- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Quest Diagnostics (DGX): 13% Earnings Growth Reverses Multi-Year Decline, Challenges Bearish Narratives

Reviewed by Simply Wall St

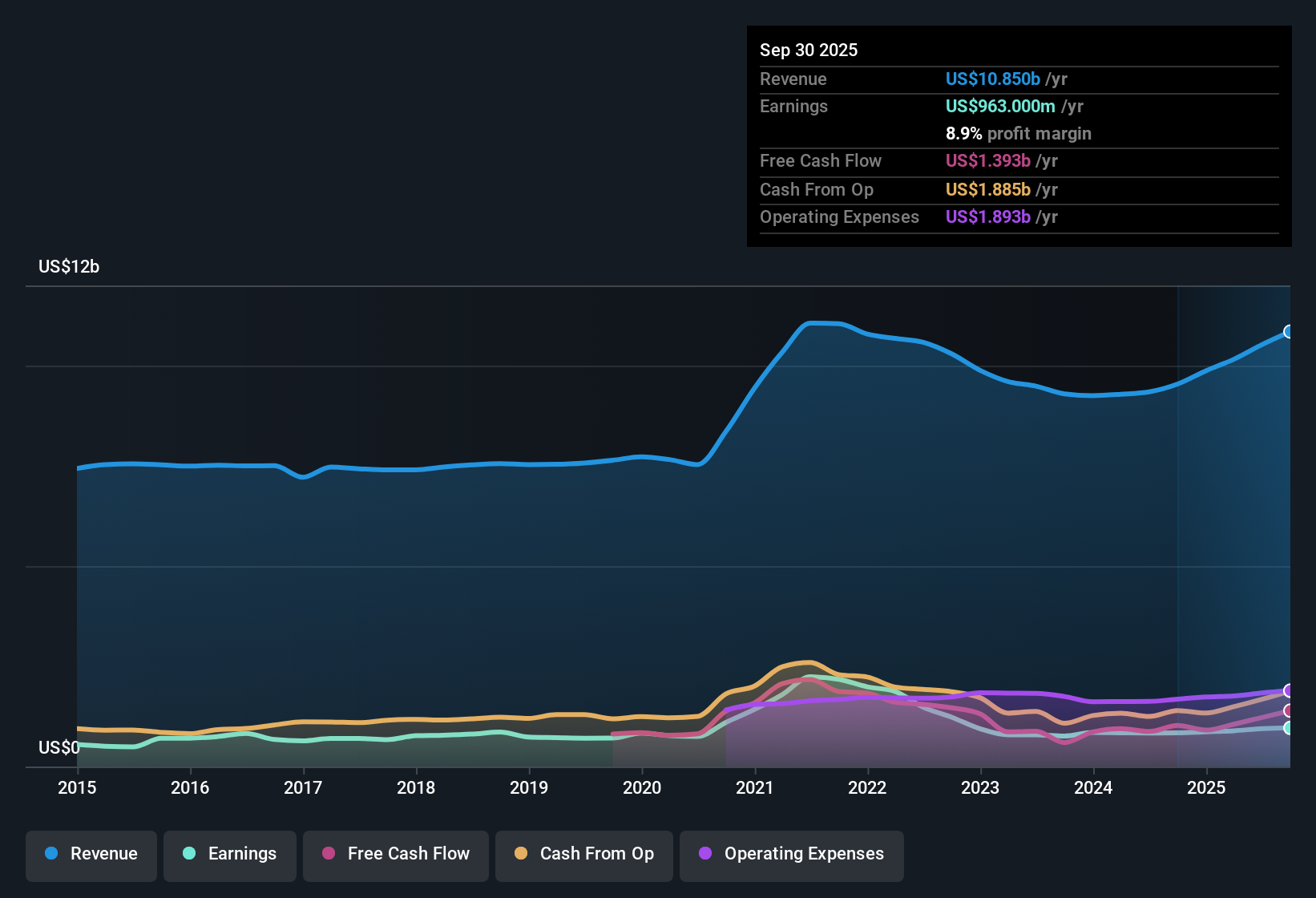

Quest Diagnostics (DGX) posted a 13% rise in earnings over the past year, reversing a five-year stretch where earnings declined an average 19.9% annually. Net profit margins increased to 9%, compared to 8.9% last year, and the company is now projected to grow earnings at 9.8% per year going forward. For investors, the key takeaway is a clear shift toward profitability. However, with future growth expectations trailing the broader US market, sentiment may remain mixed.

See our full analysis for Quest Diagnostics.Up next, we will put these numbers in the context of widely held narratives and see how the latest results stack up against market expectations.

See what the community is saying about Quest Diagnostics

Margins Edge Up, but Below Industry Pace

- Net profit margins stand at 9%, only a slight increase from 8.9% last year. Analysts expect further expansion to 10.7% over three years.

- According to the analysts' consensus view, automation, AI adoption, and operational synergies are expected to accelerate margin growth. However, these improvements may not fully offset lower projected revenue growth compared to the broader US healthcare sector.

- Consensus narrative notes that productivity gains from technology and acquisitions should drive stronger operating income, even as growth lags peers.

- Cautious optimism persists since ongoing margin expansion is underpinned by digital and cost-saving initiatives rather than purely organic top-line increases.

- The current share price of $184.64 is closely aligned with the analyst price target of 193.44, emphasizing that the market is already pricing in modest margin gains and slower revenue growth.

- Despite positive efficiency moves, analysts believe Quest is fairly valued. The difference between the share price and price target is just 4.8%.

- This muted premium suggests investors may be weighing upside from margin improvements against the modest pace of projected revenue growth.

Revenue Growth Trailing Market Averages

- Quest Diagnostics is expected to grow revenue by 3.4% per year, notably below the broader US market and analyst consensus projections of 4.1% per year over the next three years.

- Analysts' consensus view flags that, while growth in advanced diagnostics and consumer-driven wellness demand is boosting test volumes, the pace is still not enough to see Quest outpace peers or the industry average.

- Competitive threats and a shifting payer mix threaten to weigh on top-line gains, even as acquisitions and scale help steady revenues.

- The consensus expects recurring demand from preventive and wellness testing to support stability, but not to drive market-beating growth.

Trading at a Premium Despite DCF Discount

- While Quest Diagnostics is trading below its DCF fair value ($184.64 vs. $322.37), the company's price-to-earnings ratio of 21.8x sits above both the US healthcare industry average (21.7x) and its peer group (20.1x).

- Analysts' consensus view highlights the valuation tradeoff: Quest offers strong earnings quality and improving profitability but commands a higher price than sector rivals, likely due to perceived stability and dividend appeal.

- Despite its below-average revenue growth, the company's financial strength and quality are enough to keep the stock valued above its direct competitors.

- However, the premium may deter investors looking for faster growth or a deeper value discount relative to fair value estimates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Quest Diagnostics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an alternate angle in the numbers? Capture your perspective and build a custom narrative in moments with Do it your way.

A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Quest Diagnostics faces weaker revenue growth projections and struggles to keep pace with industry peers. However, the company has achieved efficiency gains and maintains stable profitability.

If reliable growth is your top priority, use stable growth stocks screener (2087 results) to zero in on companies with a proven record of steady revenue and earnings expansion through all market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)