- United States

- /

- Consumer Durables

- /

- NYSE:SN

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 5.2%, contributing to a 9.9% increase over the past year, with earnings forecasted to grow by 14% annually. In this environment of growth, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $17.60 | $34.83 | 49.5% |

| Lantheus Holdings (NasdaqGM:LNTH) | $103.96 | $203.99 | 49% |

| Trade Desk (NasdaqGM:TTD) | $54.67 | $106.35 | 48.6% |

| SharkNinja (NYSE:SN) | $81.41 | $160.42 | 49.3% |

| Curbline Properties (NYSE:CURB) | $22.89 | $45.04 | 49.2% |

| CBIZ (NYSE:CBZ) | $67.22 | $133.31 | 49.6% |

| Ligand Pharmaceuticals (NasdaqGM:LGND) | $111.38 | $220.47 | 49.5% |

| StoneCo (NasdaqGS:STNE) | $14.08 | $27.73 | 49.2% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.29 | $10.31 | 48.7% |

| Roku (NasdaqGS:ROKU) | $69.28 | $135.72 | 49% |

Let's explore several standout options from the results in the screener.

GeneDx Holdings (NasdaqGS:WGS)

Overview: GeneDx Holdings Corp. is a genomics company that offers genetic testing services and has a market cap of approximately $3.21 billion.

Operations: The company generates revenue through its Gene Dx segment, contributing $302.29 million, and its Legacy Sema4 segment, which adds $3.16 million.

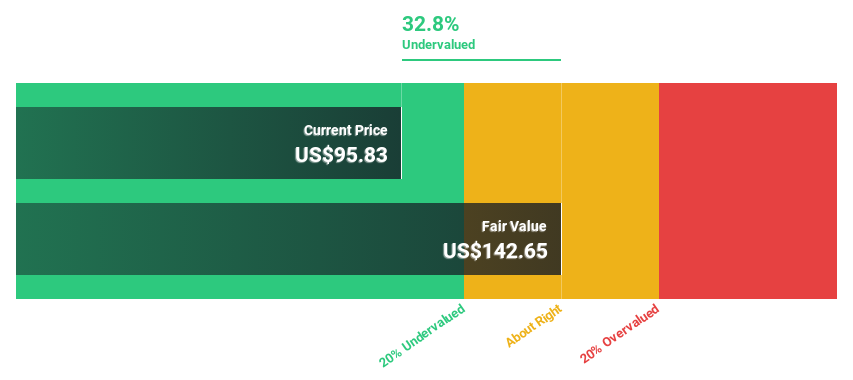

Estimated Discount To Fair Value: 14.8%

GeneDx Holdings is trading at US$116.97, 14.8% below its estimated fair value of US$137.35, indicating potential undervaluation based on cash flows. The company reported a revenue increase to US$305.45 million in 2024, with expected growth driven by strategic expansions into areas like Inborn Errors of Immunity and cerebral palsy testing. Despite recent share price volatility, GeneDx's focus on genetic insights and patient care could enhance future profitability and revenue growth prospects in the healthcare sector.

- The growth report we've compiled suggests that GeneDx Holdings' future prospects could be on the up.

- Click here to discover the nuances of GeneDx Holdings with our detailed financial health report.

Dayforce (NYSE:DAY)

Overview: Dayforce Inc. is a human capital management software company operating in the United States, Canada, Australia, and internationally, with a market cap of approximately $9.06 billion.

Operations: The company generates revenue of $1.76 billion from its Human Capital Management (HCM) segment.

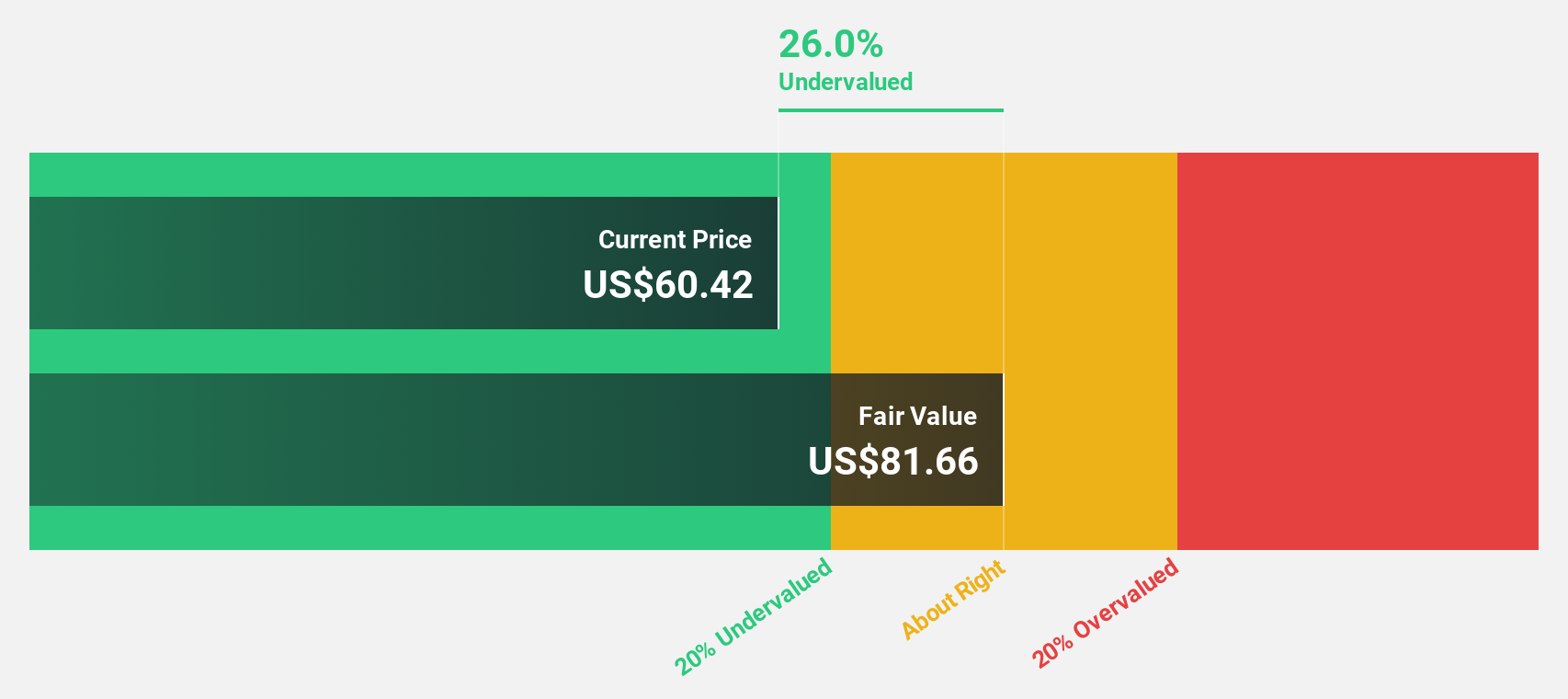

Estimated Discount To Fair Value: 31.4%

Dayforce, trading at US$57.35, is 31.4% below its estimated fair value of US$83.57, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 3.6% to 1%, revenue grew to US$1.76 billion in 2024 and is forecasted to outpace the broader U.S. market growth rate with a projected annual earnings increase of 36.3%. Recent partnerships and strategic financial adjustments could support future valuation improvements.

- Our expertly prepared growth report on Dayforce implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Dayforce.

SharkNinja (NYSE:SN)

Overview: SharkNinja, Inc. is a product design and technology company that offers consumer solutions in the United States, China, and internationally with a market cap of $11.24 billion.

Operations: The company generates revenue from its Appliance & Tool segment, amounting to $5.53 billion.

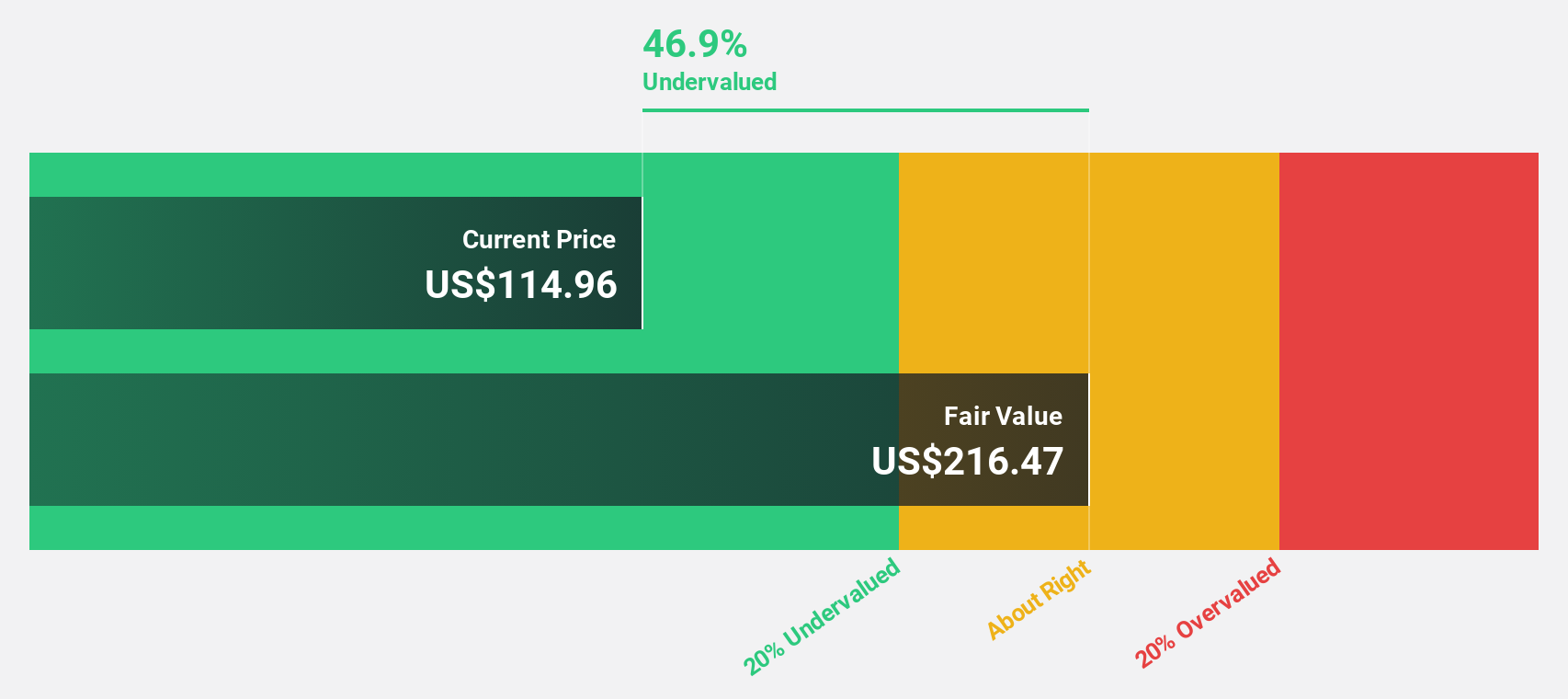

Estimated Discount To Fair Value: 49.3%

SharkNinja, trading at US$81.41, is significantly undervalued based on cash flows with an estimated fair value of US$160.42. Recent earnings grew by 162.6%, and future earnings are projected to grow faster than the U.S. market at 16.8% annually, supported by innovative product launches like FlexBreeze™ and strategic leadership changes aimed at enhancing consumer engagement and global growth strategies under new CGO Michelle Crossan-Matos.

- Upon reviewing our latest growth report, SharkNinja's projected financial performance appears quite optimistic.

- Dive into the specifics of SharkNinja here with our thorough financial health report.

Key Takeaways

- Explore the 185 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SharkNinja, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives