- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Cardinal Health (NYSE:CAH) Welcomes New Independent Directors With Tech and Healthcare Expertise

Reviewed by Simply Wall St

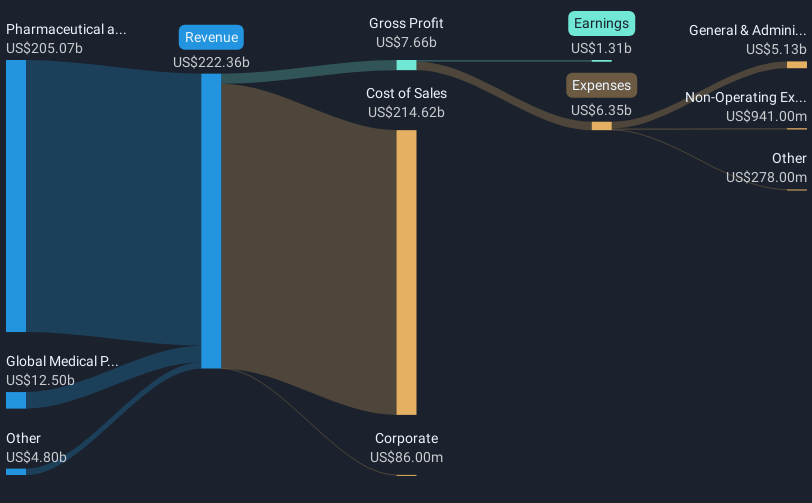

Cardinal Health (NYSE:CAH) recently appointed Robert Musslewhite and Sudhakar Ramakrishna to its Board of Directors, which may have reinforced investor confidence, culminating in a 5% share price increase over the last quarter. These appointments enhance the company's governance with expertise from healthcare and cybersecurity sectors. Despite the Dow Jones and other major indices facing declines due to economic concerns and tariff-related uncertainty, Cardinal Health sustained positive momentum. The company's Q2 2025 earnings demonstrated an increase in net income to $400 million from $368 million YoY, and diluted EPS rose to $1.65. Additionally, the firm's affirmation of a quarterly dividend of $0.51 and their active share buyback program of $75 million indicate a commitment to returning value to shareholders, potentially contributing to the stock's upward trajectory amid a backdrop of broader market challenges.

See the full analysis report here for a deeper understanding of Cardinal Health.

The past five years have been rewarding for Cardinal Health's shareholders, with the company achieving a 231.41% total return, including share price appreciation and dividends. While accounting for its performance, several key developments have emerged. In 2024, Cardinal Health successfully expanded its operational footprint, opening a 350,000 sq. ft. facility in South Carolina. The earnings growth over the past year was impressive at a sensational pace compared to the healthcare industry average, contributing to a favorable outlook. Notably, the company maintained attractive valuations, trading at good value relative to both its peers and the estimated fair value, further enhancing its long-term appeal. Additionally, the successful execution of share buyback programs, with over 3.4 million shares repurchased by the end of 2024, signaled management's focus on enhancing shareholder value.

Despite reporting a 4% decline in sales in early 2025, net income for the quarter increased, underscoring the company's ability to boost profitability even in challenging circumstances. Furthermore, Cardinal Health's earnings per share guidance for 2025 was raised, reflecting successful acquisitions that positively impacted revenue. Alongside strategic client partnerships, such as the agreement with T2 Biosystems for selling rapid sepsis diagnostics, these efforts have fortified the company's market position. While Cardinal Health's one-year return lagged behind the overall US market by a small margin, it markedly outpaced the US healthcare industry, which bore a 4.4% decrease over the same period. This performance underscores Cardinal Health's resilience and adaptability in a rapidly evolving landscape.

- Analyze Cardinal Health's fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for Cardinal Health in our thorough risk analysis report.

- Already own Cardinal Health? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cardinal Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally.

Undervalued with solid track record and pays a dividend.