- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): Has the Recent Pullback Opened a Valuation Opportunity?

Reviewed by Simply Wall St

Cencora (COR) has quietly pulled back about 6% over the past month even as its year to date gain sits above 50%, setting up an interesting check on what has actually changed.

See our latest analysis for Cencora.

That recent 6% pullback and softer 1 month share price return of 5.59% come after a powerful run. The share price is still up strongly year to date and multi year total shareholder returns remain firmly positive, suggesting momentum is cooling rather than breaking.

If Cencora’s move has you rethinking your healthcare exposure, this could be a good moment to scout other high quality names using our healthcare stocks.

With earnings still growing double digits and the share price sitting roughly 14% below analyst targets, has Cencora quietly slipped into undervalued territory, or is the market already factoring in years of future growth?

Most Popular Narrative Narrative: 11.6% Undervalued

With Cencora last closing at 341.72 dollars against a narrative fair value of 386.60 dollars, the current pullback sits within a still bullish long-term framework.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act, improving supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

Want to see what is baked into this optimism? The narrative leans on rising specialty demand, thicker margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $386.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerated generic adoption and persistent international weakness could compress margins and slow earnings growth, which may challenge assumptions behind the current undervalued narrative.

Find out about the key risks to this Cencora narrative.

Another View: Market Ratio Sends A Different Signal

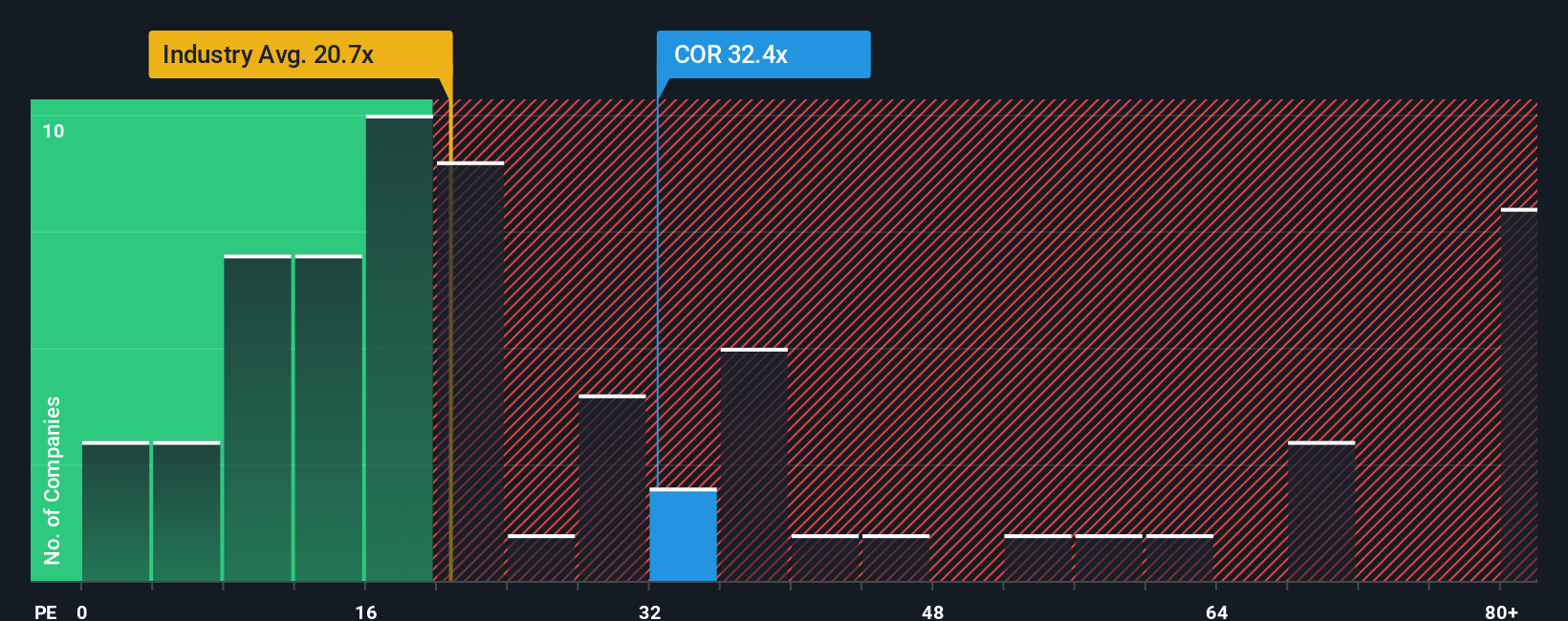

While the narrative fair value frames Cencora as 11.6 percent undervalued, its current price to earnings ratio of 42.7 times looks stretched versus peers at 22.4 times and a fair ratio of 34.1 times. This suggests downside valuation risk if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when a world of opportunities is within reach. Use the Simply Wall Street Screener to target strategies that match your goals.

- Capture early stage potential by reviewing these 3628 penny stocks with strong financials that pair tiny share prices with balance sheets and cash flows that still look surprisingly resilient.

- Strengthen your long term income plan by scanning these 13 dividend stocks with yields > 3% that can help support reliable cash returns in changing markets.

- Position yourself ahead of the next AI wave by assessing these 25 AI penny stocks that are harnessing machine learning to reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Shopify: The Quiet Shift From Store Builder to Commerce Operating System

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)