- United States

- /

- Diversified Financial

- /

- NYSE:TOST

3 US Insider Picks With Earnings Growth Up To 98%

Reviewed by Simply Wall St

As the S&P 500 extends its winning streak amid anticipation of the Federal Reserve's interest rate decision, investors are keenly observing market movements and economic indicators. In this environment, stocks with high insider ownership and significant earnings growth can offer unique insights into potential opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Below we spotlight a couple of our favorites from our exclusive screener.

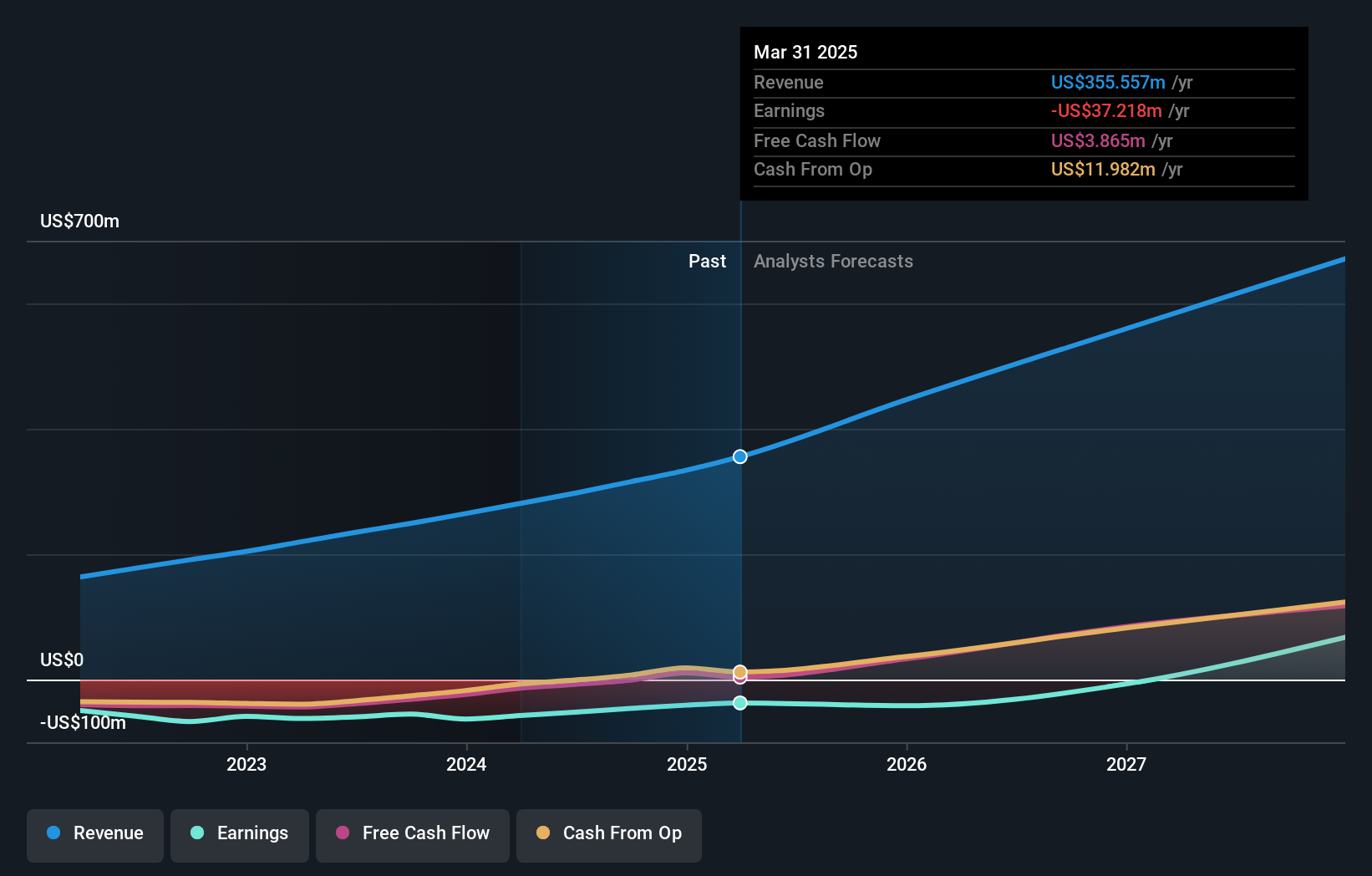

Alkami Technology (NasdaqGS:ALKT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of $2.99 billion.

Operations: Alkami Technology's revenue from Internet Software & Services is $297.36 million.

Insider Ownership: 11.3%

Earnings Growth Forecast: 98.5% p.a.

Alkami Technology's revenue is forecast to grow 21.4% annually, outpacing the US market average of 8.8%. Despite recent shareholder dilution, insiders have bought more shares than sold in the past three months. The company aims to become profitable within three years with earnings expected to grow by 98.47% per year. Recent initiatives include advanced fraud detection features and a significant follow-on equity offering of five million shares, indicating ongoing innovation and expansion efforts.

- Click here to discover the nuances of Alkami Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Alkami Technology is trading beyond its estimated value.

Hims & Hers Health (NYSE:HIMS)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of $3.52 billion.

Operations: The company generates revenue primarily through its online retail segment, which brought in $1.07 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 40.7% p.a.

Hims & Hers Health, Inc. has shown strong growth, becoming profitable this year with earnings expected to grow 40.7% annually over the next three years. Revenue is forecast to increase by 23.8% per year, outpacing the US market average of 8.8%. Despite recent shareholder dilution and no substantial insider buying in the past three months, insiders have bought more shares than sold recently. The company raised its full-year revenue guidance to $1.37 billion-$1.40 billion and completed a $50 million share buyback program in Q2 2024.

- Unlock comprehensive insights into our analysis of Hims & Hers Health stock in this growth report.

- Our valuation report unveils the possibility Hims & Hers Health's shares may be trading at a discount.

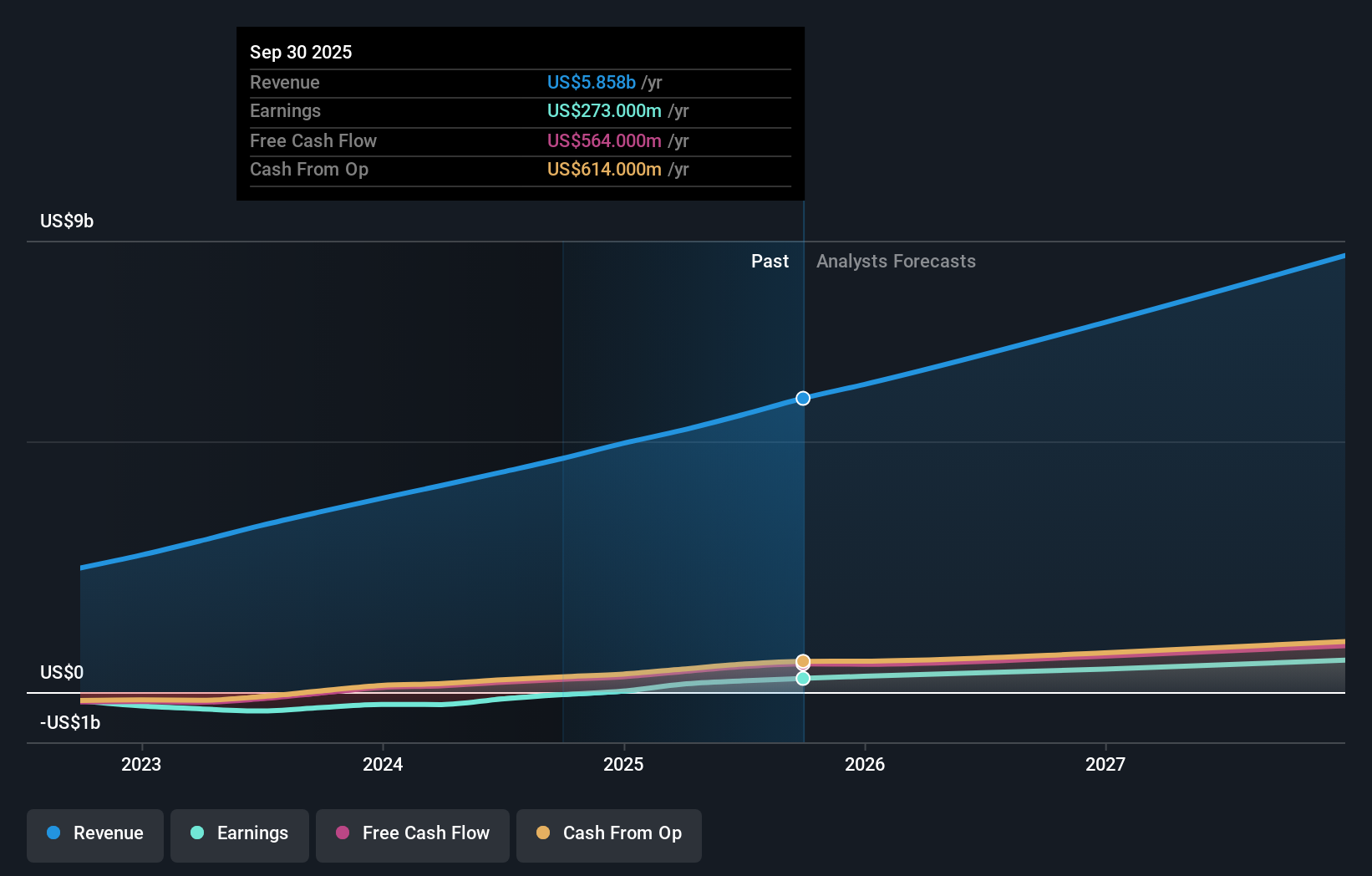

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India, with a market cap of $14.93 billion.

Operations: Toast's revenue from data processing is $4.39 billion.

Insider Ownership: 21.3%

Earnings Growth Forecast: 60.9% p.a.

Toast, Inc. is a growth company with high insider ownership, forecasted to grow earnings by 60.86% annually and become profitable within three years, outpacing the average market growth. Revenue is expected to increase by 16.7% per year, exceeding the US market average of 8.8%. Recent Q2 results showed revenue at US$1.24 billion and net income of US$14 million compared to a net loss last year; however, shareholders experienced dilution over the past year despite share buybacks totaling $49 million.

- Click here and access our complete growth analysis report to understand the dynamics of Toast.

- Our expertly prepared valuation report Toast implies its share price may be too high.

Make It Happen

- Click this link to deep-dive into the 177 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India.

Flawless balance sheet with high growth potential.