- United States

- /

- Healthcare Services

- /

- NYSE:CAH

How Cardinal Health’s (CAH) New Robotic Center Could Shape Its Long-Term Distribution Strategy

Reviewed by Sasha Jovanovic

- Cardinal Health recently announced plans for a new 230,000-square-foot automated pharmaceutical distribution center in Indianapolis, featuring an industry-first robotic storage and retrieval system designed with Swisslog to enhance efficiency and support more than 70,000 daily deliveries nationwide.

- This facility, expected to be operational by fall 2027 and create over 100 new jobs, marks a major step in the company’s continued expansion and technological modernization of its national pharmaceutical distribution network.

- We'll explore how this significant investment in automation and supply chain infrastructure could influence Cardinal Health's longer-term growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cardinal Health Investment Narrative Recap

To be a shareholder in Cardinal Health right now, you need to believe that industry-wide demand for pharmaceuticals and medical supplies will remain resilient and that automation will support more efficient, profitable operations. The newly announced automated Indianapolis distribution center reinforces Cardinal’s push for long-term margin improvement, but likely does not alter the company’s main short-term catalyst, ongoing pharmaceutical volume growth, nor does it materially reduce the largest risk for now, which remains the potential for regulatory and pricing pressures on margins.

Among Cardinal Health’s recent announcements, the launch of the new Groveport, Ohio Consumer Health Logistics Center stands out. Similar in scope to the Indianapolis project, this hub also leverages automation and demonstrates how the company is executing on its infrastructure expansion plans, providing further support for the supply chain efficiency catalyst.

By contrast, the challenge of increasing government regulation and margin compression remains a key issue all investors should be following closely, particularly as...

Read the full narrative on Cardinal Health (it's free!)

Cardinal Health's narrative projects $288.0 billion revenue and $2.2 billion earnings by 2028. This requires 9.0% yearly revenue growth and a $0.6 billion increase in earnings from $1.6 billion today.

Uncover how Cardinal Health's forecasts yield a $180.46 fair value, a 17% upside to its current price.

Exploring Other Perspectives

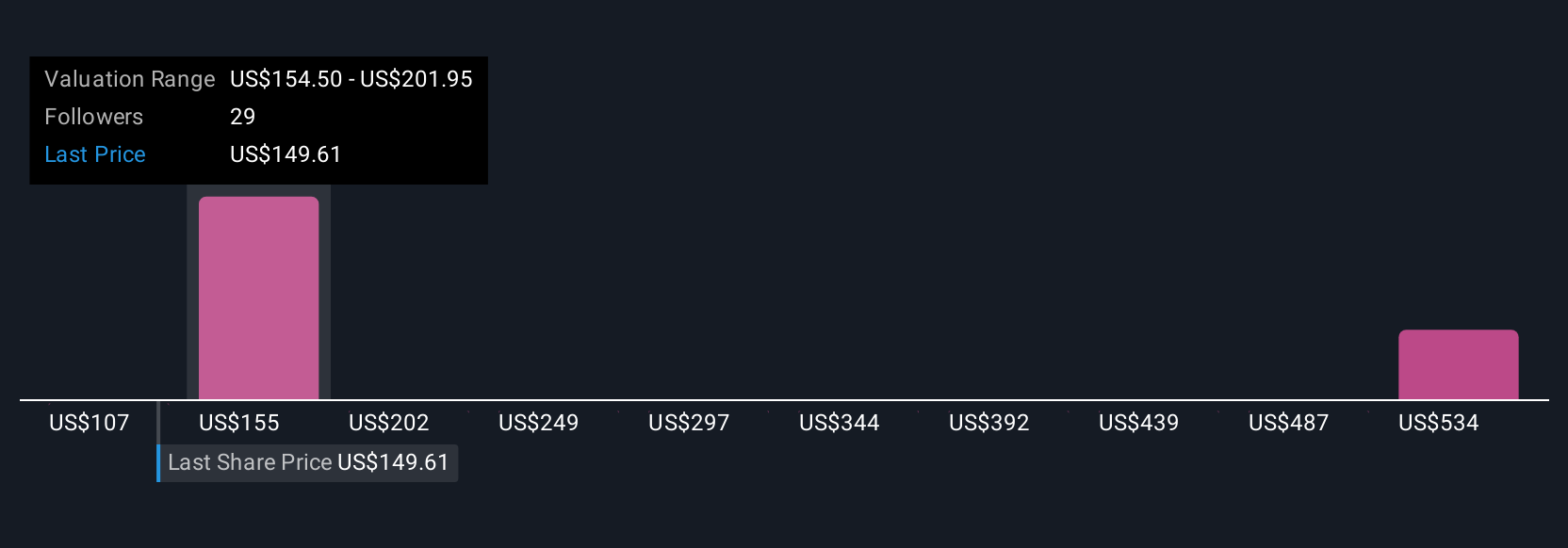

Simply Wall St Community members estimate fair value for Cardinal Health stock anywhere from US$135 to US$584, based on four distinct forecasts. While many see automation and infrastructure investment as growth drivers, others remain focused on the regulatory headwinds that could shape future returns, reminding you to consider a full span of perspectives.

Explore 4 other fair value estimates on Cardinal Health - why the stock might be worth 13% less than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

No Opportunity In Cardinal Health?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives