- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Is There an Opportunity in Elevance Health Amid ACA Subsidy Uncertainty?

Reviewed by Bailey Pemberton

If you are staring at Elevance Health’s stock chart and wondering what to do next, you are not alone. With the share price closing recently at $350.48, this is a stock that has gotten the attention of plenty of investors, both for its rollercoaster moves and for what might be coming next. Over the past month, Elevance has rallied 12.4%, even though it dipped slightly this past week, down 2.0%. Year-to-date, it is still slightly in the red at -4.2%, and looking at the past year, the stock is off by more than 26%. Looking at a five-year timeframe, there is a gain of 28.5%, which is far from shabby.

Some of these swings make more sense when considering recent news. Government negotiations around health insurance subsidies, for example, are having a significant impact and creating waves across the sector. Meanwhile, proposed double-digit premium hikes for ACA marketplace plans suggest insurers like Elevance could have growth tailwinds ahead, but increased scrutiny over prescription drug approvals and rising regulatory risks are keeping some investors more cautious.

So how does Elevance look in terms of valuation? For those watching for deals, the value score stands out. Elevance Health is undervalued on 4 out of 6 key metrics, giving it a score of 4. This is a strong signal compared to peers and provides a foundation for a deeper look at how various valuation models compare, as well as how investors may want to approach value in the future. Next, let’s break down those approaches and stay tuned for a perspective on valuation you will not want to miss.

Why Elevance Health is lagging behind its peers

Approach 1: Elevance Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. This approach helps investors understand if a stock is trading below or above its intrinsic value based on how much cash the company can generate in the future.

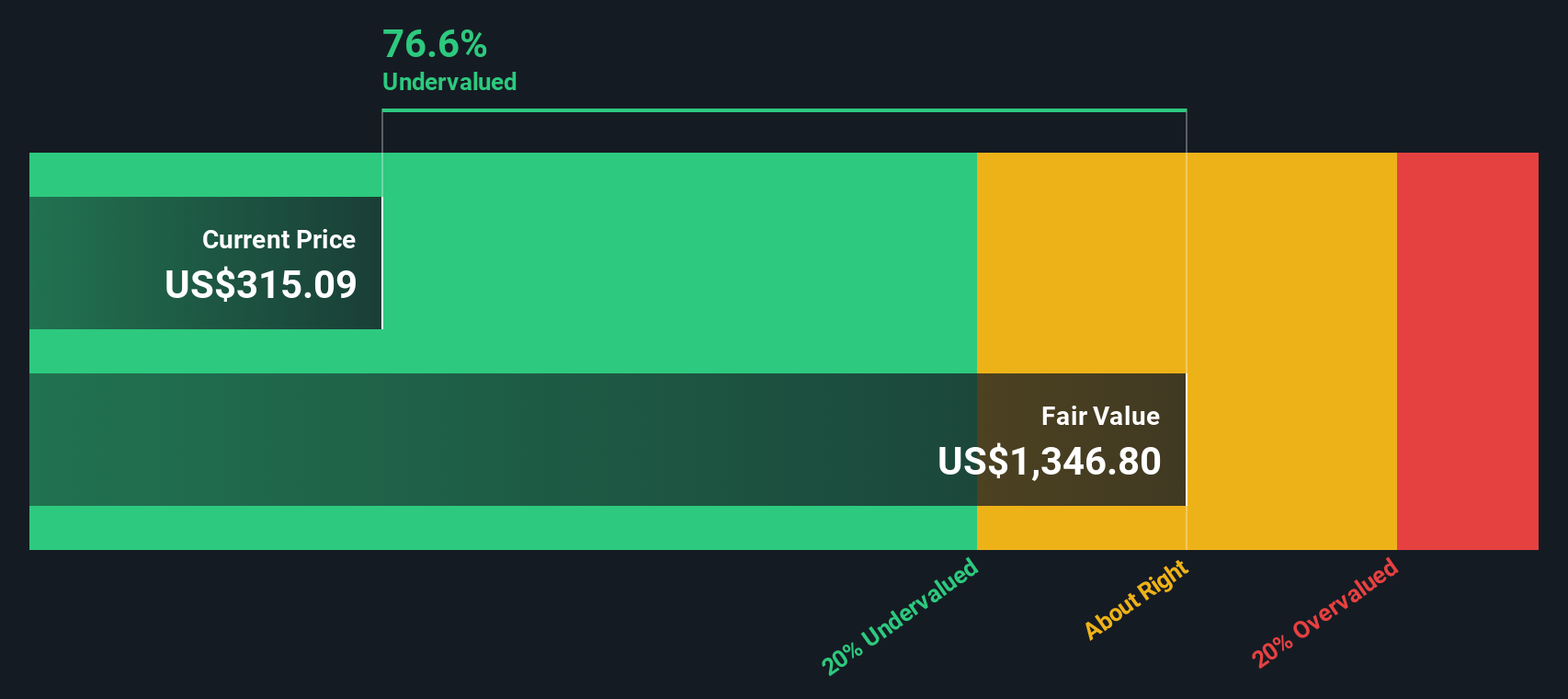

For Elevance Health, the latest reported Free Cash Flow (FCF) stands at $5.2 Billion, with projections suggesting steady growth over the next decade. Analyst estimates extend about five years out, with Simply Wall St extrapolating further to forecast FCF beyond that period. By 2029, FCF is forecast to reach $11.3 Billion, and the ten-year projection indicates annual FCF exceeding $15 Billion by 2035. These numbers, all in US dollars, signal meaningful long-term growth for the business.

Based on this DCF model, Elevance Health's estimated intrinsic value is $1,344.87 per share. With the recent share price at $350.48, this suggests the stock is trading at a 73.9% discount to its estimated fair value according to the DCF methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elevance Health is undervalued by 73.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Elevance Health Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a popular valuation tool for companies that are consistently profitable, like Elevance Health. It provides a quick lens to measure how much investors are paying for each dollar of a company’s earnings. Using the P/E metric makes sense here because it directly relates to profitability and can be compared across businesses in the same sector.

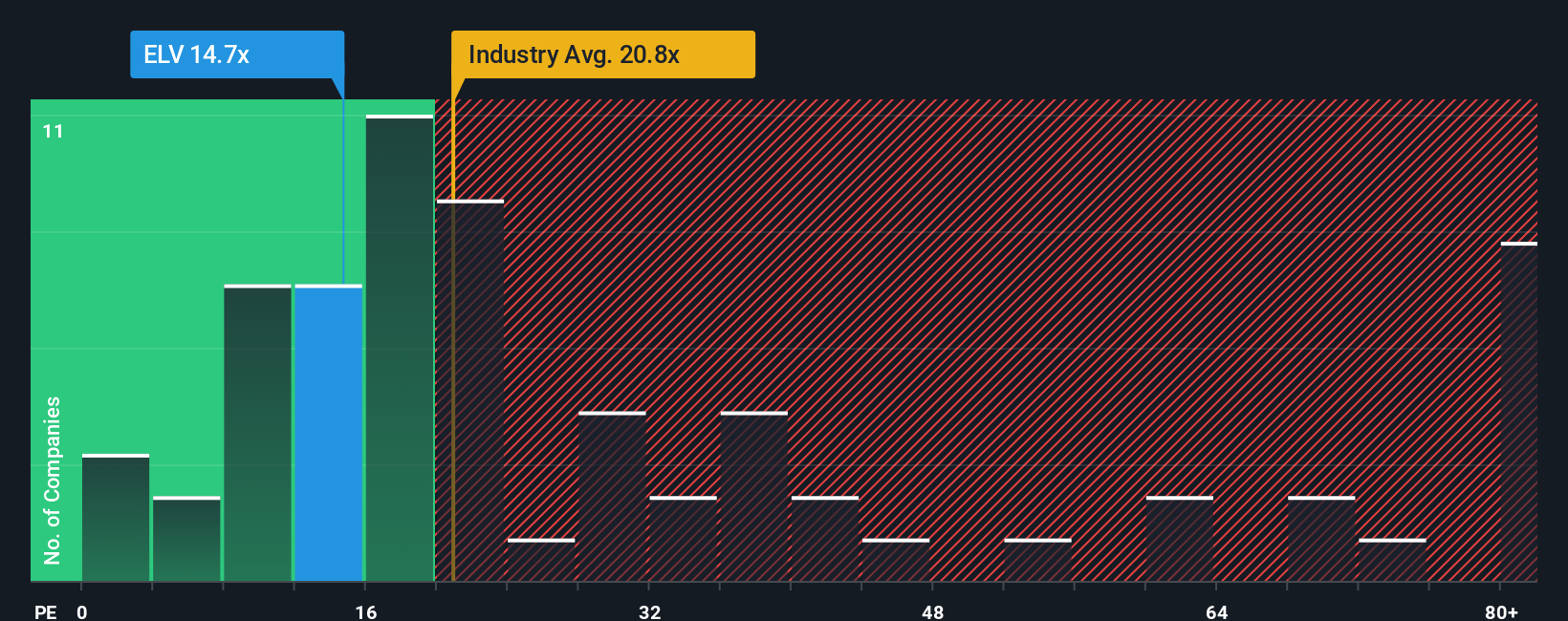

Typically, higher earnings growth and lower risk justify a higher “normal” P/E ratio. Slower-growing, riskier companies might trade at lower multiples. Elevance currently trades at a P/E of 14.7x, which is just above its peer average of 13.3x but well below the broader healthcare industry average of 20.8x. This places Elevance on the lower end of its sector despite its established market position.

Simply Wall St takes valuation a step further by calculating a proprietary “Fair Ratio” for Elevance Health, which is 33.0x. Unlike industry or peer averages, the Fair Ratio is more comprehensive as it weighs not only sector norms, but also Elevance’s earnings growth, profitability, potential risks, and market capitalization. This detailed approach provides a better sense of what a reasonable P/E should look like specifically for Elevance.

Comparing Elevance’s current P/E of 14.7x to the Fair Ratio of 33.0x, the stock appears to be undervalued when accounting for its growth potential, quality of earnings, and overall risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elevance Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company that connects what you believe about its future, such as revenue growth, earnings, and profit margins, to a reasoned financial forecast and a fair value estimate. Unlike traditional ratios or models, Narratives let investors express their perspectives on Elevance Health by outlining their assumptions and seeing exactly how those beliefs translate to an intrinsic value.

Narratives are easy to create and update thanks to Simply Wall St’s Community page, where millions of investors share and compare their views on Elevance Health and countless other stocks. When you use Narratives, you not only link a company’s story to the numbers, but also get real-time updates when news or earnings are released, helping your outlook stay relevant as things evolve.

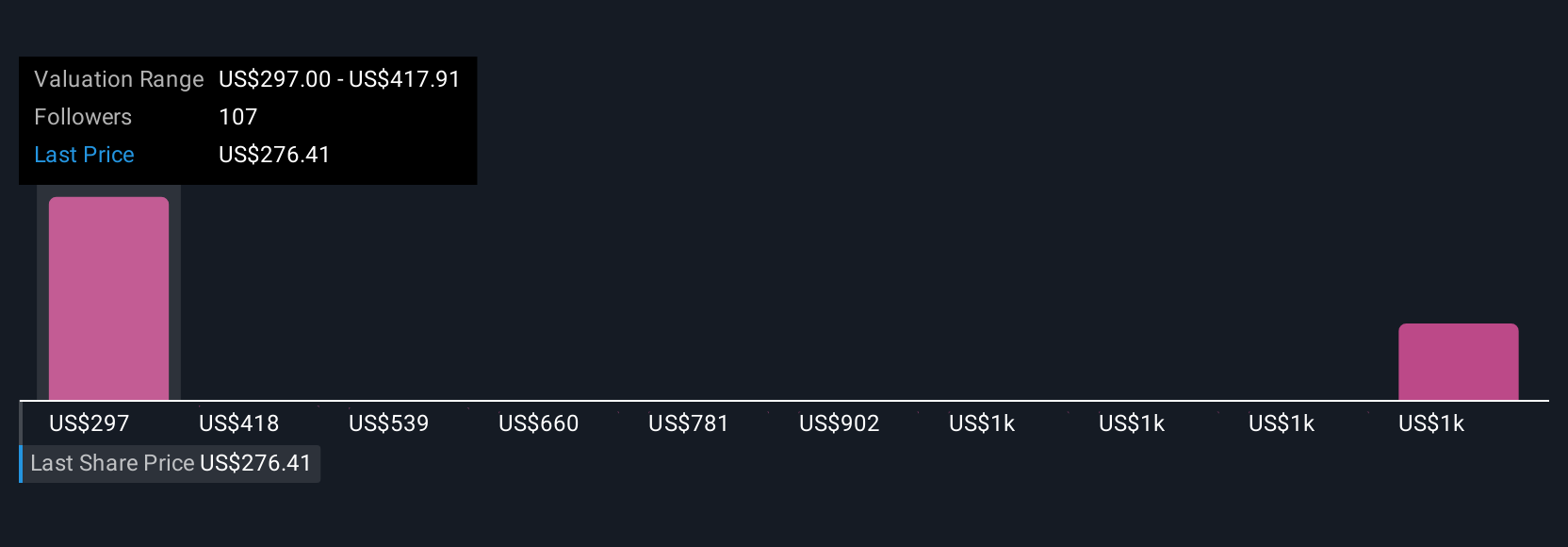

Narratives also help investors act quickly, as you can see at a glance if Elevance Health’s current share price is above or below your fair value, making buy or sell decisions clearer and more grounded. For example, some in the community have set fair values as high as $507 per share, expecting strong growth in Medicare Advantage or digital innovation. Others, focused on Medicaid headwinds and cost pressures, believe fair value is closer to $297 per share. This broad range of perspectives shows how Narratives let you match actions to your own outlook, not just the consensus.

Do you think there's more to the story for Elevance Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives