- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (BDX): Valuation Check After New Cell Analyzers Launch and ChemoGLO Safety Alliance

Reviewed by Simply Wall St

Recent moves in Becton Dickinson (BDX) have been driven by two MedTech updates: a global rollout of next generation cell analyzers and a new ChemoGLO alliance focused on hazardous drug contamination testing.

See our latest analysis for Becton Dickinson.

Those launches and the ChemoGLO tie up land at a moment when momentum is tentatively improving, with a 90 day share price return of 8.16% but a weaker one year total shareholder return of 9.01%.

If you like the defensive healthcare angle here, it is also worth scanning healthcare stocks for other medical names quietly building similar long term potential.

With shares still trading at a sizable intrinsic discount despite improving earnings growth and fresh MedTech catalysts, is Becton Dickinson quietly undervalued right now, or is the market already pricing in its next leg of expansion?

Most Popular Narrative: 0.8% Undervalued

Against a last close near 201 dollars, the most followed narrative pegs Becton Dickinson's fair value slightly higher, implying only a slim upside and a carefully balanced long term outlook based on discounted future cash flows.

The pending separation of the Biosciences and Diagnostic Solutions business will transform BD into a pure play medical technology leader with a consumables heavy portfolio (>90% of revenue). This is expected to enable higher cash flow predictability and margin improvement, while anticipated aggressive share buybacks directly support EPS growth.

Curious how modest revenue growth, rising margins, and a lower future earnings multiple can still support a higher fair value than today? Want to see the full playbook behind that 8 percent plus annual earnings trajectory, the share count assumptions, and the discount rate used to bring it all back to present day? The next step is understanding exactly which long term profit and valuation targets this narrative is banking on and how they stack up against the broader medical equipment space.

Result: Fair Value of $202.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and execution risks around the 2026 business separation could still derail the earnings and margin progress that is built into this narrative.

Find out about the key risks to this Becton Dickinson narrative.

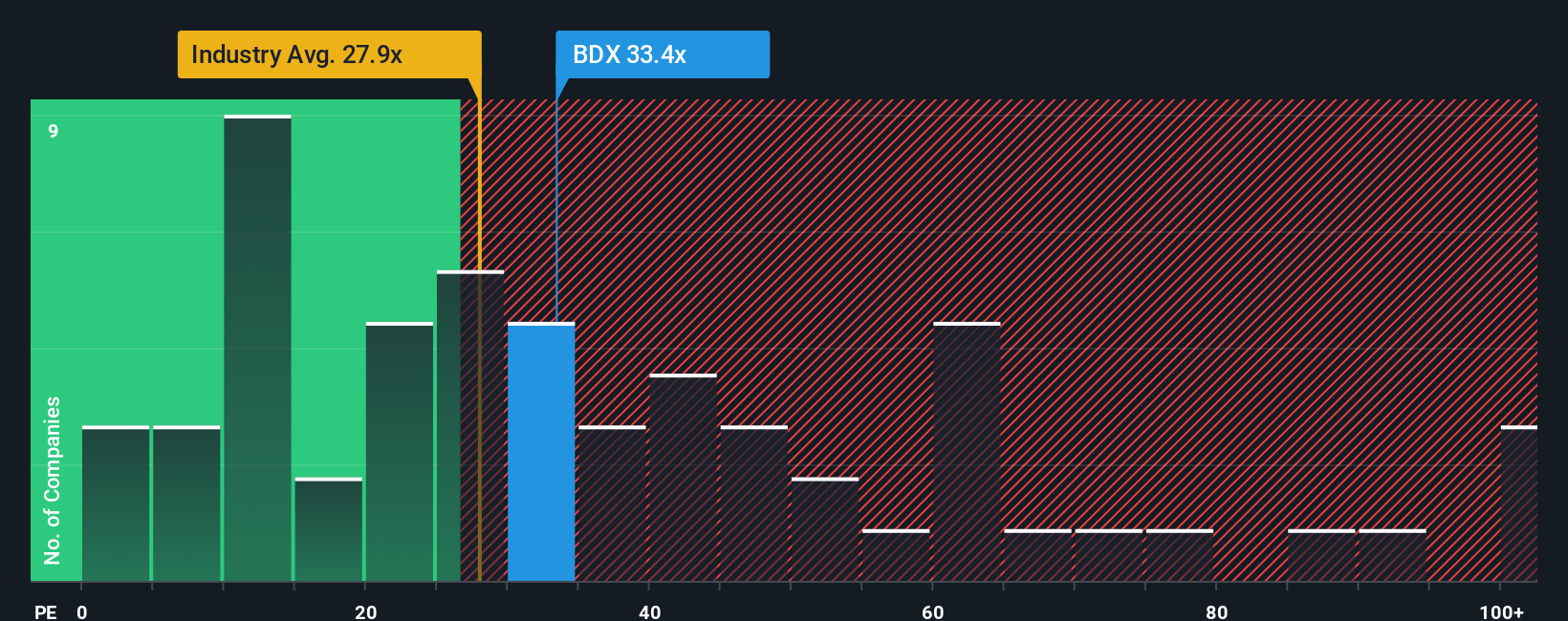

Another View: Market Ratios Flash Caution

Market ratios tell a cooler story. On earnings, Becton Dickinson trades at about 34.2 times, above both the US Medical Equipment average of 30.4 times and a fair ratio of 32.9 times, suggesting investors are already paying a premium that could cap future upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Becton Dickinson Narrative

If this perspective does not quite match your own, or you prefer digging into the numbers yourself, you can build your version in minutes using Do it your way.

A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall Street Screener to uncover targeted lists of stocks that match exactly how you like to invest.

- Capture income potential by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

- Position yourself ahead of the next tech wave by reviewing these 26 AI penny stocks that are shaping how artificial intelligence affects entire industries.

- Enhance your bargain hunting by analysing these 908 undervalued stocks based on cash flows where quality cash flows may still be trading at overlooked prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)