- United States

- /

- Healthcare Services

- /

- NYSE:HUM

How Humana’s (HUM) Medicare Advantage Enrollment Surge and Guidance Reaffirmation Shape Its Investment Case

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Humana reaffirmed its full-year earnings guidance and announced a marked increase in enrollment for its higher-rated Medicare Advantage plans for 2026, setting it apart from peers adjusting their plan offerings amid industry pressures.

- This positive update comes as the company faces ongoing legal scrutiny related to alleged industry-wide reimbursement practices and uncertainties over Medicare Advantage rating protocols, underscoring Humana's emphasis on growth despite sector headwinds.

- We’ll explore how Humana’s renewed earnings outlook and Medicare Advantage enrollment surge impacts the company’s forward-looking investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Humana Investment Narrative Recap

To be a Humana shareholder right now, you need confidence in the company’s ability to grow Medicare Advantage enrollment while navigating regulatory pressures and legal scrutiny. The recent federal antitrust litigation alleging reimbursement underpayment does not appear to directly affect Humana’s most critical short-term catalyst, membership gains in high-rated plans, but it does underscore ongoing risk tied to regulatory and legal changes in the sector.

Of recent announcements, Humana’s reaffirmation of full-year earnings guidance amid a sharp increase in higher-rated Medicare Advantage enrollments is most relevant. This supports investor focus on operational execution and growth drivers, even as ongoing litigation and regulatory uncertainties remain areas to watch for their impact on near-term profitability and overall business resilience.

However, investors should be aware that against this backdrop, questions still remain around the implications of federal antitrust lawsuits for...

Read the full narrative on Humana (it's free!)

Humana's outlook foresees $150.9 billion in revenue and $3.3 billion in earnings by 2028. This projection requires 7.0% annual revenue growth and an earnings increase of $1.7 billion from the current $1.6 billion.

Uncover how Humana's forecasts yield a $292.87 fair value, a 5% upside to its current price.

Exploring Other Perspectives

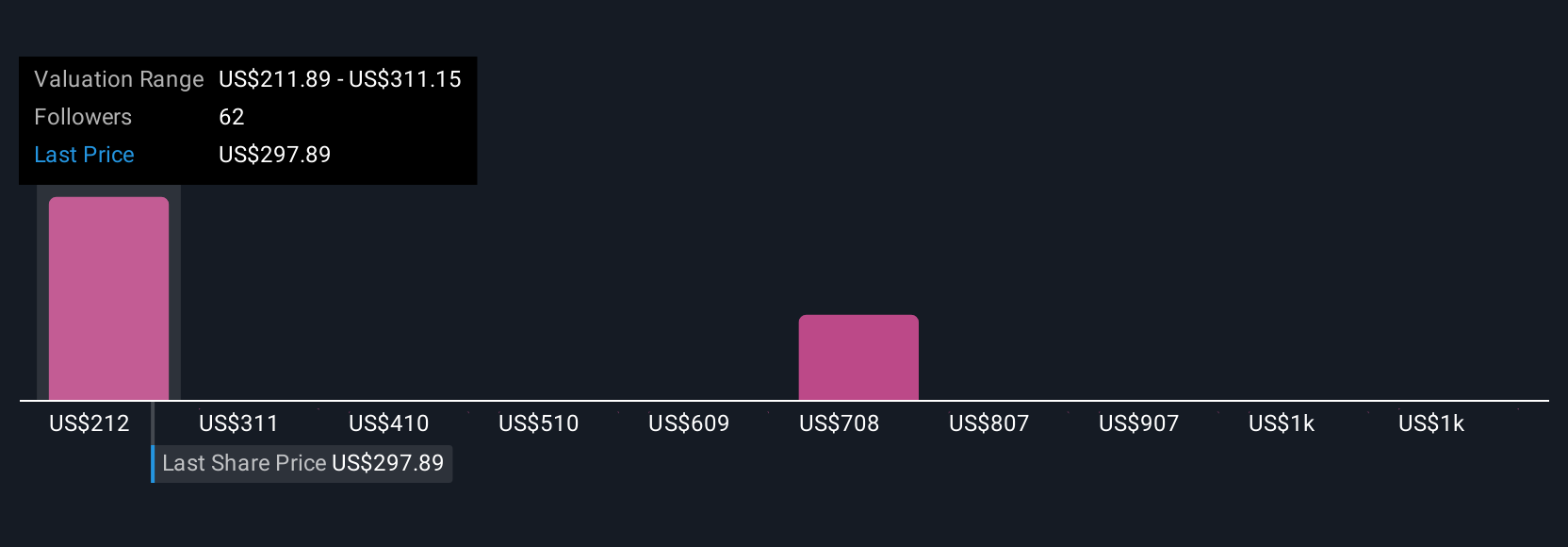

Ten Simply Wall St Community fair value estimates for Humana range widely from US$211.89 to US$1,204.45 per share, underscoring substantial differences in investor sentiment. With litigation over industry reimbursement practices at play, considering how these regulatory pressures could affect future earnings is key, explore the full scope of viewpoints to make informed decisions.

Explore 10 other fair value estimates on Humana - why the stock might be worth 24% less than the current price!

Build Your Own Humana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humana research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Humana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humana's overall financial health at a glance.

No Opportunity In Humana?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives