- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Waystar Holding (WAY): Assessing Valuation After Strong Q3 Results, Raised Outlook, and Analyst Upgrades

Reviewed by Simply Wall St

Waystar Holding (WAY) has seen its stock in the spotlight after delivering strong third-quarter numbers. With revenue up 12% over last year, the company raised its outlook and attracted fresh attention from institutional investors.

See our latest analysis for Waystar Holding.

After a solid run in the headlines, Waystar Holding’s share price has pulled back in recent weeks, down 5.7% for the past month. However, with a 1-year total shareholder return of 11.7%, momentum is still firmly on the investor’s side as market confidence in its growing healthcare payments platform deepens.

If the buzz around digital healthcare leaders sparks your curiosity, consider expanding your search. Our healthcare stocks screener is the perfect way to discover See the full list for free.

With analyst upgrades and rising institutional interest, investors are left wondering: is Waystar Holding undervalued at current prices, or is all its future growth already reflected in the share price?

Most Popular Narrative: 30.8% Undervalued

Waystar Holding's most widely followed narrative places its fair value at $50.38, significantly above the last close price of $34.87. This notable valuation gap reflects an expectation that the company's current momentum will translate into even greater financial results over the medium term.

The acquisition of Iodine Software, a leading provider of AI-powered clinical intelligence, will expand Waystar's total addressable market by over 15%. It will accelerate its product roadmap and immediately boost gross margins and adjusted EBITDA margins, setting up compounding, long-term revenue and earnings growth.

What are the bold assumptions that power this high valuation? From projected market expansion to ambitious margin targets, the full narrative breaks down the pivotal numbers and winning strategies that could drive a major re-rating. See exactly which financial forecasts are doing the heavy lifting in this 30% upside case.

Result: Fair Value of $50.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt from acquisitions and increased bargaining power among large healthcare clients could challenge Waystar’s margins and profitability if conditions shift.

Find out about the key risks to this Waystar Holding narrative.

Another View: Is the Valuation Too High?

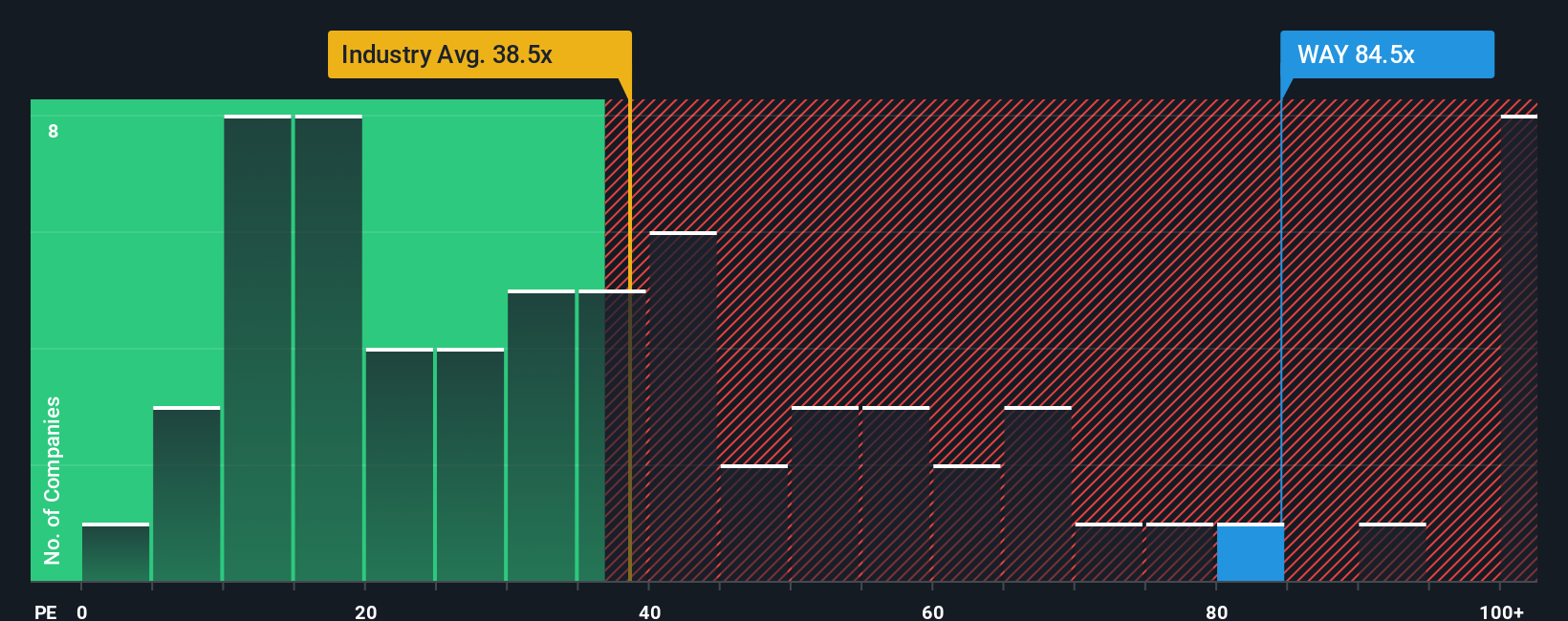

While analyst and narrative models see big upside, the market’s current valuation tells a more cautious story. Waystar trades at a price-to-earnings ratio of 60x, which is higher than both the Global Healthcare Services industry average of 34.6x and its own fair ratio of 31.5x. This kind of premium raises clear questions about valuation risk. Can the business deliver enough growth to justify such a mark-up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waystar Holding Narrative

If you see the story differently or want to run your own numbers, you can easily build a custom analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waystar Holding.

Looking for more investment ideas?

Your next winning investment could be just a click away. Don’t let great opportunities pass you by. Put our powerful screener tools to work today.

- Unlock steady income streams by uncovering high-yield opportunities with these 18 dividend stocks with yields > 3% that consistently reward shareholders.

- Zero in on tech innovators and get ahead of the curve through these 27 AI penny stocks focused on artificial intelligence breakthroughs.

- Tap into companies with attractive valuations and growth prospects using these 905 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)