- United States

- /

- Healthcare Services

- /

- NYSE:CVS

CVS Health (CVS): $6.3 Billion One-Off Loss Challenges Margin Recovery Narratives

Reviewed by Simply Wall St

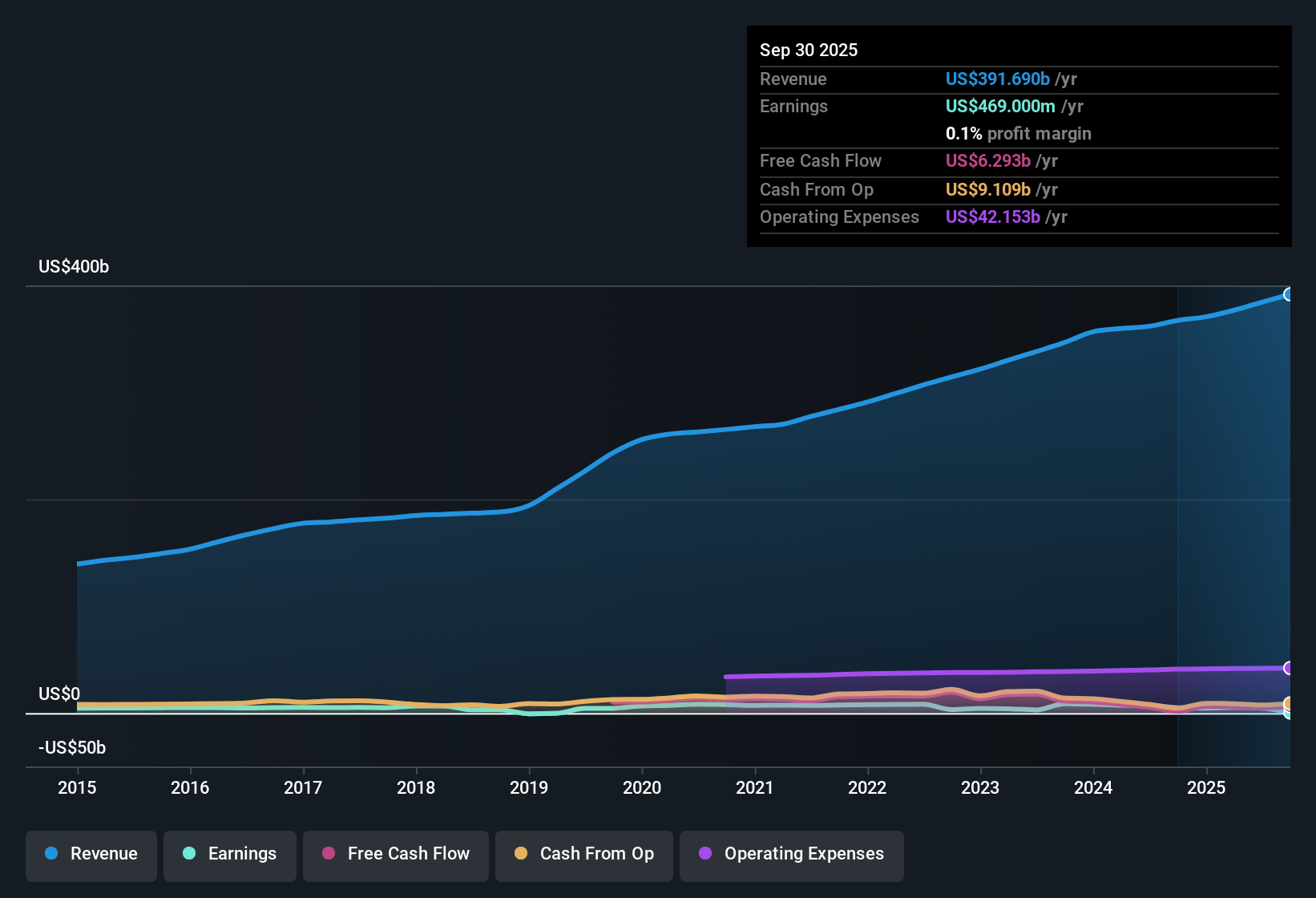

CVS Health (CVS) posted a mixed year, with revenue growth expected to come in at 4.6% per year, trailing the broader US market’s 10.3%. Analysts see EPS climbing at a robust 40.8% annual pace over the next three years. However, actual results show earnings moving backwards over the past twelve months, a net profit margin that narrowed to just 0.1% from 1.4% a year ago, and a hefty one-off $6.3 billion loss that weighed on reported earnings. For investors, solid future profit growth estimates are balanced by recent profit margin compression and the impact of extraordinary charges.

See our full analysis for CVS Health.Now that we’ve seen the headline figures, let’s see how these results compare with the stories investors and analysts have been following, spotlighting which narratives hold up and which get challenged.

See what the community is saying about CVS Health

Profit Margins Remain at 0.1% After $6.3 Billion One-Off Loss

- This past year’s net profit margin is just 0.1%, down sharply from 1.4% a year ago, as a $6.3 billion non-recurring loss continues to overshadow underlying operating profits.

- According to the analysts' consensus view, CVS’s current margin pressure ties back to both exceptional costs and structural challenges in insurance and retail. These factors limit upside from recent digital and care delivery investments.

- While strategic acquisitions and the integration of health services are designed to support margin recovery, ongoing cost headwinds in health care delivery and prolonged front-store weakness have made it harder for margin improvement plans to gain traction.

- Consensus narrative notes that value-based care expansion and pharmacy volume growth are intended to support sustainable long-term profitability. However, the lack of visible margin progress so far causes analysts to remain cautious that normalization could take longer than bulls hope.

- To see how analysts debate these margin pressures and the mix of risks and rewards in depth, read the full consensus narrative for CVS Health. 📊 Read the full CVS Health Consensus Narrative.

Valuation at a Discount to Sector Even on Muted Margins

- At a share price of $76.69, CVS trades well below analysts’ target of $89.88 and at a discount based on its price-to-sales ratio compared to healthcare peers. This is further reinforced by a DCF fair value of $282.68.

- Consensus narrative underlines that this discount reflects a blend of skepticism about the pace of profit recovery and optimism over projected earnings growth. Sector-leading prescription volumes and integrated care are cited as long-run positives.

- Analysts expect the company’s price-to-earnings ratio to contract from 20.1x today to a below-industry 15.8x by 2028, assuming margins rebound and planned earnings materialize as forecasted.

- Despite a broad valuation discount, the consensus view cautions that these assumptions depend heavily on execution. If CVS struggles to lift profit margins above today’s levels, the discounted share price may simply reflect persistent operating challenges rather than a true value opportunity.

Prescription Volumes, Digital Push Lead Revenue Growth Forecast

- Analysts expect CVS’s revenue to increase by 5.0% per year over the next three years, driven by an expanding prescription base, digital health platforms, and senior healthcare demand, even as this lags the US market’s 10.3% pace.

- Consensus narrative points out that strategic digital and vertical integration moves, coupled with targeted acquisitions like Oak Street and Signify Health, position CVS to defend and grow its market share, even if existing structural headwinds in retail and reimbursement may cap the top line.

- Growth in prescription volume and expanded digital offerings are intended to offset secular front-store weakness. Management is betting that coordinated, long-term care models will prove stickier for customers and help stabilize recurring revenue streams.

- Skeptics argue that success is not guaranteed until margin pressures ease and in-store trends improve, but consensus opinion still attributes solid revenue growth expectations to the company’s strong demographic tailwinds and integrated platform.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CVS Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story looks different in your view? Share your insights and shape your perspective in just a few minutes. Do it your way

A great starting point for your CVS Health research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Muted profit margin progress and earnings setbacks show CVS Health still faces major hurdles to achieving sustainable, reliable growth.

If consistency matters for your portfolio, discover companies showing more dependable revenue and earnings performance across cycles by checking out stable growth stocks screener (2110 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)