- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

3 US Stocks Estimated To Be Trading Up To 32.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market faces turbulence with major indices like the Dow and S&P 500 experiencing significant declines, investors are keenly observing opportunities that might arise from current valuations. In such a volatile environment, identifying stocks that trade below their intrinsic value can present potential investment opportunities, as these may offer room for appreciation when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Flushing Financial (NasdaqGS:FFIC) | $14.27 | $27.60 | 48.3% |

| First National (NasdaqCM:FXNC) | $24.06 | $46.63 | 48.4% |

| Old National Bancorp (NasdaqGS:ONB) | $21.18 | $40.78 | 48.1% |

| Afya (NasdaqGS:AFYA) | $14.58 | $28.59 | 49% |

| Western Alliance Bancorporation (NYSE:WAL) | $83.74 | $166.25 | 49.6% |

| Symbotic (NasdaqGM:SYM) | $23.97 | $47.09 | 49.1% |

| Crown Holdings (NYSE:CCK) | $82.87 | $163.38 | 49.3% |

| WEX (NYSE:WEX) | $167.90 | $332.99 | 49.6% |

| Progress Software (NasdaqGS:PRGS) | $66.22 | $130.49 | 49.3% |

| Paycor HCM (NasdaqGS:PYCR) | $19.58 | $38.44 | 49.1% |

Let's uncover some gems from our specialized screener.

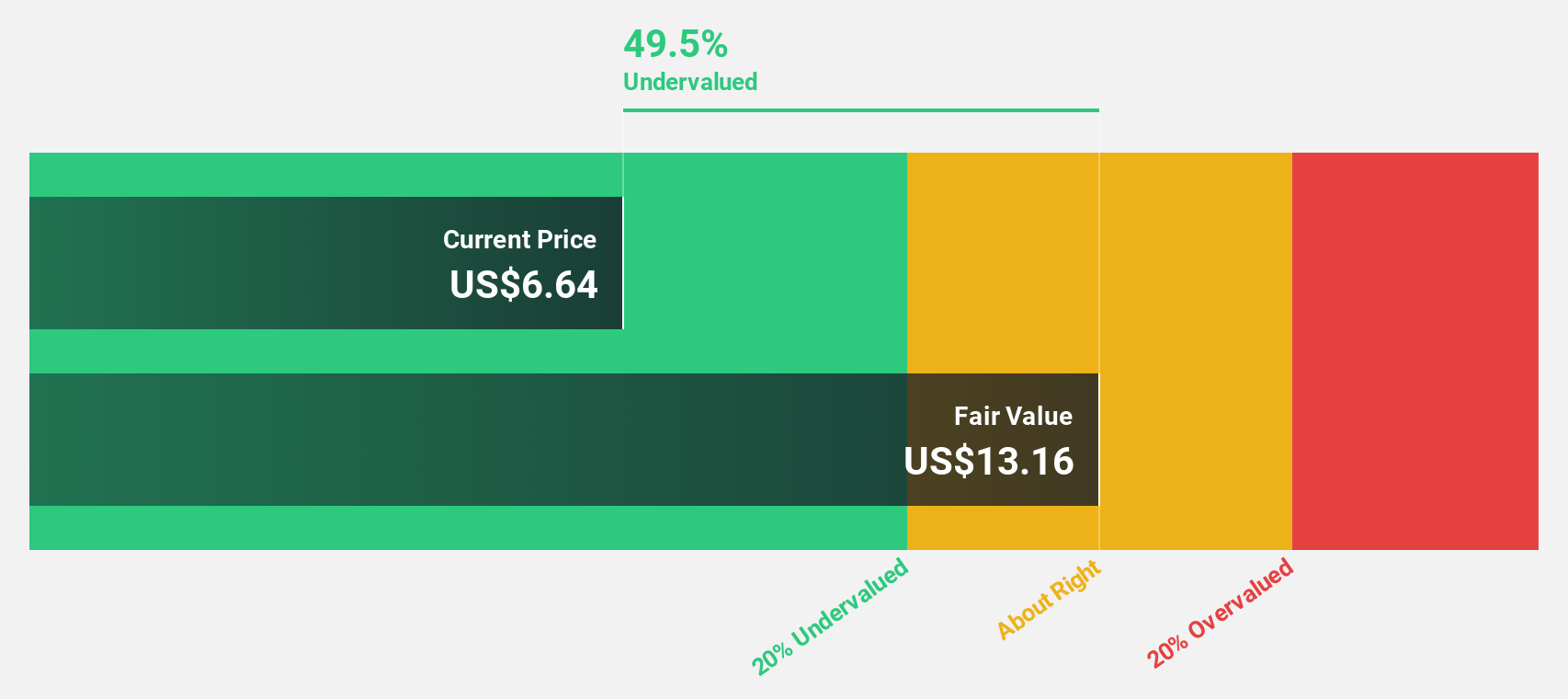

Infinera (NasdaqGS:INFN)

Overview: Infinera Corporation manufactures semiconductors and provides networking equipment, optical semiconductors, software, and services globally, with a market cap of approximately $1.56 billion.

Operations: The company generates revenue primarily from its optical transport networking equipment, software, and related services segment, amounting to $1.46 billion.

Estimated Discount To Fair Value: 32.1%

Infinera is trading at US$6.58, significantly below its estimated fair value of US$9.69, indicating it may be undervalued based on cash flows. Despite recent financial challenges, including a third-quarter net loss of US$14.31 million and declining revenue, the company is forecasted to achieve profitability over the next three years with high return on equity expectations. Strategic partnerships and technology advancements could support future growth despite current shareholder dilution concerns.

- Our growth report here indicates Infinera may be poised for an improving outlook.

- Dive into the specifics of Infinera here with our thorough financial health report.

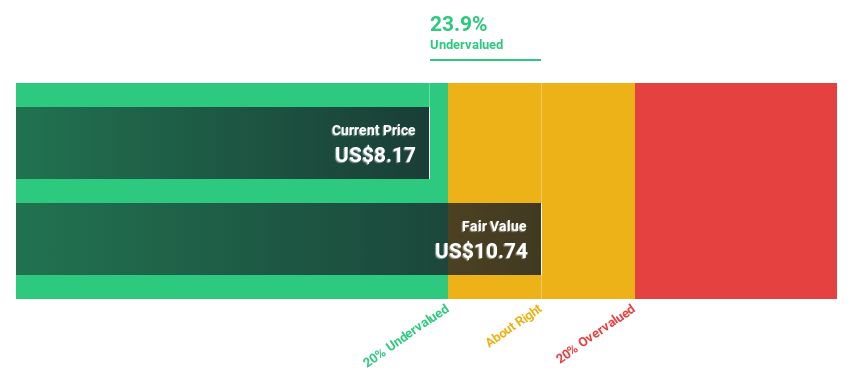

Zynex (NasdaqGS:ZYXI)

Overview: Zynex, Inc., along with its subsidiaries, designs, manufactures, and markets medical devices for pain treatment and muscle rehabilitation using electrical stimulation; it has a market cap of $267.50 million.

Operations: The company's revenue segment consists of medical devices, generating $193.67 million.

Estimated Discount To Fair Value: 23.9%

Zynex, trading at US$8.17, is significantly below its estimated fair value of US$10.74, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins from 8.6% to 2.5% and high debt levels, earnings are projected to grow at 45.2% annually, outpacing the broader market's growth rate of 15.3%. Recent advancements in pulse oximetry technology could enhance future revenue streams as Zynex targets a multi-billion dollar market opportunity.

- Insights from our recent growth report point to a promising forecast for Zynex's business outlook.

- Take a closer look at Zynex's balance sheet health here in our report.

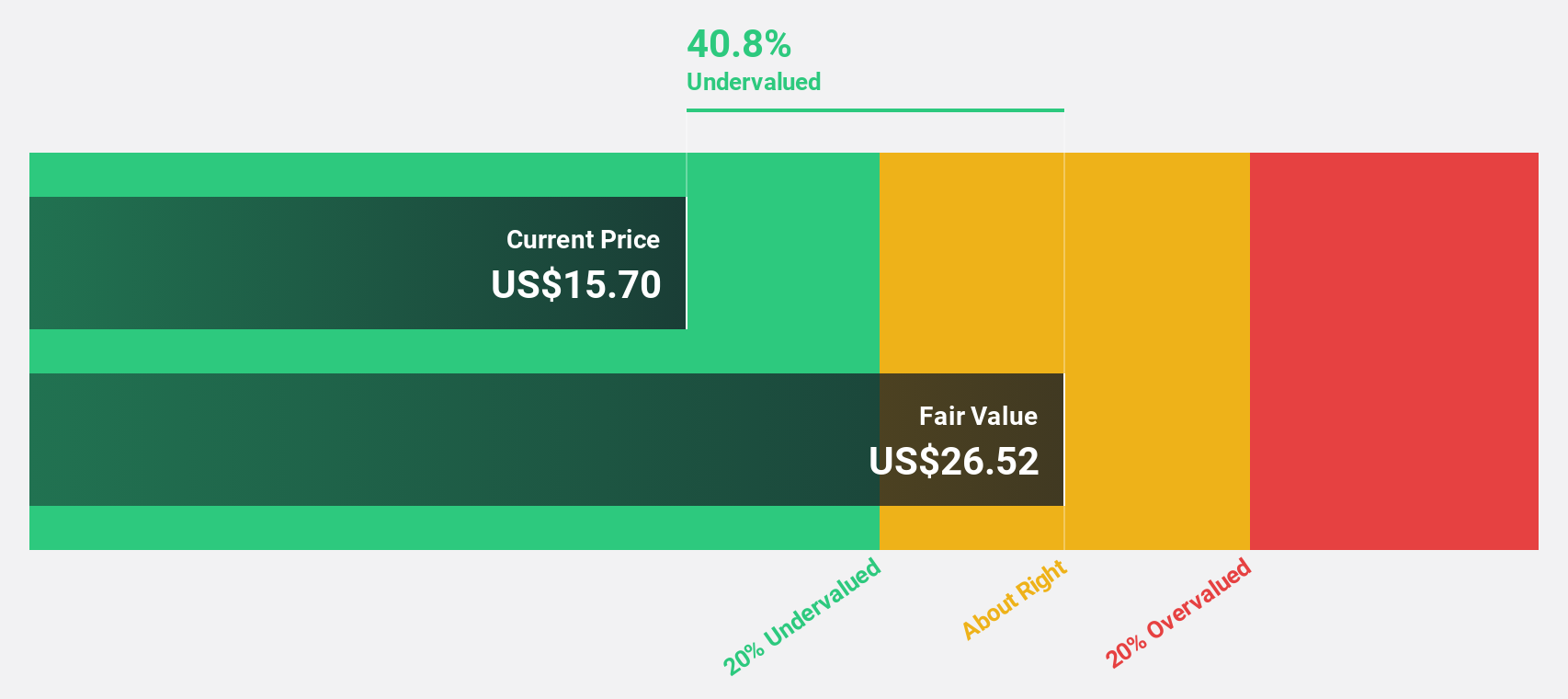

Guild Holdings (NYSE:GHLD)

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States and has a market cap of approximately $831.75 million.

Operations: The company's revenue is primarily derived from its origination segment, which accounts for $684.44 million, and its servicing segment, contributing $16.82 million.

Estimated Discount To Fair Value: 32.9%

Guild Holdings, trading at US$13.25, is priced well below its estimated fair value of US$19.74, reflecting potential undervaluation based on cash flows. Despite recent net losses and challenges with debt coverage through operating cash flow, the company is forecasted to achieve profitability within three years and exhibit annual revenue growth of 23.8%, outpacing the broader U.S. market's growth rate. Additionally, Guild Holdings actively seeks acquisitions to bolster its market presence further.

- Upon reviewing our latest growth report, Guild Holdings' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Guild Holdings with our detailed financial health report.

Where To Now?

- Click through to start exploring the rest of the 174 Undervalued US Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Guild Holdings Company originates, sells, and services residential mortgage loans in the United States.

Undervalued with high growth potential.