- United States

- /

- Healthcare Services

- /

- NYSE:CON

Concentra (CON): Fresh Analyst Upgrades and Growth Moves Prompt a Closer Look at Valuation

Reviewed by Kshitija Bhandaru

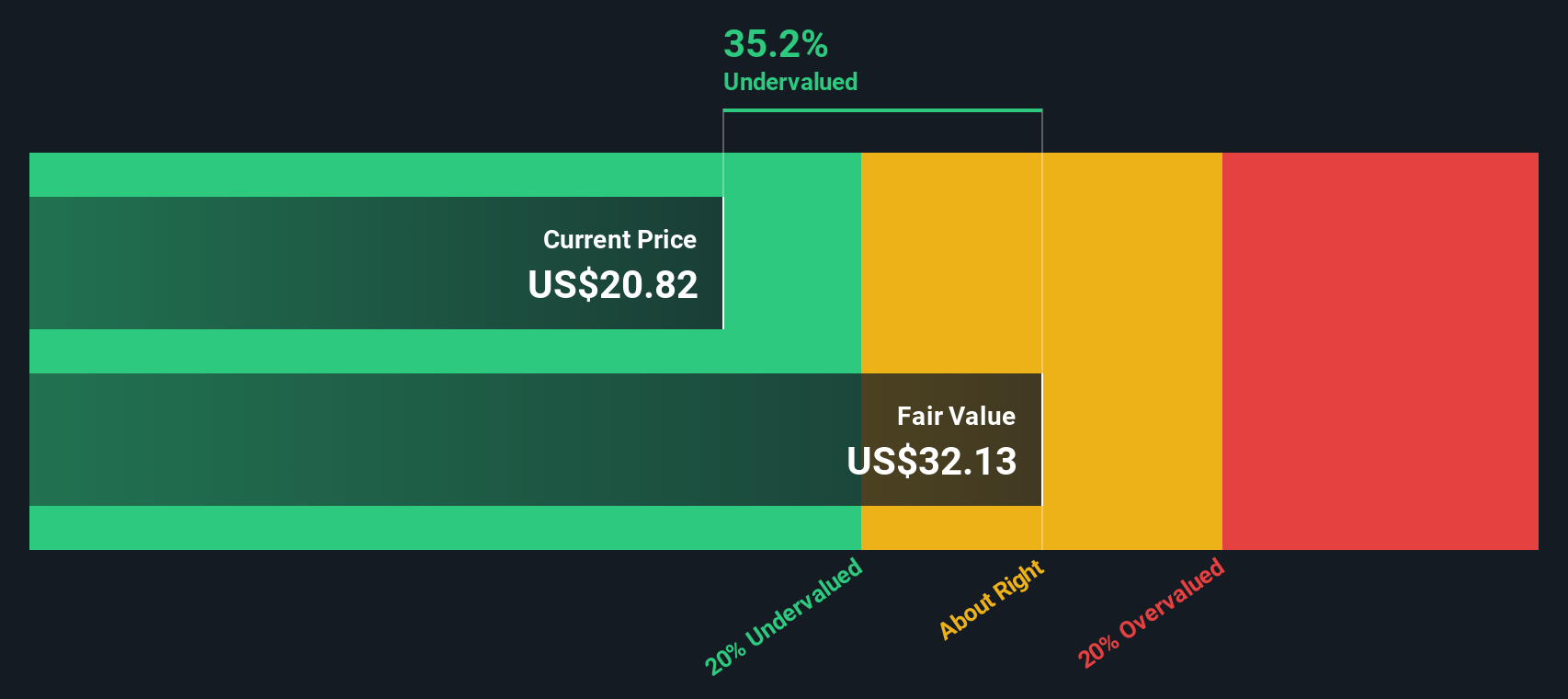

Most Popular Narrative: 25.8% Undervalued

According to the most widely followed narrative, Concentra Group Holdings Parent could be significantly undervalued, with a fair value estimate that is over 25% higher than its current share price. This assessment factors in the company's expected earnings growth, margin improvements, and a discount rate aligned with industry standards.

Strategic acquisitions (Nova and Pivot) and de novo clinic expansion are actively increasing Concentra's national footprint and service capabilities, providing revenue growth through increased volumes and operational leverage. Full integration and synergy realization are expected to further improve EBITDA margins and overall earnings in coming quarters.

Curious about the engine behind this bullish outlook? The analysts are betting big on Concentra’s ability to boost growth, sharpen margins, and bank on multiple expansion. One critical and perhaps surprising assumption lies at the heart of this valuation. Want to see what powers this number?

Result: Fair Value of $28.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high integration costs or a slowdown in core occupational health demand could quickly change this outlook and temper analyst optimism.

Find out about the key risks to this Concentra Group Holdings Parent narrative.Another View: Discounted Cash Flow Perspective

A different lens on valuation comes from applying our SWS DCF model. This approach, which looks at Concentra's forecasted future cash flows, also points to the stock being undervalued at current levels. Does this second method make the case even stronger, or is there something both models could be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Concentra Group Holdings Parent Narrative

If you have a different take on these figures or prefer to analyze the numbers yourself, you can build your own view of Concentra in just a few minutes. Do it your way.

A great starting point for your Concentra Group Holdings Parent research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Stay ahead of the curve by tapping into high-potential stock themes. Don’t let opportunities pass by, when tomorrow’s market leaders could be waiting for you right now.

- Seize the chance to uncover resilient value with undervalued stocks based on cash flows and see which companies are priced well below their intrinsic worth.

- Spot top-tier cash flow from proven business models with dividend stocks with yields > 3% and find income opportunities yielding over 3% in today’s market.

- Tap into the future of healthcare by browsing healthcare AI stocks for innovative companies transforming patient care through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CON

Concentra Group Holdings Parent

Provides occupational health services in the United States.

Undervalued with moderate growth potential.

Market Insights

Community Narratives