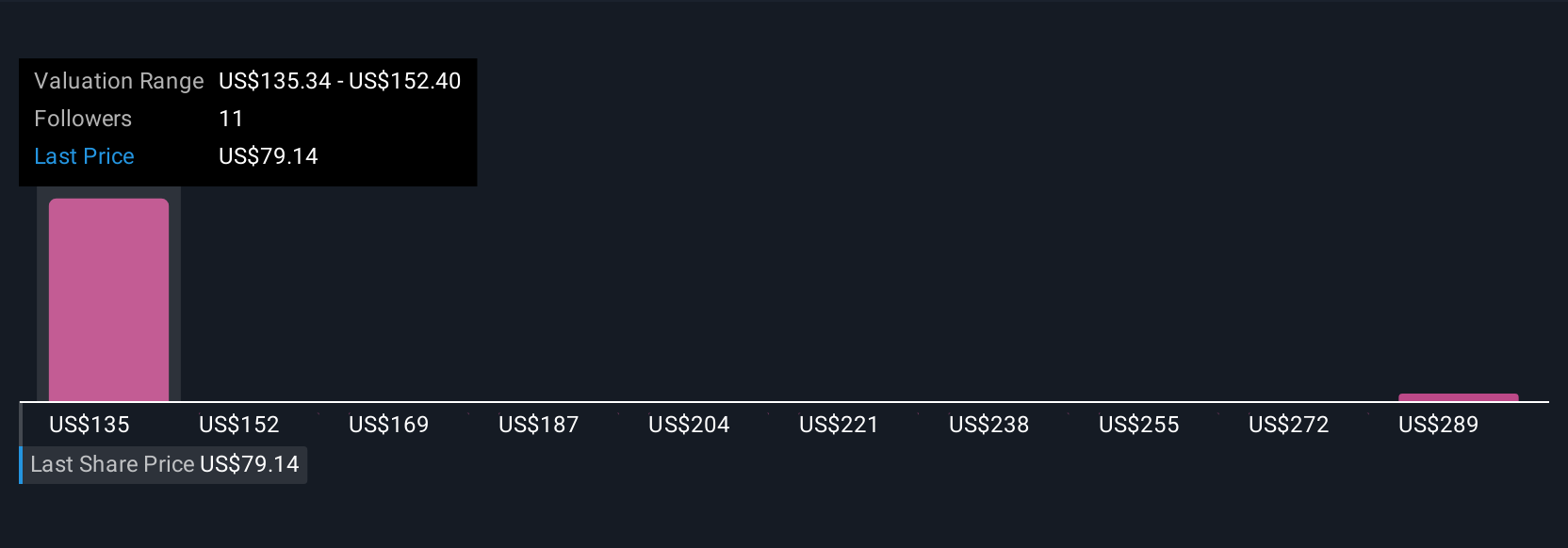

Uncover how Inspire Medical Systems' forecasts yield a $135.13 fair value, a 74% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Inspire Medical Systems’ fair value between US$93.33 and US$305.94, based on 8 unique analyses. With ongoing reimbursement changes still taking shape, your outlook may depend on how you weigh operational execution against these optimistic or cautious valuations.

Explore 8 other fair value estimates on Inspire Medical Systems - why the stock might be worth just $93.33!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives