- United States

- /

- Healthcare Services

- /

- NYSE:HUM

How Investors Are Reacting To Humana (HUM) Expanding Value-Based Care for Medicare Advantage Members

Reviewed by Simply Wall St

- In late August 2025, Humana Inc. announced new value-based care partnerships with Vori Health and HOPCo to expand individualized musculoskeletal care for Medicare Advantage members, alongside research highlighting improved heart failure treatment outcomes under value-based models.

- These developments highlight Humana’s efforts to provide more personalized and coordinated care, focusing on improving patient health outcomes for chronic conditions among the Medicare-aged population.

- We’ll examine how Humana’s partnership expansion, specifically around value-based musculoskeletal care, could impact its investment narrative and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Humana Investment Narrative Recap

To see value in Humana as a shareholder, one generally needs to believe in the company’s ability to drive growth through value-based care initiatives and enhance operational efficiency, which are viewed as near-term growth catalysts. The recent partnerships with Vori Health and HOPCo expand Humana’s reach within musculoskeletal and chronic care but do not materially alter the single most important short-term catalyst: successful integration and profitable growth of its CenterWell and Medicaid platforms. However, evolving regulatory risks, particularly around Medicare Advantage Stars ratings and CMS litigation, remain significant and should not be overlooked.

Among recent developments, Humana’s announcement of stronger clinical outcomes in heart failure treatment from value-based care models is highly relevant. This supports the core investment thesis, suggesting that these partnerships could reinforce the case for improved outcomes and member engagement, which are important drivers of the company’s broader value-based care expansion and initiatives linked to Medicare Advantage performance, and, consequently, near-term revenue momentum.

On the other hand, investors should remain aware of the risk that regulatory or legal changes impacting the Medicare Advantage Stars program could suddenly shift the outlook for Humana’s earnings and...

Read the full narrative on Humana (it's free!)

Humana's outlook anticipates $150.0 billion in revenue and $3.3 billion in earnings by 2028. This scenario requires a 6.8% annual revenue growth and a $1.7 billion increase in earnings from the current $1.6 billion level.

Uncover how Humana's forecasts yield a $291.82 fair value, a 4% downside to its current price.

Exploring Other Perspectives

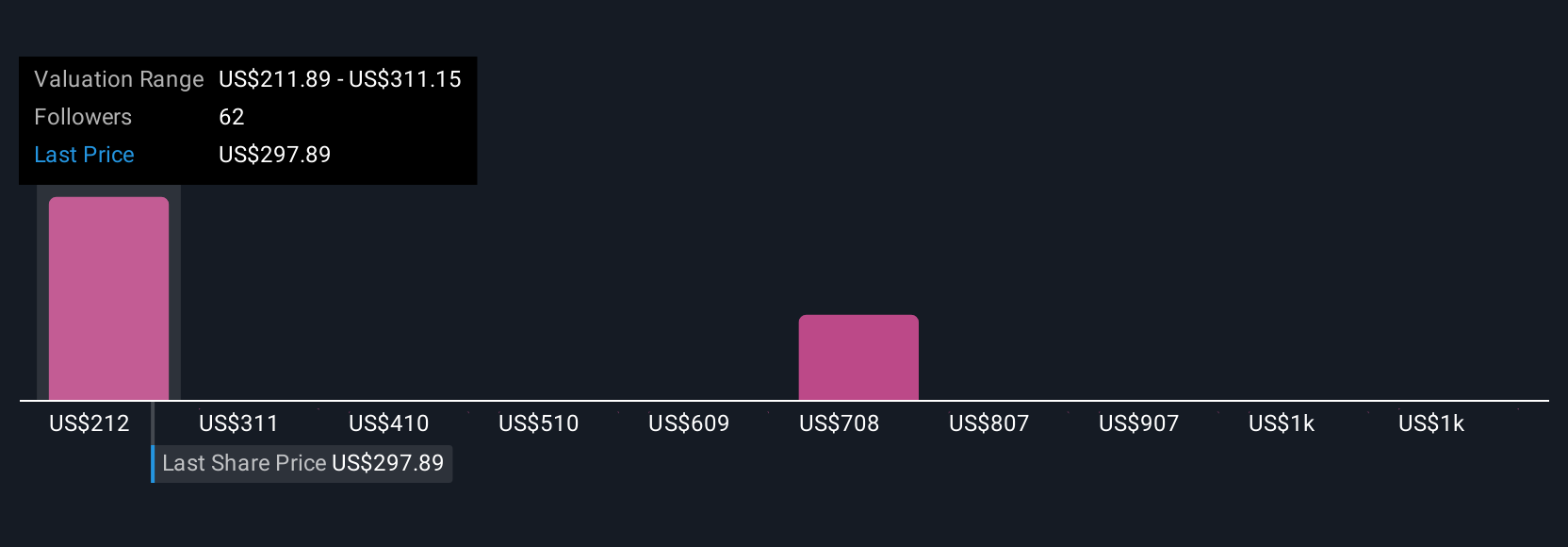

Private investors in the Simply Wall St Community set fair value estimates for Humana from US$211.89 to US$1,204.45 across 11 perspectives, with striking differences. While the optimism for value-based care as a growth catalyst is widespread, diverging opinions highlight how regulatory uncertainty could drive future volatility, making it essential to consider multiple viewpoints.

Explore 11 other fair value estimates on Humana - why the stock might be worth over 3x more than the current price!

Build Your Own Humana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humana research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Humana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humana's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives