- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

Does UFP Technologies’ (UFPT) Insider Alignment and Earnings Growth Reinforce the Investment Case?

Reviewed by Sasha Jovanovic

- In recent news, UFP Technologies reported that its earnings per share have grown by 47% annually over the last three years, with revenue up 41% and EBIT margins holding steady from last year.

- An interesting insight is that company insiders collectively hold shares valued at US$54 million, closely aligning their interests with those of other shareholders.

- We’ll explore how sustained earnings momentum and substantial insider ownership could potentially reshape UFP Technologies’ investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

UFP Technologies Investment Narrative Recap

For someone to be a shareholder in UFP Technologies, the core belief centers on the company’s ability to sustain strong earnings growth through innovation in medical device components and packaging, while effectively managing customer concentration and operational execution risks. The recent news of exceptional EPS and revenue growth underscores continued momentum, but it does not materially change the near-term catalyst tied to normalization of labor and facility efficiency challenges, nor does it significantly alter the ongoing risk from reliance on large customers. The company’s August 2025 quarterly results, which showed both sales and earnings rising strongly year-on-year, reinforce the underlying catalyst, gradual improvement in gross margins as recent labor inefficiencies at the AJR facility are expected to subside. Sustained operational recovery is supporting earnings, but any persistent disruptions at critical sites could challenge the reliability of future performance. In contrast, investors should be aware of the revenue concentration risk if one of UFP Technologies’ major customers changes direction...

Read the full narrative on UFP Technologies (it's free!)

UFP Technologies is projected to reach $694.3 million in revenue and $96.3 million in earnings by 2028. This outlook assumes a 5.7% annual revenue growth rate and a $29.2 million earnings increase from the current $67.1 million.

Uncover how UFP Technologies' forecasts yield a $329.50 fair value, a 69% upside to its current price.

Exploring Other Perspectives

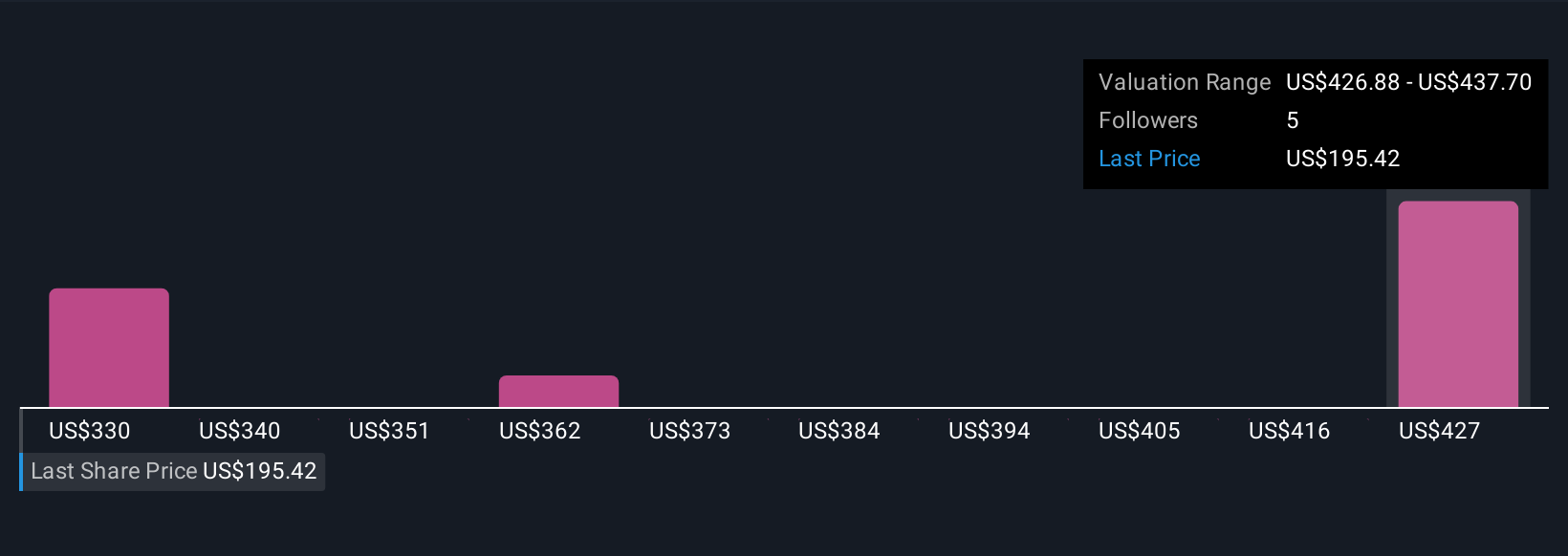

Three different Simply Wall St Community fair value estimates for UFP Technologies range from US$329.5 to US$437.40 per share, spotlighting a wide span of independent outlooks. While recent consensus highlights operational improvement as a short-term catalyst, the breadth of community valuations shows that expectations for future profitability can differ significantly, explore these viewpoints for a fuller picture.

Explore 3 other fair value estimates on UFP Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own UFP Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UFP Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Technologies' overall financial health at a glance.

No Opportunity In UFP Technologies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives