- United States

- /

- Medical Equipment

- /

- NasdaqGS:TRIB

The Market Lifts Trinity Biotech plc (NASDAQ:TRIB) Shares 34% But It Can Do More

Trinity Biotech plc (NASDAQ:TRIB) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. But the last month did very little to improve the 54% share price decline over the last year.

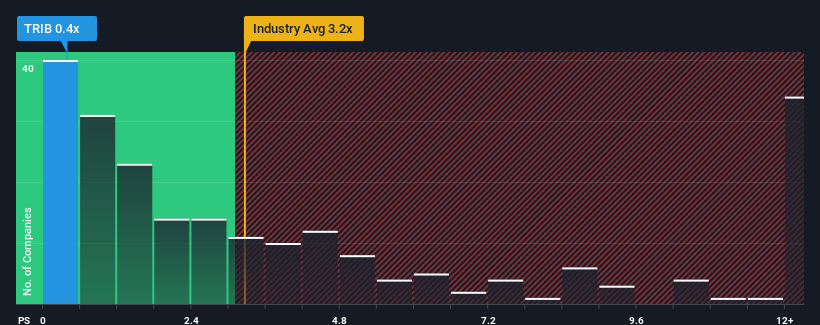

Even after such a large jump in price, Trinity Biotech may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Trinity Biotech

What Does Trinity Biotech's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Trinity Biotech's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Trinity Biotech will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Trinity Biotech's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 9.5% growth forecast for the broader industry.

With this information, we find it odd that Trinity Biotech is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in Trinity Biotech have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Trinity Biotech currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Trinity Biotech (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRIB

Trinity Biotech

Acquires, together with its subsidiaries, develops, acquires, manufactures, and markets medical diagnostic products for the clinical laboratory and point-of-care (POC) segments of the diagnostic market in the Americas and Ireland.

Medium-low and undervalued.

Similar Companies

Market Insights

Community Narratives