- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Is Centene's (CNC) Financial Guidance Withdrawal Reshaping Investor Trust in Its Transparency?

Reviewed by Simply Wall St

- In August 2025, Centene Corporation faced several securities class-action lawsuits after withdrawing its 2025 financial guidance, citing lower than expected market growth and less favorable morbidity trends identified by an independent actuarial review.

- This wave of litigation has intensified scrutiny on Centene's prior disclosures and raised concerns about transparency and reliability in reporting business fundamentals.

- We'll now examine how renewed questions regarding Centene's financial transparency may affect its investment narrative and outlook.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Centene Investment Narrative Recap

To invest in Centene today, you have to trust in the company’s ability to recover margins and stabilize earnings through its core Medicaid and Medicare businesses, even as recent lawsuits and the withdrawal of financial guidance increase the urgency and uncertainty around near-term outlooks. The biggest risk currently is heightened scrutiny over reporting transparency following the abrupt guidance withdrawal, while the most important catalyst remains the company’s potential to restore confidence via operational improvements and more reliable disclosures; the immediate impact of the lawsuits is material, as they challenge the trust foundational to these recovery plans.

Among recent announcements, Centene’s July 1, 2025 withdrawal of its financial guidance in response to actuarial findings is central to these developments, as it directly triggered the lawsuits and increased investor focus on both risk and the path to any future catalyst. How management addresses disclosure quality and rebuilds credibility is now intertwined with the stock’s prospects for recovery.

However, investors should pay close attention to the risk that ongoing litigation and questions about public disclosures could...

Read the full narrative on Centene (it's free!)

Centene's outlook forecasts $195.5 billion in revenue and $2.3 billion in earnings by 2028. Achieving this would require 7.0% annual revenue growth and a $0.2 billion increase in earnings from the current $2.1 billion.

Uncover how Centene's forecasts yield a $34.88 fair value, a 19% upside to its current price.

Exploring Other Perspectives

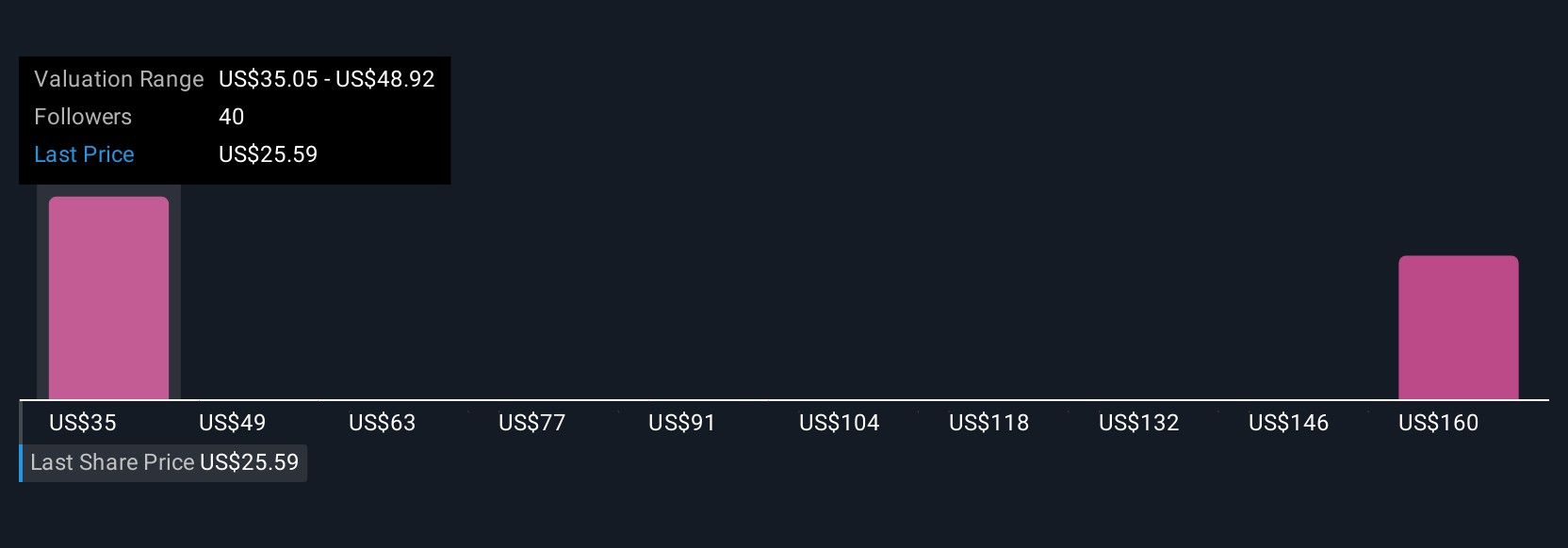

Fourteen individual fair value estimates from the Simply Wall St Community range widely, from US$24 to over US$192 per share. This diversity reflects uncertainty, especially in the face of recent legal and disclosure risks that could weigh on both sentiment and future performance; explore these perspectives to see how different investors assess opportunity and risk.

Explore 14 other fair value estimates on Centene - why the stock might be worth 18% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives