- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Is Brookdale Senior Living Set for More Growth After 59% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do next with Brookdale Senior Living stock? You are definitely not alone. Investors have watched this name closely, and its recent movements may have complicated your decision a bit. The stock closed at $8.06, taking a small dip of -3.4% over the past week. But step back and you will see some remarkable momentum: up 4.8% for the month, and a whopping 59.3% so far this year. That adds to a powerful longer-term trend. Brookdale shares have climbed nearly 188% over the past five years, with solid progress in between.

A lot of this performance comes on the back of changing sentiment around the senior living sector. Emerging market optimism, stronger occupancy rates, and broader trends in healthcare have started to shift risk perceptions for companies like Brookdale. While it can be tempting to chase returns, understanding how much value is left in the stock is critical, especially after such sustained gains.

If you are valuation-minded, here is something you will like: Brookdale earns a value score of 5 out of 6 according to our checklist. That score reflects five distinct checks where the stock is still trading at a discount; this is not something you see every day in a market this strong. But is that the only way to look at value? Let us walk through the different valuation approaches you might use, and I will share a method that could give you an even clearer answer by the end of this article.

Approach 1: Brookdale Senior Living Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for determining the fair value of a company's stock. It works by taking the company's projected future cash flows and discounting them back to their value today, giving investors a sense of what those future dollars are worth in present terms.

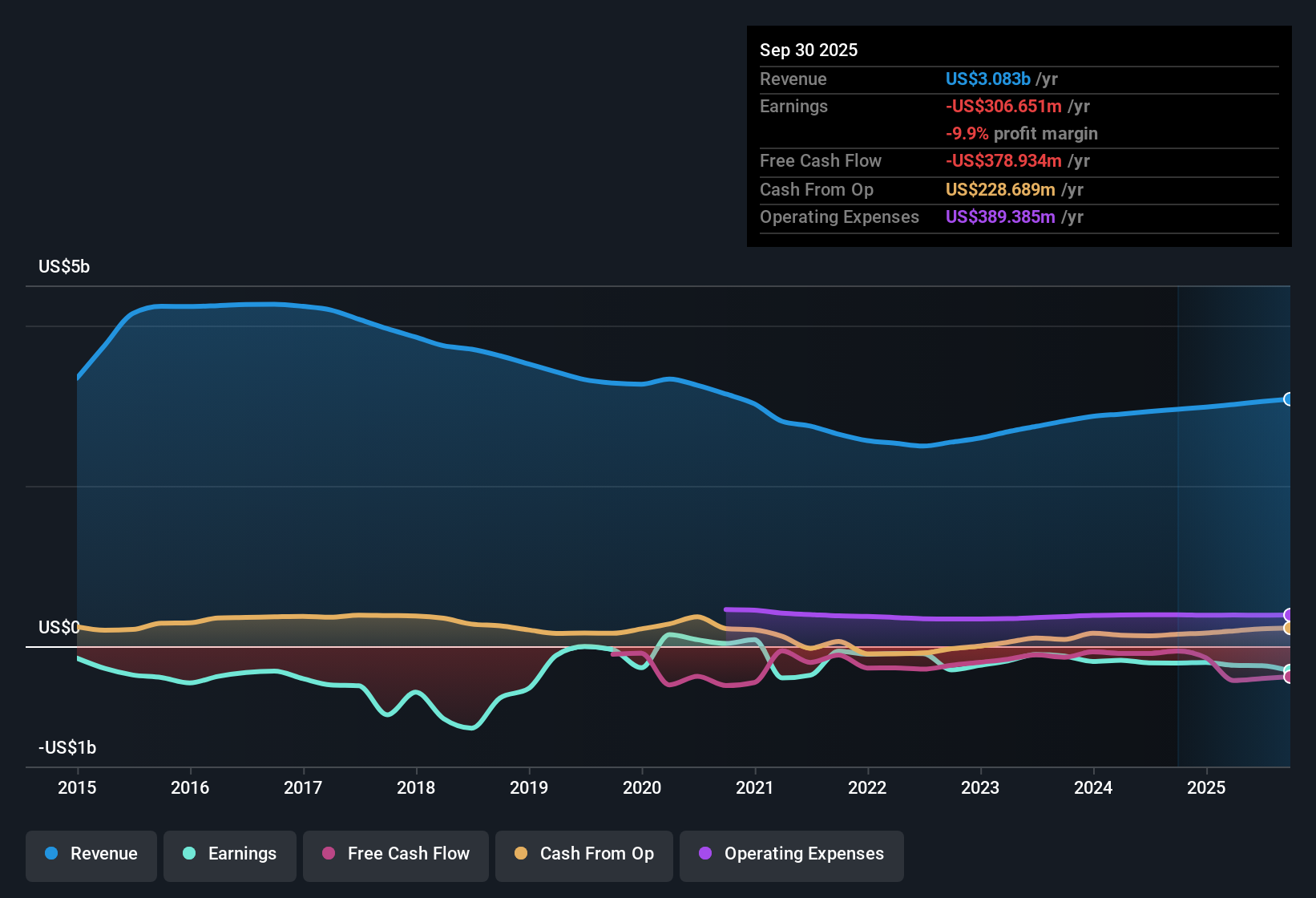

For Brookdale Senior Living, the most recent Free Cash Flow (FCF) stands at -$149.1 million, illustrating that the company is still in the process of turning around its cash-generating capacity. Projections indicate that FCF may rise to $69.7 million by 2026. Beyond that, forecasts suggest even stronger growth, with estimates reaching $593.8 million in 2035. Analyst estimates inform the early years, while Simply Wall St extrapolates the later projections.

