- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Is Now the Moment to Revisit Humana After This Week’s 12% Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with your Humana shares or eyeing an entry point? You’re far from alone as investors size up the sharp twists and turns in the stock’s performance over the past few years. Whether you hold a longtime portfolio position or are just kicking the tires on this healthcare heavyweight, it’s clear that Humana’s recent moves have left some scratching their heads and looking for opportunity.

Let’s look at how the market has been treating Humana. In just the last week, shares took a steep 12% dip, which may seem like panic selling, especially given the steady downward drift of nearly 5% for the month. Step back for a moment, and the story shifts. A modest gain of 3.8% for the year so far, and a virtually flat 4% total return over the past year, tells us the market’s caution is not entirely new. Over the longer term, it is true that Humana has not kept up with peers, posting a 45.9% drop over three years and a 37.3% slide over five. These swings reflect more than just sector jitters; the evolving health policy landscape and shifting competitive dynamics have kept the risk perception in flux and made every price dip or recovery feel meaningful.

But does the current price actually represent good value, or is there more pain ahead? Here is where it gets interesting: by classic valuation standards, Humana scores a 5 out of 6, signalling undervaluation on nearly all the major checks we track. Next, we will dive deeper into the specific valuation methods behind that score and explore why an even more accurate measure of worth might be just around the corner.

Approach 1: Humana Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the current fair value of a company’s shares by projecting its future cash flows and then discounting those projections back to today, reflecting both time and risk. This approach gives long-term investors an idea of what the business might truly be worth beyond just recent market swings.

For Humana, analysts project Free Cash Flow (FCF) of $2.07 Billion (latest reported), with forecasts climbing steadily over the next several years and reaching nearly $3.74 Billion by 2029. Keep in mind, while analysts have provided estimates for the first five years, the remaining projections are extrapolated based on historical patterns and industry expectations.

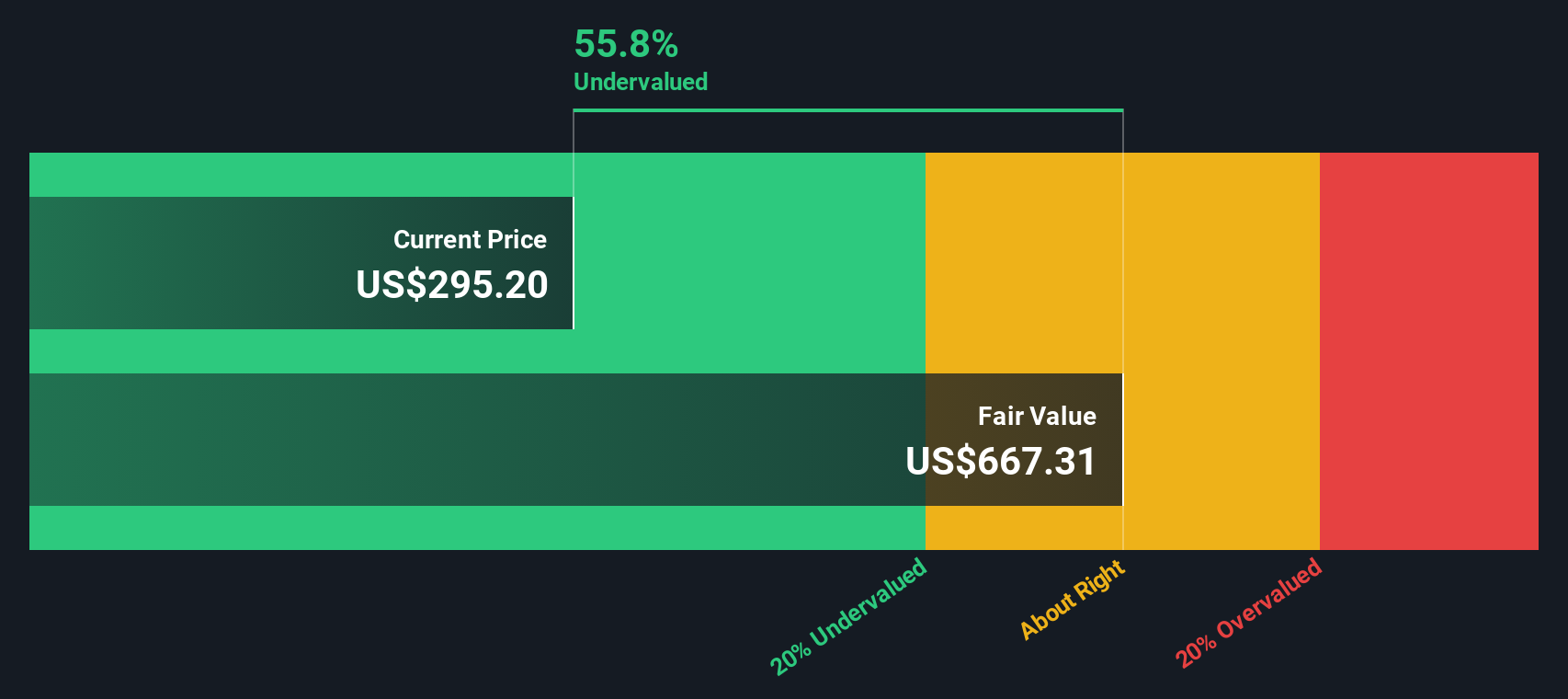

Based on these projections, the DCF model places Humana’s intrinsic value at $667.31 per share. Given the current market price, this equates to a substantial intrinsic discount of 60.7%, suggesting the stock is significantly undervalued according to these long-term cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Humana is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Humana Price vs Earnings (P/E)

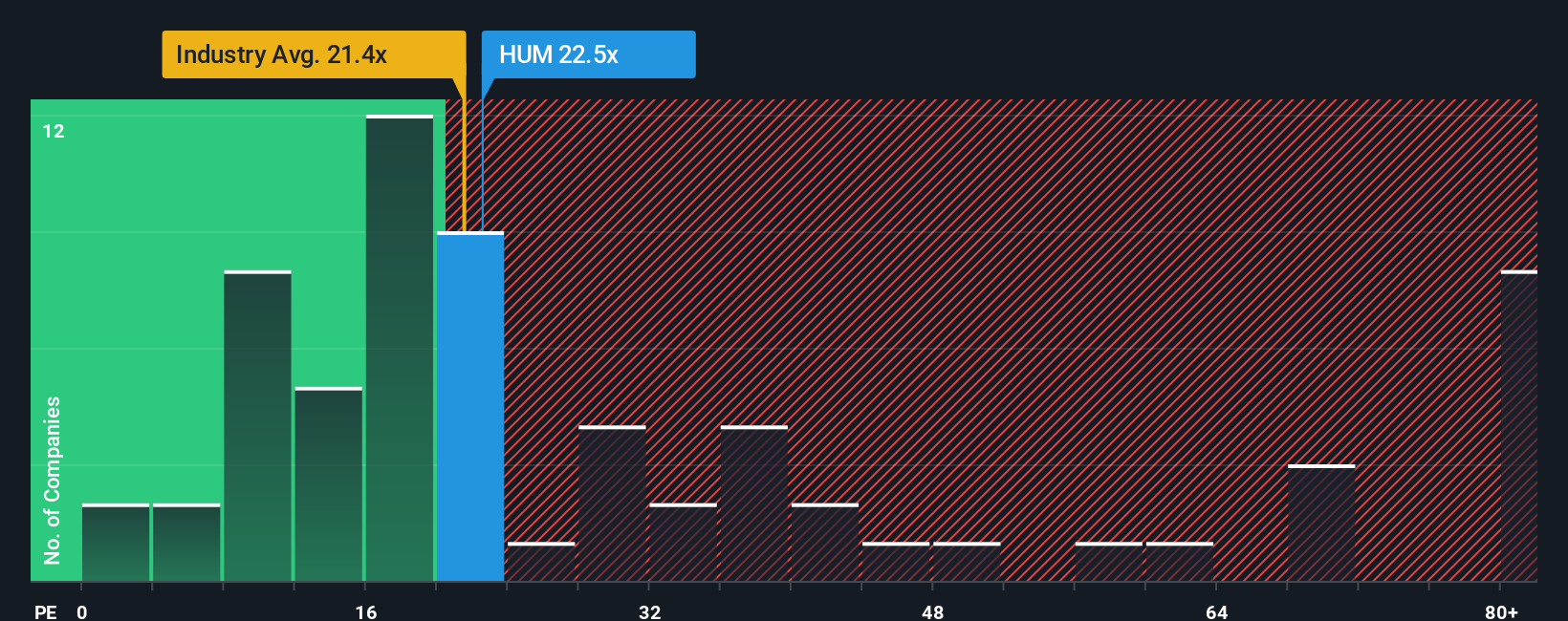

The Price-to-Earnings (P/E) ratio is widely recognized as a useful gauge for valuing established, profitable companies like Humana. It tells investors how much they are paying for each dollar of current earnings and helps to compare companies regardless of their absolute size. Typically, a "normal" or "fair" P/E ratio reflects an investor’s collective view on a company’s future growth prospects and risk, with faster-growing, less risky businesses commanding higher multiples and vice versa.

