- United States

- /

- Healthtech

- /

- NYSE:EVH

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

The United States market has shown impressive momentum, climbing 1.6% in the last seven days and 32% over the past year, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 23.74% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.44% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

GDS Holdings (NasdaqGM:GDS)

Simply Wall St Growth Rating: ★★★★☆☆

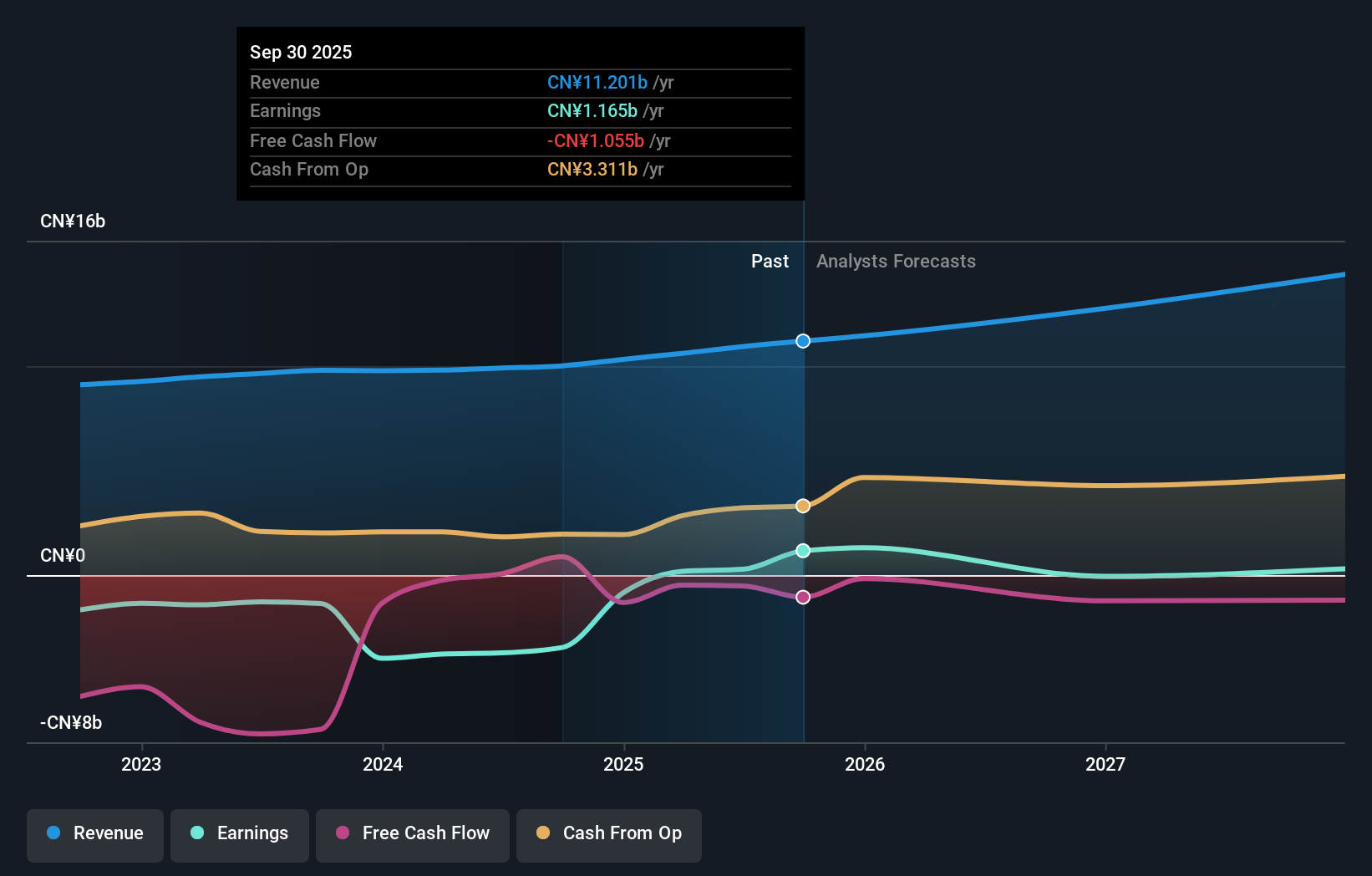

Overview: GDS Holdings Limited, along with its subsidiaries, focuses on developing and operating data centers in the People's Republic of China and has a market capitalization of approximately $3.55 billion.

Operations: GDS Holdings generates revenue primarily through the design, build-out, and operation of data centers in China, with this segment contributing CN¥10.98 billion.

GDS Holdings, navigating through a challenging tech landscape, has shown a notable revenue increase of 15.1% annually, outpacing the US market average of 8.9%. Despite its current unprofitability, the firm is on an upward trajectory with earnings expected to surge by 83.27% per year. This growth is underpinned by significant R&D investments which are crucial for maintaining competitiveness in the data center sector. Recent financials reflect a reduction in net loss from CNY 421.18 million to CNY 192.34 million year-over-year for Q3, alongside stable revenue forecasts for 2024 signaling potential stabilization and future profitability prospects amidst volatile market conditions.

- Click to explore a detailed breakdown of our findings in GDS Holdings' health report.

Review our historical performance report to gain insights into GDS Holdings''s past performance.

Certara (NasdaqGS:CERT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Certara, Inc. offers software products and technology-enabled services for biosimulation in drug discovery and research processes worldwide, with a market cap of approximately $1.76 billion.

Operations: Certara, Inc. generates revenue primarily through its healthcare software segment, which accounted for $372.80 million in sales. The company's operations focus on providing solutions for biosimulation across various stages of drug development and market access globally.

Certara, amidst a transformative phase in the tech-driven biopharmaceutical sector, reported a significant reduction in net loss to $1.37 million from $48.97 million year-over-year for Q3 2024, alongside an uplift in sales to $94.82 million from $85.58 million. This performance is underpinned by robust R&D investments aimed at enhancing its software solutions for drug development—a critical factor as it navigates toward profitability with an expected earnings growth of 107.2% annually. Moreover, the company's strategic appointments and conference participations signal a strong focus on integrating advanced data sciences into healthcare, positioning it well within the high-growth tech landscape despite current unprofitability and a revenue growth forecast of 9.6%, slightly above the US market average.

- Get an in-depth perspective on Certara's performance by reading our health report here.

Gain insights into Certara's past trends and performance with our Past report.

Evolent Health (NYSE:EVH)

Simply Wall St Growth Rating: ★★★★☆☆

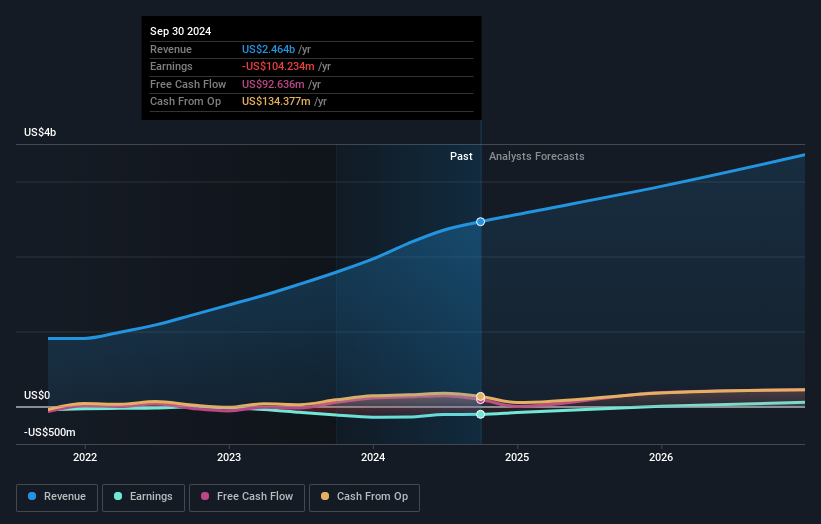

Overview: Evolent Health, Inc., through its subsidiary Evolent Health LLC, provides specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States with a market cap of approximately $1.53 billion.

Operations: Evolent Health generates revenue primarily through its pharmacy services, which contributed $2.46 billion.

Evolent Health, amid a transformative landscape in healthcare tech, has demonstrated notable financial resilience and strategic growth. With a recent expansion in its partnership with Humana to streamline oncology-related processes, the company leverages advanced technology to enhance efficiency and patient care quality. This move aligns with Evolent's robust revenue surge to $621.4 million in Q3 2024 from $511.02 million the previous year, reflecting a growth rate of 13.7%. Despite a net loss reduction to $23.14 million from $25.32 million year-over-year, the firm's commitment is evident in its R&D investments which are crucial for sustaining innovation and competitiveness in the high-stakes tech-driven healthcare sector.

- Take a closer look at Evolent Health's potential here in our health report.

Explore historical data to track Evolent Health's performance over time in our Past section.

Where To Now?

- Dive into all 249 of the US High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolent Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVH

Evolent Health

Through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States.

Undervalued with reasonable growth potential.