- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Quest Diagnostics (DGX): Assessing Valuation After Launch of Pharmacogenomic Test Service for Personalized Care

Reviewed by Simply Wall St

If you have been following Quest Diagnostics (DGX) lately, there is a fresh development that could be a game changer for the company. Just this week, Quest Diagnostics introduced an advanced pharmacogenomic laboratory test service, giving providers new tools to tailor drug prescriptions based on each patient’s genetic profile. With the potential to guide safer and more effective treatments across multiple specialties, and a partnership with Coriell Life Sciences that elevates the offering’s clinical depth, investors now face a compelling question about what this move means for the company's value and future growth.

This launch comes after a year of solid momentum. Quest Diagnostics’ stock has climbed 21% so far in 2025 and returned just over 20% for investors over the past year, signaling continued confidence from the market. Recent months have featured other strategic moves, including a joint venture with Corewell Health and upcoming presentations at major healthcare conferences. Together, these developments show management’s drive to expand the company’s reach and support revenue growth, which has increased 4% year-over-year alongside healthy annual net income gains.

After this run and with the news fueling new interest, is Quest Diagnostics still trading at an attractive valuation, or has the market already priced in the potential from these new offerings?

Most Popular Narrative: 3% Undervalued

The most widely followed narrative suggests Quest Diagnostics is trading below its calculated fair value, with analysts viewing potential for modest upside.

The rising importance of health data analytics and Quest's role as a "lab engine" for consumer wellness brands positions the company to benefit from new revenue streams and further monetization opportunities as healthcare becomes more data-driven. This supports long-term earnings power.

Curious why the valuation is leaning bullish? The secret sauce behind this target price includes ambitious assumptions around more profitable margins and a steady ramp in recurring revenue. The analysts may be seeing strength where others are missing signals. Want to find out which surprising financial forecasts are fueling this consensus price? The answer is locked into the numbers and strategic insights driving this narrative.

Result: Fair Value of $188.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory reimbursement changes or rising operating costs could quickly shift this positive outlook. Strong execution is critical for Quest’s continued outperformance.

Find out about the key risks to this Quest Diagnostics narrative.Another View: Discounted Cash Flow Model

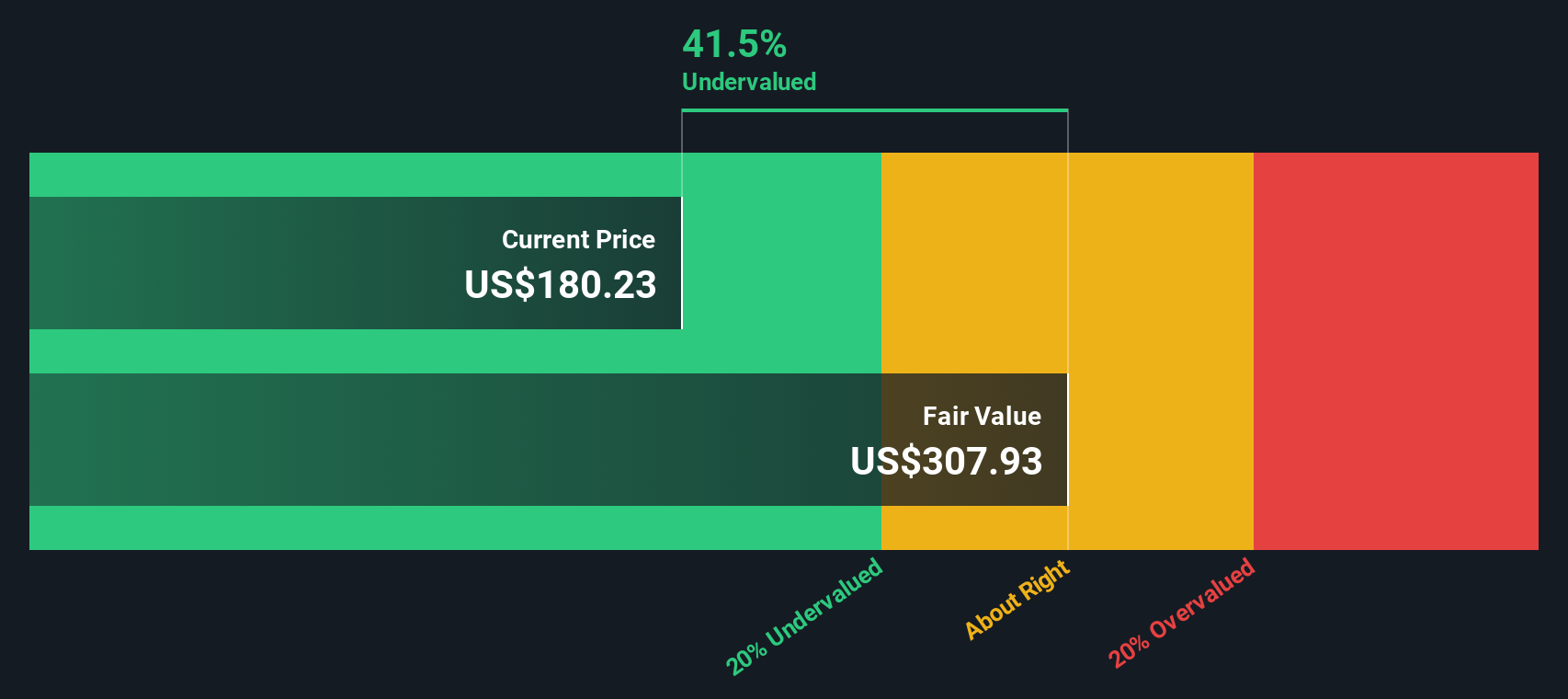

Taking a closer look, our DCF model offers a strikingly different perspective. It suggests the stock may be far more undervalued than most realize. Could the market be missing something significant, or is this model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Quest Diagnostics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Quest Diagnostics Narrative

If you have a different perspective or want to dive deeper into the details, you can explore the data first-hand and shape your own view in just a few minutes. Do it your way

A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Give your portfolio a fresh edge by acting on unique opportunities you might otherwise miss. Go beyond the headlines and set yourself up for smarter investing now.

- Supercharge your returns with companies offering attractive yields by heading to the dividend stocks with yields > 3%.

- Tap into tomorrow's tech leaders disrupting healthcare by checking out the healthcare AI stocks.

- Snap up stocks trading below their potential with the power of our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)