- United States

- /

- Healthcare Services

- /

- NYSE:CNC

What Centene (CNC)'s Community Impact Initiatives and Analyst Optimism Mean for Shareholders

Reviewed by Sasha Jovanovic

- In recent weeks, Centene subsidiaries have made headlines, including MHS Health Wisconsin achieving a 4.5-Star NCQA rating, placing it among the top Medicaid health plans nationally, and WellCare of North Carolina directing over US$1.6 million in funding to local nonprofits, while analysts applauded Centene’s operational execution amid ongoing Medicaid cost pressures and uncertainty around policy reforms.

- These events reflect the company’s focus on community healthcare impact and transparency in addressing industry challenges, which has coincided with higher analyst price targets and increased optimism about future Medicaid margin improvements and Marketplace segment performance.

- As Centene faces rising Medicaid costs and adapts its pricing strategy, we'll explore how effective cost controls and analyst optimism influence its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Centene Investment Narrative Recap

To be a Centene shareholder today, you need to believe that the company can successfully restore net margins in its Medicaid and Marketplace businesses despite unpredictable patient costs and significant policy reform risks. The recent news, including positive analyst reactions and Centene’s transparency about corrective actions on cost pressures, has added optimism, but the impact on the short-term catalyst (Medicaid margin recovery) and the biggest risk (policy-driven revenue uncertainty) remains limited for now.

Among the latest announcements, Centene's well-recognized Medicaid performance in Wisconsin stands out, reinforcing the company's competitive strength in contract renewals. This is directly relevant as contract wins and high-quality ratings could support margin recovery and offset some of the ongoing earnings headwinds.

However, investors should also keep in mind that ongoing policy uncertainty could affect future Medicaid rate negotiations, and...

Read the full narrative on Centene (it's free!)

Centene's outlook anticipates $195.6 billion in revenue and $2.1 billion in earnings by 2028. This assumes a 7.0% annual revenue growth rate with no change in earnings from the current level of $2.1 billion.

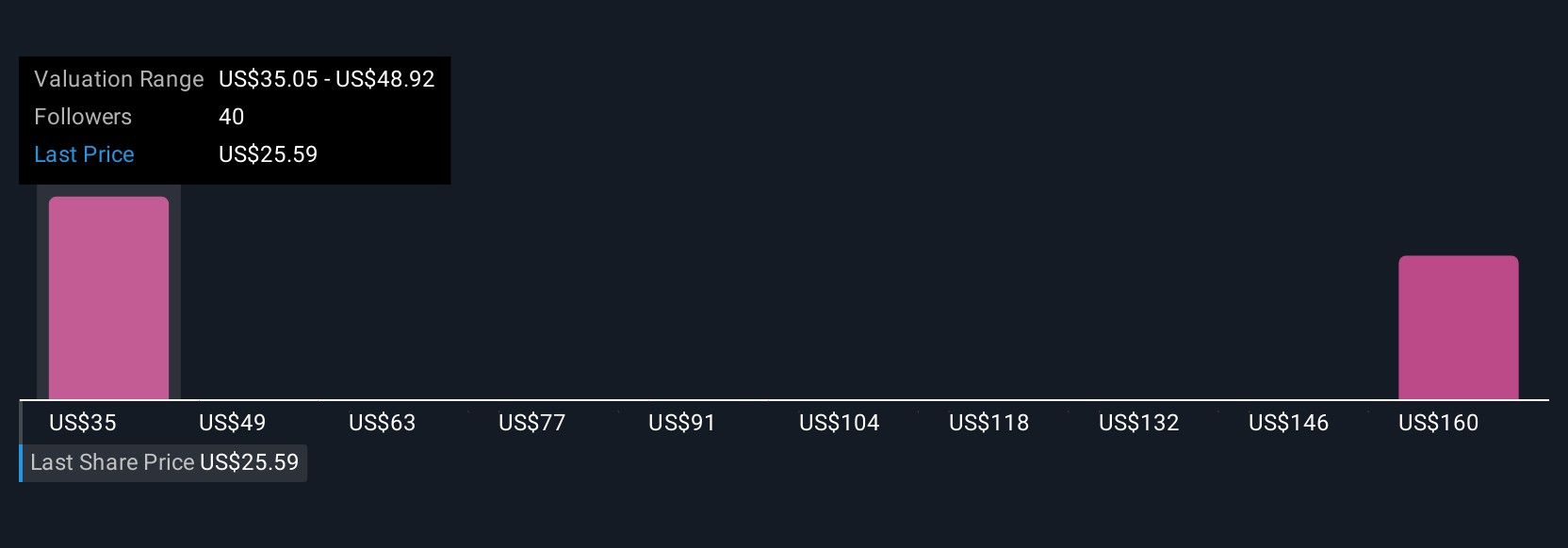

Uncover how Centene's forecasts yield a $34.62 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community range from US$31.58 to US$187.86 per share, reflecting wide differences among retail investors. While recent optimism centers on margin recovery, unresolved policy risks may shape future performance and it is worth exploring additional viewpoints.

Explore 16 other fair value estimates on Centene - why the stock might be worth over 4x more than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives