- United States

- /

- Biotech

- /

- NasdaqGS:HALO

Top High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.6%, yet it remains up by an impressive 30% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience in rapidly evolving sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.92% | 27.84% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Ardelyx | 27.52% | 65.97% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.21% | 70.72% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 243 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Halozyme Therapeutics (NasdaqGS:HALO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Halozyme Therapeutics, Inc. is a biopharma technology platform company that focuses on the research, development, and commercialization of proprietary enzymes and devices across multiple countries including the United States, Switzerland, Belgium, and Japan; it has a market cap of approximately $6.41 billion.

Operations: Halozyme Therapeutics generates revenue primarily through the research, development, and commercialization of its proprietary enzymes, amounting to $873.30 million. The company's operations span multiple countries including the United States, Switzerland, Belgium, and Japan.

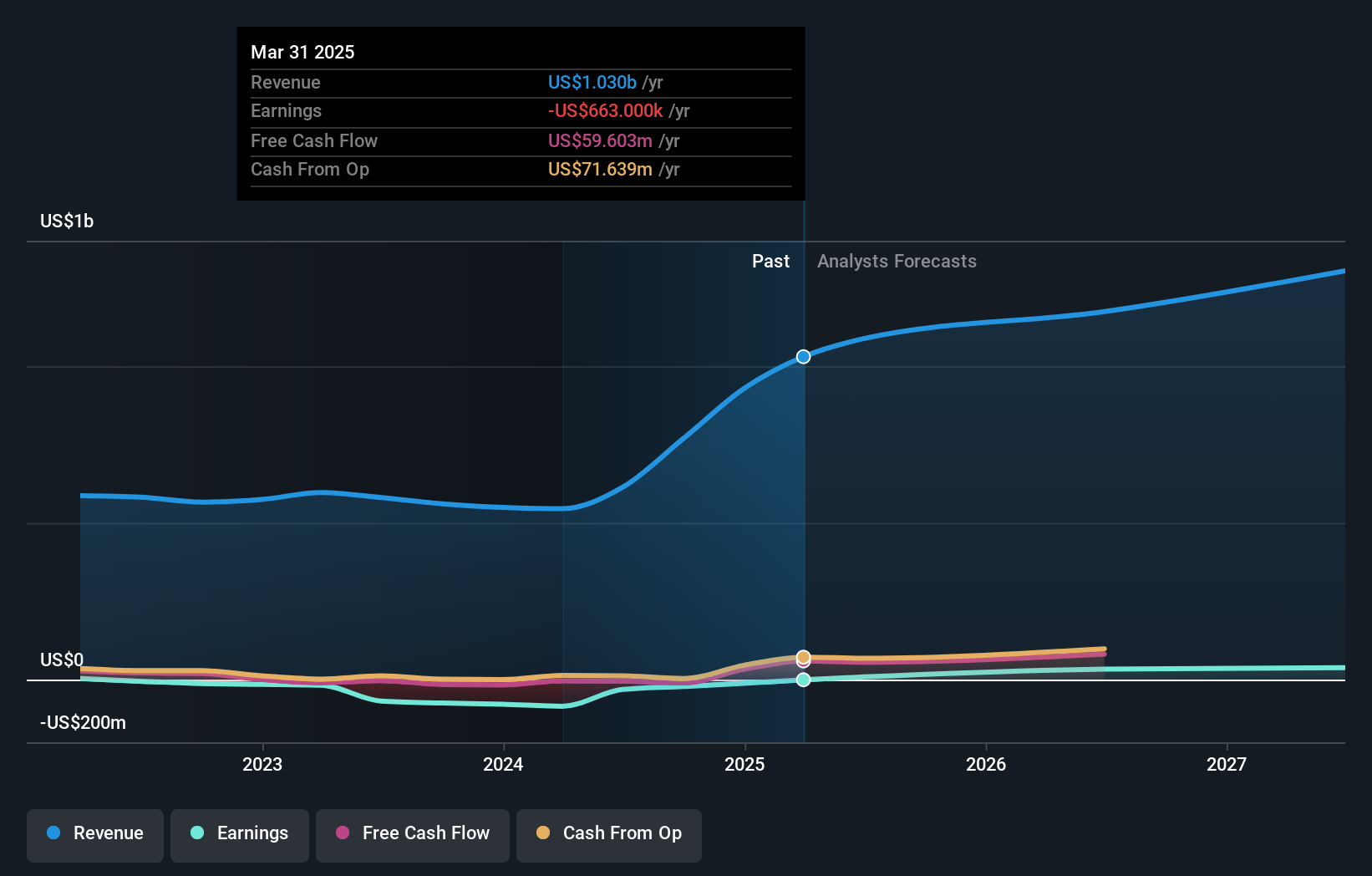

Halozyme Therapeutics, demonstrating a robust trajectory in the biotech sector, anticipates revenue growth of 15.7% annually, outpacing the broader US market's 8.9%. This surge is fundamentally anchored in escalating royalty streams and collaborative revenues, notably with recent FDA approvals enhancing its product offerings like OCREVUS ZUNOVO for multiple sclerosis treatment. Impressively, Halozyme's earnings are projected to climb by 22.4% each year over the next three years, significantly above the market average of 15.2%. The company has strategically leveraged its proprietary ENHANZE technology to forge lucrative partnerships, as evidenced by a $30 million deal with argenx for drug delivery enhancements across multiple targets—underscoring its innovative edge and potential for sustained financial health despite a high debt level noted earlier this year.

- Click here to discover the nuances of Halozyme Therapeutics with our detailed analytical health report.

Gain insights into Halozyme Therapeutics' past trends and performance with our Past report.

QuinStreet (NasdaqGS:QNST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services both in the United States and internationally, with a market cap of approximately $1.18 billion.

Operations: QuinStreet generates revenue primarily through its Direct Marketing segment, which contributes approximately $613.51 million. The company focuses on customer acquisition services for clients across various industries both domestically and internationally.

QuinStreet's trajectory in the Interactive Media and Services sector is marked by a significant expected revenue growth of 16.4% annually, contrasting with an industry average of 20%. Despite current unprofitability, the firm is poised for a turnaround with earnings forecasted to surge by 110.7% per year. Notably, its R&D investments are robust, aligning with strategic expansions in high-margin areas like Auto Insurance which recently projected an impressive year-over-year revenue increase up to $230 million for Q1 2025. These developments underscore QuinStreet's potential to harness sector trends and innovate continuously, despite facing challenges like significant insider selling and past shareholder dilution.

Waystar Holding (NasdaqGS:WAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waystar Holding Corp. develops a cloud-based software solution for healthcare payments and has a market capitalization of approximately $4.75 billion.

Operations: Waystar Holding generates revenue primarily through its Internet Software & Services segment, totaling $863.29 million. The company focuses on providing cloud-based solutions for healthcare payments.

Waystar Holding, recently added to the S&P TMI Index, is navigating a challenging landscape with a net loss widening to $43.62 million over six months, despite revenue climbing by 9.2% annually to $459.34 million. The company's commitment to growth is evident as it eyes acquisitions and forecasts annual revenues up to $918 million. Significantly, Waystar's R&D investments are robust, aligning with its strategic goals; this focus on innovation could be pivotal as earnings are expected to surge by 113.1% annually over the next three years. This blend of aggressive revenue pursuits and substantial R&D spending underscores its potential in a competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Waystar Holding.

Examine Waystar Holding's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Access the full spectrum of 243 US High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharma technology platform company, researches, develops, and commercializes proprietary enzymes and devices in the United States, Switzerland, Belgium, Japan, and internationally.

Very undervalued with solid track record.