- United States

- /

- Healthcare Services

- /

- NYSE:CVS

CVS Health (NYSE:CVS) Achieves 15 Percent Weight Loss With New Management Program

Reviewed by Simply Wall St

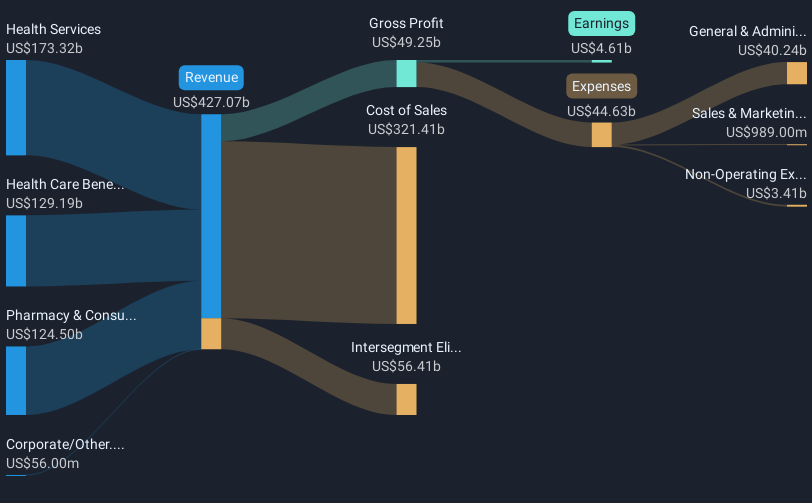

CVS Health (NYSE:CVS) recently made headlines with the release of its CVS Weight Management program results, which showcased significant success in weight loss and medication cost savings for program participants. The program's impressive enrollment figures and high satisfaction rates have likely bolstered investor confidence. During the same period, the company's stock saw a substantial 33% increase, which coincided with market conditions that saw the Dow Jones, S&P 500, and Nasdaq rally after previous losses. CVS's earnings report also revealed an increase in revenue to over $97 billion, despite a drop in net income. Additionally, the affirmation of a quarterly dividend and the successful launch of new app features may have contributed to positive sentiment. Overall, the convergence of these events amid a rebounding market, where major indexes such as the Dow and Nasdaq were recovering from declines, likely played a role in driving the stock's quarterly performance.

Unlock comprehensive insights into our analysis of CVS Health stock in this financial health report.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the last five years, CVS Health's total shareholder return, including share price and dividends, amounted to 38.95%. This return reflects a complex interplay of various elements, despite a challenging backdrop where the company's earnings declined by 6.2% annually. A factor that may have played a significant role is CVS's substantial share buyback program, which by the end of 2024 had completed the repurchase of over 96 million shares, enhancing shareholder value. Additionally, the company has maintained a reliable dividend, recently approving a payout of $0.665 per share, further contributing to total returns.

Investors have also benefited from CVS trading at an attractive valuation, with its Price-To-Earnings ratio consistently lower than both peer and industry averages. This valuation attractiveness aligns with CVS's efforts to enhance health service delivery, as seen in their partnership with Varo Bank and the launch of the new CVS Health app, bolstering investor confidence and supporting long-term returns. Meanwhile, despite recent underperformance compared to the broader U.S. market, CVS's continued focus on innovation and value provision underpins its ability to navigate complex market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives