- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Assessing Abbott (ABT) Valuation After New Lingo CGM Expansion and Protein-Glucose Data Release

Reviewed by Simply Wall St

Abbott Laboratories (ABT) just widened the audience for its Lingo glucose sensor by rolling it out on Android, pairing that step with fresh real world data on how protein intake shapes daily glucose control.

See our latest analysis for Abbott Laboratories.

Those Lingo updates and new Ensure protein launches land while Abbott’s 1 year total shareholder return of about 10 percent edges ahead of its year to date share price return near 9 percent, suggesting steady long term momentum despite recent softness.

If this kind of health tech story is on your radar, it is worth exploring other innovative names using our curated screen of healthcare stocks.

With diversified growth, new tech launches and shares still trading roughly 17 percent below Wall Street’s target, is Abbott quietly offering upside for patient investors, or has the market already priced in its next leg of expansion?

Most Popular Narrative: 15% Undervalued

With the latest fair value estimate sitting above Abbott’s recent close at $123.28, the most followed narrative frames today’s price as leaving room for upside.

The analysts have a consensus price target of $142.485 for Abbott Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $159.0, and the most bearish reporting a price target of just $122.0.

Want to see how a shrinking margin profile still supports a premium earnings multiple? The narrative leans on steady revenue growth and a future valuation hurdle that many mature healthcare names rarely clear. Curious which forecasts make that math work, and how much execution it assumes between now and 2028? Dive in to unpack the full playbook behind this price target.

Result: Fair Value of $144.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking diagnostics margins and potential integration hiccups around the Exact Sciences deal could quickly challenge the upbeat valuation narrative.

Find out about the key risks to this Abbott Laboratories narrative.

Another Angle on Value

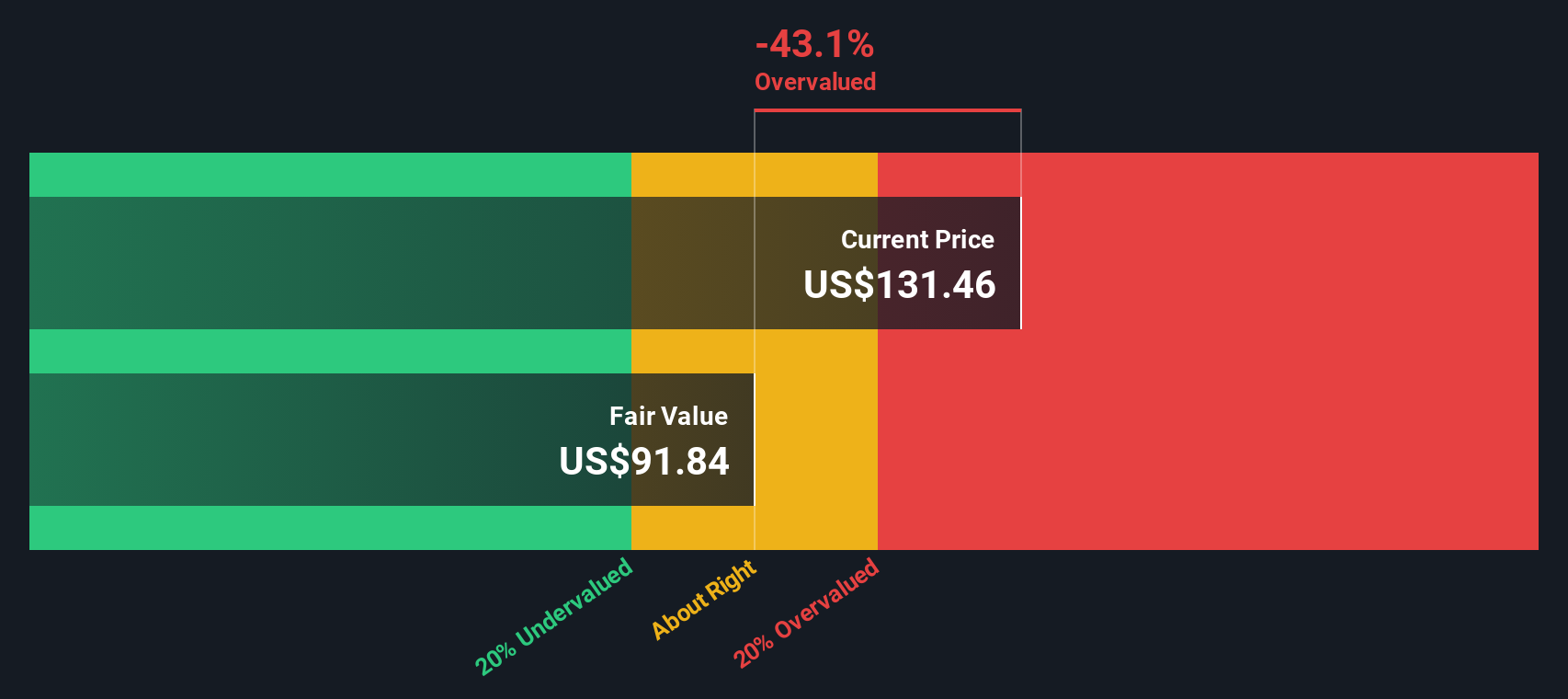

While analysts see around 15 percent upside to $144.43, our SWS DCF model paints a stricter picture, placing fair value closer to $73.23, which implies Abbott is trading well above intrinsic value. Is the market betting on a richer future than the cash flows justify?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abbott Laboratories for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abbott Laboratories Narrative

If you find yourself questioning these assumptions or simply prefer your own deep dive, you can build a personalized view in just minutes with Do it your way.

A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research to work by lining up your next opportunity with a few focused stock ideas tailored to different strategies.

- Lock in potential long term income by scanning these 12 dividend stocks with yields > 3% that could strengthen your cash flow beyond what a single healthcare leader can offer.

- Ride the next wave of innovation by reviewing these 25 AI penny stocks that may outpace traditional names as artificial intelligence reshapes entire industries.

- Spot tomorrow’s mispriced opportunities early by checking these 904 undervalued stocks based on cash flows that still fly under most radars but stack up strongly on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion