- United States

- /

- Medical Equipment

- /

- NYSE:ABT

A Look at Abbott Laboratories’s Valuation Following Strong Medical Device Launches and Regulatory Milestones

Reviewed by Simply Wall St

Abbott Laboratories’ Recent Performance: What’s Fueling the Momentum?

If you’ve been following Abbott Laboratories (ABT) this year, you’ve probably noticed a quiet but clear uptick in its stock. The company’s recent progress is drawing attention for good reason. Major gains in its Medical Devices and Structural Heart divisions are turning heads among investors. Standout product launches like the Libre CGM and the AVEIR leadless pacemaker, paired with new FDA approvals such as the Tendyne mitral replacement valve, have not only pushed sales higher but have also improved Abbott’s gross margins even as the broader economic backdrop remains choppy.

This operational strength has played out in the stock’s performance, with shares climbing nearly 19% over the past year. The momentum appears to be driven more by the market’s recognition of Abbott’s product success and its ability to push through higher-margin offerings, rather than by M&A rumors circulating about its interest in Synlait’s New Zealand facility. The gains have come alongside a string of regulatory wins and further adoption of its new devices, creating a contrast to the mixed moves earlier in the year.

The key question for investors now is whether Abbott’s current price fully reflects its growth story or if there is still value left on the table for those looking to buy in.

Most Popular Narrative: Narrative: 6.9% Undervalued

According to community narrative, Abbott Laboratories is currently seen as undervalued by about 6.9% relative to analysts' fair value estimate. Analysts base this on a range of quantitative and qualitative assumptions about growth, margins, and market risks.

The expansion of healthcare access and the rising middle class in key emerging markets (such as India, China, Latin America, and the Middle East) is fueling robust growth in branded generics and biosimilars. Abbott's record sales in these regions and upcoming biosimilar launches underscore this trend, which may help drive sustained double-digit top-line growth and further geographic revenue diversification.

Want to know why Wall Street sees Abbott as being worth more than its current market value suggests? This narrative is centered on international expansion and ambitious profit projections. Are you interested in discovering which future assumptions and key drivers analysts believe support this higher valuation? Explore further to uncover the complete financial story and the outlook supporting these figures.

Result: Fair Value of $142.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent challenges, such as declining COVID testing demand and tightening price controls in China, could undermine Abbott's impressive international growth story.

Find out about the key risks to this Abbott Laboratories narrative.Another View: What Does Our DCF Model Reveal?

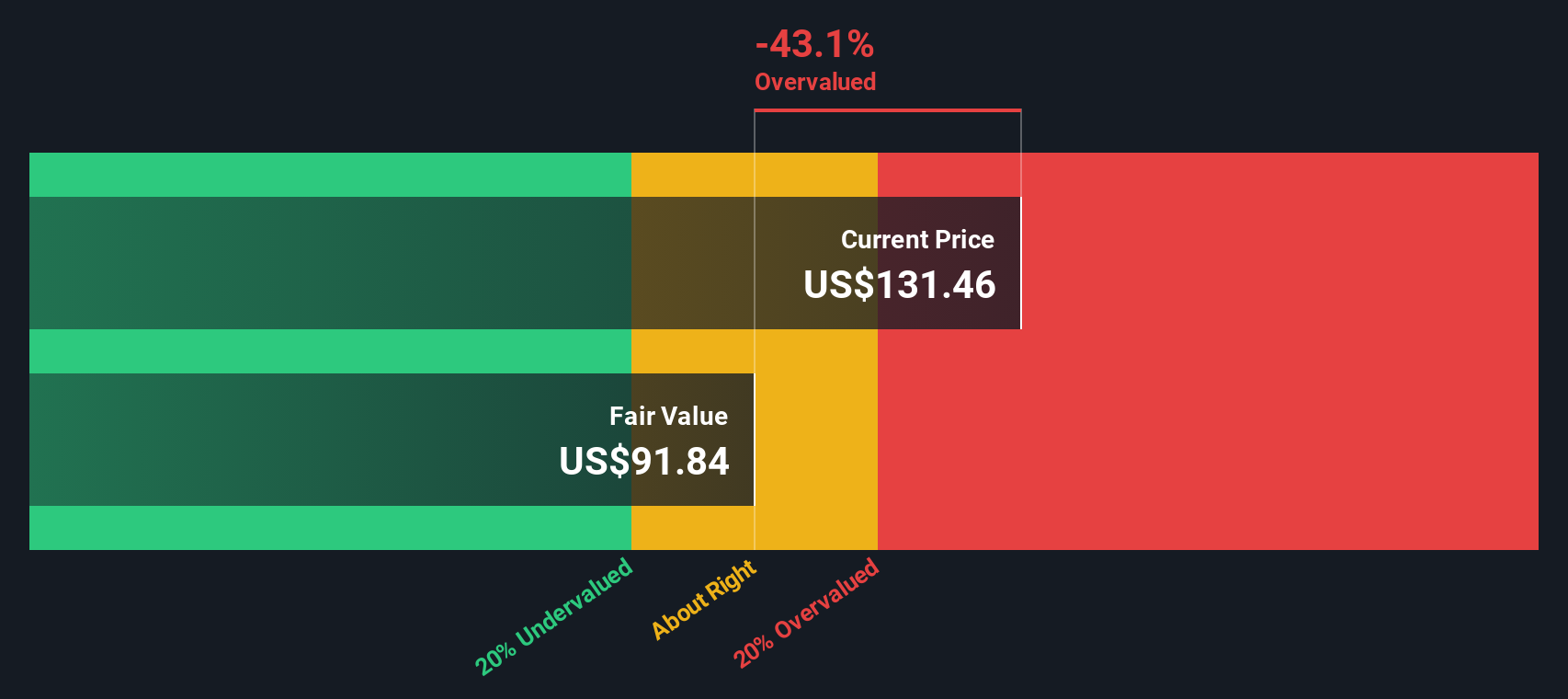

While analysts see upside based on their fair value estimates, our DCF model takes a different angle and suggests the stock may actually be trading above its intrinsic value. Does this shift in perspective change your outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Abbott Laboratories Narrative

If you have a different take or would rather dive into the numbers yourself, it’s easy to investigate and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Staying ahead in the market means always being on the lookout for fresh ideas. Don’t miss out on the chance to target winning stocks tailored to your investing goals. These unique lists have already helped thousands of investors spot hidden potential. Take action before the next opportunity slips away.

- Maximize your wealth potential with dividend stocks with yields > 3%, offering attractive yields above 3% for income-focused investors.

- Tap into future disruptors with AI penny stocks, which harness the explosive growth of artificial intelligence trends.

- Strengthen your portfolio with undervalued stocks based on cash flows to uncover stocks trading below their intrinsic value before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)