- United States

- /

- Healthcare Services

- /

- NYSE:HCA

HCA Healthcare (NYSE:HCA) Faces Shareholder Proposals on Plant-Based Meals Staffing Levels and Executive Pay

Reviewed by Simply Wall St

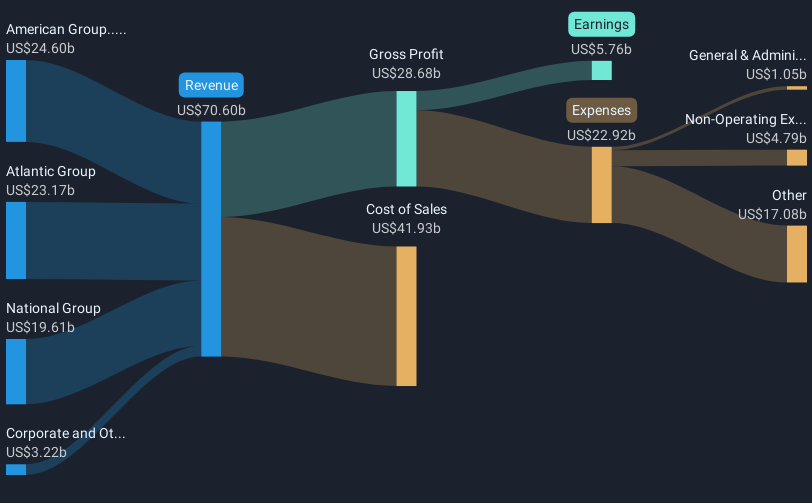

HCA Healthcare (NYSE:HCA) recently encountered significant investor activism with proposals advocating changes in corporate governance, including a shift to plant-based diets and adjustments in executive compensation. Management's opposition to these proposals could have played a role in the company's 3.71% share price decline over the last quarter. Despite strong full-year earnings growth, with sales increasing to USD 70.6 billion, net income rising to USD 5.76 billion, and a substantial share buyback program, the response to shareholder activism and broader market fluctuations may have influenced investor sentiment. During this period, the broader market experienced volatile trading, with investor concerns around tariffs impacting general market sentiment, evidenced by a 3.1% market decline over the same timeframe. This context underscores how external factors and internal governance disputes can outweigh positive financial performance, impacting shareholder returns for HCA.

Dig deeper into the specifics of HCA Healthcare here with our thorough analysis report.

HCA Healthcare's shares delivered a total return of 167.58% over the past five years, reflecting its robust long-term performance. Key drivers behind this result include consistent earnings growth, with profits increasing by 9.3% annually. A significant share repurchase program, cumulating in buybacks worth US$5.24 billion, also contributed to the shareholder value. Additionally, HCA's operations showed resilience, with continued profit growth and dividends, which increased to $0.72 per share recently declared.

The healthcare company's relative valuation, trading at 47.4% below the estimated fair value, has made it a compelling option, especially within its industry. Its Price-To-Earnings ratio has remained favorable compared to both industry and peer averages. HCA's proactive steps to enhance operational efficiencies and expand healthcare access have further supported its sustained share price appreciation, despite challenges from investor activism and broader market fluctuations.

- See whether HCA Healthcare's current market price aligns with its intrinsic value in our detailed report

- Discover the key vulnerabilities in HCA Healthcare's business with our detailed risk assessment.

- Got skin in the game with HCA Healthcare? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HCA Healthcare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Very undervalued with proven track record.