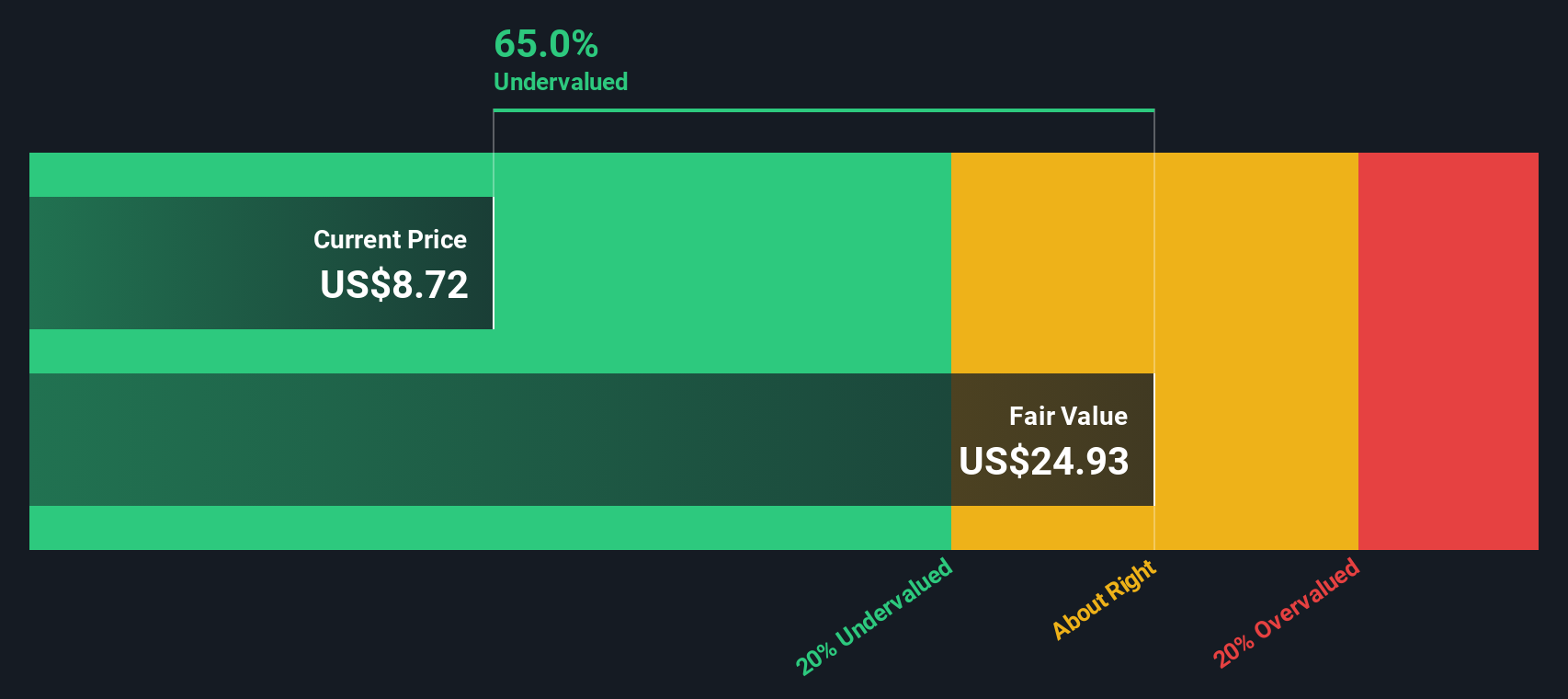

According to the DCF calculation, the intrinsic value is $22.97 per share. When compared to Brookdale’s current share price of $8.06, this indicates the stock is trading at a 64.9% discount to its estimated fair value.

This model suggests that Brookdale Senior Living is significantly undervalued, based on long-term cash flow projections and consensus analyst figures.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brookdale Senior Living is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Brookdale Senior Living Price vs Sales

The Price-to-Sales (P/S) ratio is often preferred for valuing companies like Brookdale Senior Living, where consistent profitability may be challenged by industry dynamics or business turnaround periods. Sales-based multiples are especially useful because they strip out the distortions of short-term losses and offer a clearer view for investors comparing growth-stage or cyclical businesses.

While growth expectations and risk levels both play a big role in setting what qualifies as a “normal” P/S ratio, investors should remember that higher-growth, lower-risk companies usually earn higher ratios. On the other hand, if investors see greater risks or lackluster growth prospects, they demand a lower multiple.

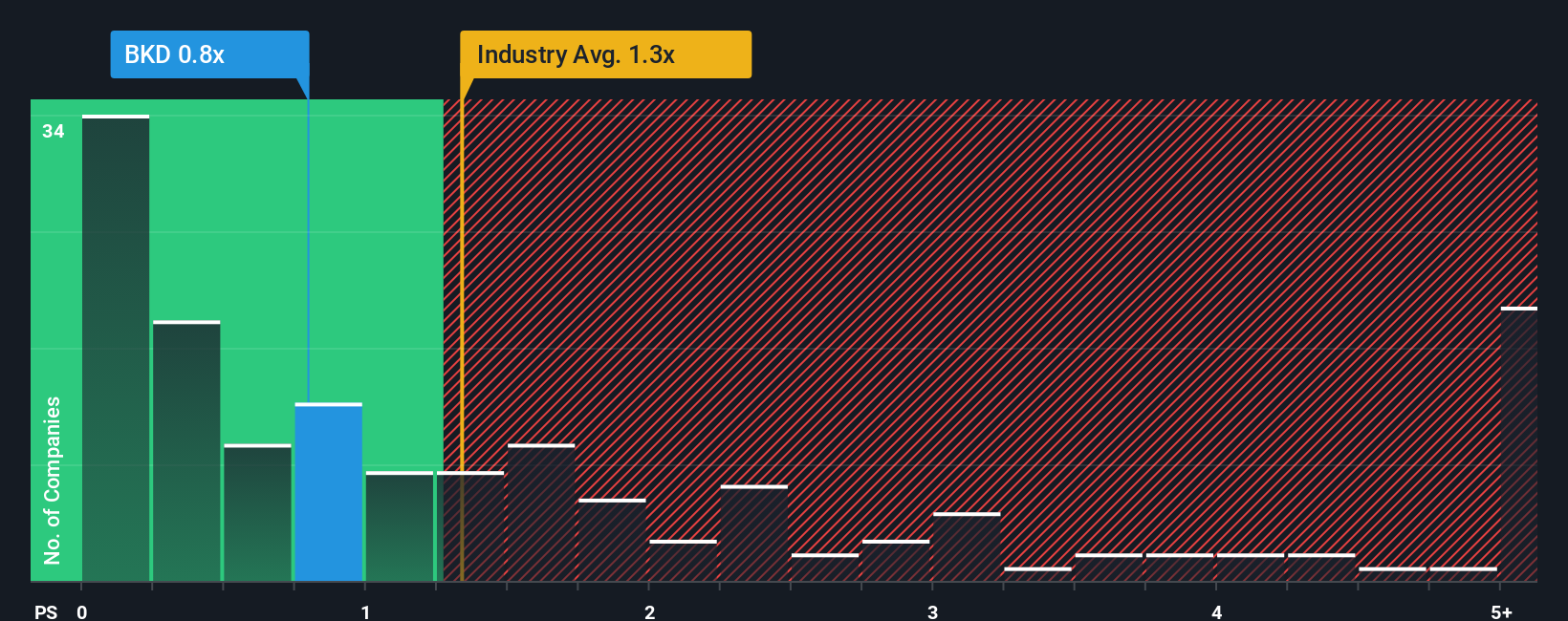

Brookdale’s latest P/S ratio stands at 0.63x. That is below the healthcare industry average of 1.43x and also beneath the 0.75x average across its closest peers. At first glance, this lower multiple might signal that the market expects less growth or sees higher risk relative to competitors.

However, Simply Wall St’s Fair Ratio for Brookdale comes in at 0.65x. This proprietary measure goes beyond simple peer comparisons by weighing the company’s individual growth outlook, profitability, risk factors, industry context, and market cap. Because the Fair Ratio adapts to Brookdale’s unique circumstances, it gives a more nuanced take than simply benchmarking against the sector.

Comparing Brookdale’s current P/S of 0.63x to its Fair Ratio of 0.65x shows the valuation is almost spot on. The very small gap suggests the shares are trading at a price well aligned with underlying expectations and fundamentals.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brookdale Senior Living Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your perspective on a company’s story with its expected future financials, such as revenue growth, profit margins, and fair value. This approach helps you easily justify your investment decisions.

Using Narratives, you can create or explore the story behind the numbers for Brookdale Senior Living, clearly outlining your beliefs about what will drive the company’s future and seeing how those beliefs translate into a fair value estimate. Narratives tie together a company’s unique situation, a financial forecast, and a fair value, making the investment process much more intuitive than simply reading ratios or analyst reports.

Best of all, Narratives are easy to use and available in the Simply Wall St Community, where millions of investors share their own scenarios and assumptions. As new information like news or earnings arrives, Narratives update dynamically, ensuring your view stays relevant and allowing you to quickly compare your fair value estimate to the market price to help decide when to buy, hold, or sell.

- For example, some investors expect strong demographic demand and improving margins, supporting a fair value as high as $9.5 per share.

- Others remain cautious about labor costs and leverage, leading them to set fair value as low as $6.0.

Do you think there's more to the story for Brookdale Senior Living? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)