Right now, Humana trades at a P/E ratio of 20x. That sits slightly below both the Healthcare industry average of 20.8x and the average among its peers at 21.8x, suggesting the market sees Humana’s prospects as somewhat muted compared to the broader sector. However, these benchmarks do not consider Humana’s unique blend of growth, profit margins, risks, and market position.

This is where Simply Wall St's "Fair Ratio" comes in. Unlike a simple comparison to industry averages or peers, the Fair Ratio reflects a proprietary estimate of what Humana’s P/E should be, factoring in its earnings growth, margins, competitive landscape, and risk profile, as well as its size within the market. Humana's Fair Ratio is estimated at 38.4x, which is much higher than its actual P/E of 20x. This wide gap suggests that even after accounting for the company’s fundamentals and risks, Humana appears to be trading significantly below its fair value based on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Humana Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a clear story behind the numbers, where you connect your views on Humana’s strategy, risks, and industry changes to your own forecasts for future revenue, earnings, and profit margins. This approach helps build out the fair value you believe is most reasonable for the company. Narratives go beyond static ratios by tying together everything you know or believe about the company into a single, continually updated picture that is accessible right on Simply Wall St’s Community page, used by millions of investors.

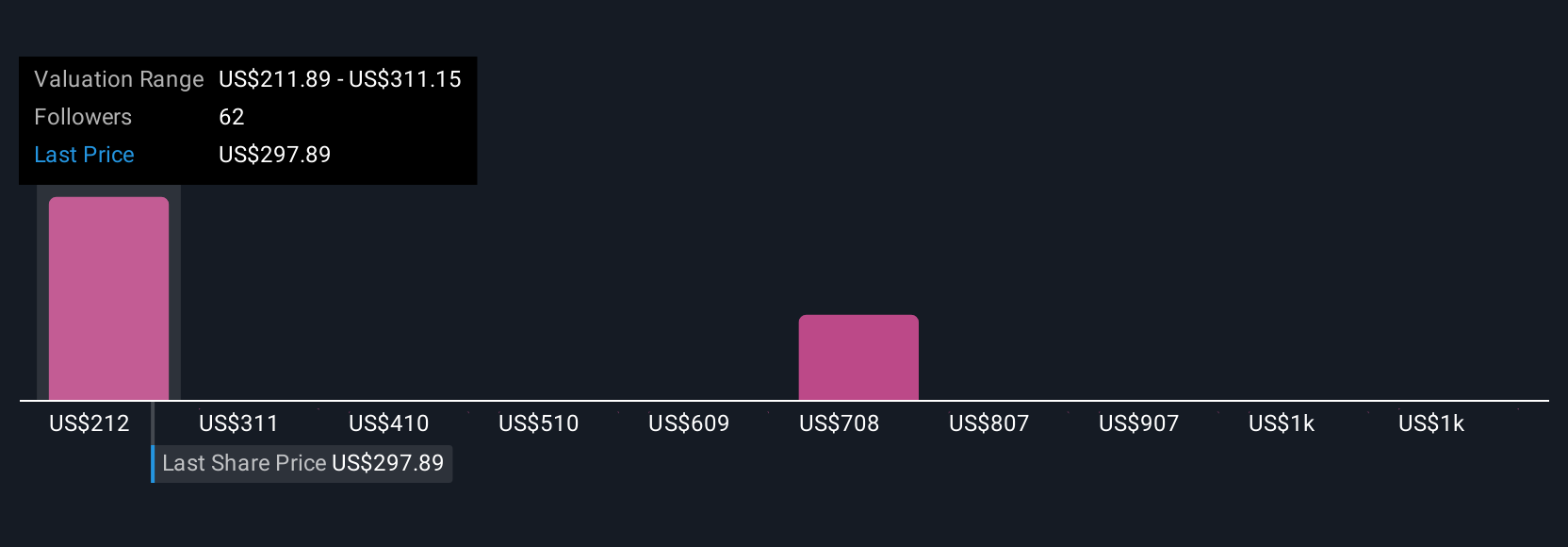

Narratives empower you to decide what you think Humana is worth, easily compare that fair value with today’s share price, and quickly see if the stock looks undervalued, overvalued, or just right. Crucially, your Narrative stays dynamic because it syncs up with new earnings releases and industry news automatically, so your valuation stays relevant as circumstances shift. For example, while some investors see Humana fairly valued at $353 per share due to AI-driven efficiency and expansion in primary care, others are more cautious, valuing it closer to $250 out of concern for margin pressure and regulatory risks. Narratives put you, and your understanding, at the center of every investment decision.

Do you think there's more to the story for Humana? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives