- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

TransMedics Group (TMDX): Assessing Valuation as Analyst Upgrades Fuel Investor Interest

Reviewed by Simply Wall St

TransMedics Group (TMDX) has caught the eye of investors lately after several analysts bumped up their earnings forecasts. This wave of optimism is anchored in the company’s progress transforming the organ transplant space. The real excitement comes from how these revised projections hint at an improving financial outlook. For investors, an uptick in analyst confidence often signals shifts in growth expectations, raising a timely question: does this change the case for owning the stock?

The past year has been anything but straightforward for TransMedics Group’s stock. Despite a sharp jump of 80% year to date, longer-term investors have watched returns swing, including a pullback of nearly 30% over the last year. Short-term momentum has returned over the past month, likely reflecting investors warming to fresh earnings estimates, even as the market weighs earlier volatility and continued revenue gains.

With positive momentum building again and analysts raising the bar on earnings, investors are left to consider: does TransMedics Group have more upside from here, or is the company’s future growth already fully priced in?

Most Popular Narrative: 15.8% Undervalued

According to community narrative, analysts see TransMedics Group as undervalued based on future earnings and growth expectations. This suggests there could be more upside from current levels.

Structural increases in organ transplant demand, driven by the aging population and higher rates of chronic disease globally, are expected to expand the addressable market for TransMedics' OCS platform. This positions the company for sustained revenue growth as transplant volumes rise. Ongoing healthcare modernization initiatives and increased recognition of organ transplantation as a cost-effective treatment are prompting both U.S. and international health systems to invest in advanced transplant infrastructure. This supports broader clinical adoption of the OCS system and should drive both domestic and international revenue acceleration.

Curious what’s fueling this optimistic target? The narrative relies on bold assumptions for ramping profitability, ambitious expansion into new markets, and a premium growth multiple that outpaces the industry. Want to find out which financial forecasts are powering this undervalued call, and how one forecast number changes everything? The details of this narrative could surprise you.

Result: Fair Value of $142.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected regulatory hurdles or setbacks in next-generation product launches could challenge this upbeat outlook and serve as catalysts for downside risk.

Find out about the key risks to this TransMedics Group narrative.Another View: SWS DCF Model Suggests Upside

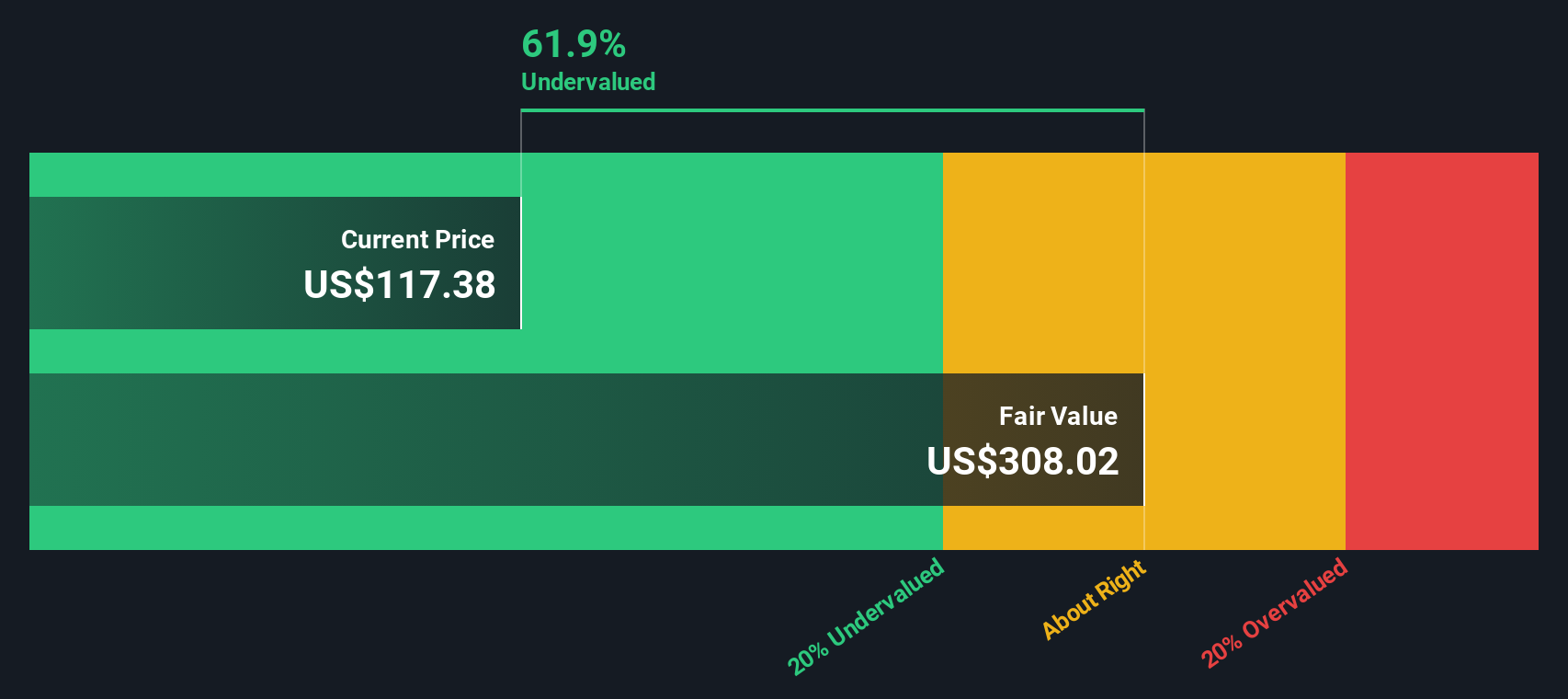

Taking a different perspective, our DCF model indicates that TransMedics Group may be undervalued. This contrasts with the premium suggested by market multiples. The question remains whether future cash flows might support even greater value than analysts currently anticipate.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TransMedics Group Narrative

If you see things differently, or want to dig into the numbers yourself, you can craft a personal narrative of your own in just minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TransMedics Group.

Looking for More Winning Investment Ideas?

Smart investors never settle for just one opportunity. If you want to stay ahead and uncover unique stocks poised for growth, now is the perfect time to tap into our handpicked investing ideas. Don't risk missing out while others identify tomorrow's outperformers; take charge with these standout screens:

- Target strong and resilient businesses by filtering for dividend stocks with yields > 3% to boost your income potential with reliable dividend-paying stocks.

- Unearth innovation powerhouses in the healthcare industry by using healthcare AI stocks to spot companies transforming medicine with AI breakthroughs.

- Secure your portfolio with technology leaders by checking out quantum computing stocks where quantum computing pioneers are shaping tomorrow's tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives