- United States

- /

- Healthcare Services

- /

- NasdaqCM:TALK

Spotlight On Talkspace And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with tech shares declining and the energy sector outperforming, investors are exploring diverse opportunities to navigate these fluctuating conditions. Penny stocks, despite their somewhat outdated name, continue to attract attention due to their potential for significant returns when backed by solid financials. This article examines three penny stocks that stand out for their financial strength and potential for growth, offering investors a chance to uncover hidden value in promising companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.03 | $443.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.92 | $708.86M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.21 | $212.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.71 | $224.65M | ✅ 3 ⚠️ 2 View Analysis > |

| Sensus Healthcare (SRTS) | $3.16 | $51.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.87 | $23.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.50 | $22.41M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.97604 | $7.18M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $87.91M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 373 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States, with a market cap of $437.09 million.

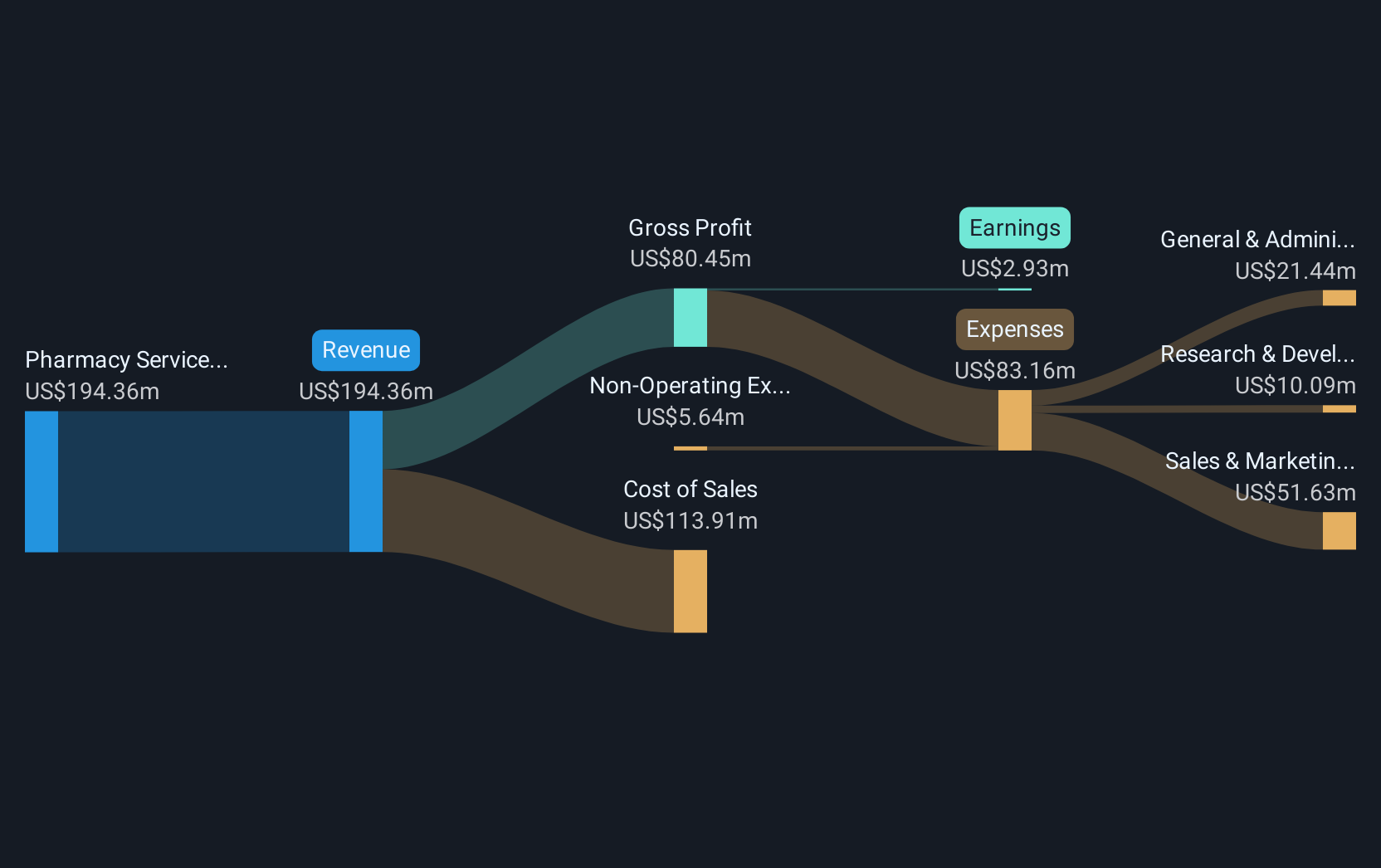

Operations: The company generates revenue from its Healthcare Facilities & Services segment, totaling $202.61 million.

Market Cap: $437.09M

Talkspace, Inc., a virtual behavioral healthcare company, recently reported a revenue of US$54.31 million for Q2 2025, marking an improvement from the previous year. Despite experiencing a net loss of US$0.541 million in the same period, Talkspace has become profitable over the past year and maintains no debt obligations. The company's short-term assets significantly exceed both its short- and long-term liabilities, indicating strong financial health. Recent partnerships with Express Access and Tia Health aim to enhance mental health access and expand into women's health services, potentially driving future growth within its healthcare facilities segment.

- Dive into the specifics of Talkspace here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Talkspace's future.

GoPro (GPRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoPro, Inc. is a company that offers cameras, mountable and wearable accessories, along with subscription services across various regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific; it has a market cap of approximately $455.57 million.

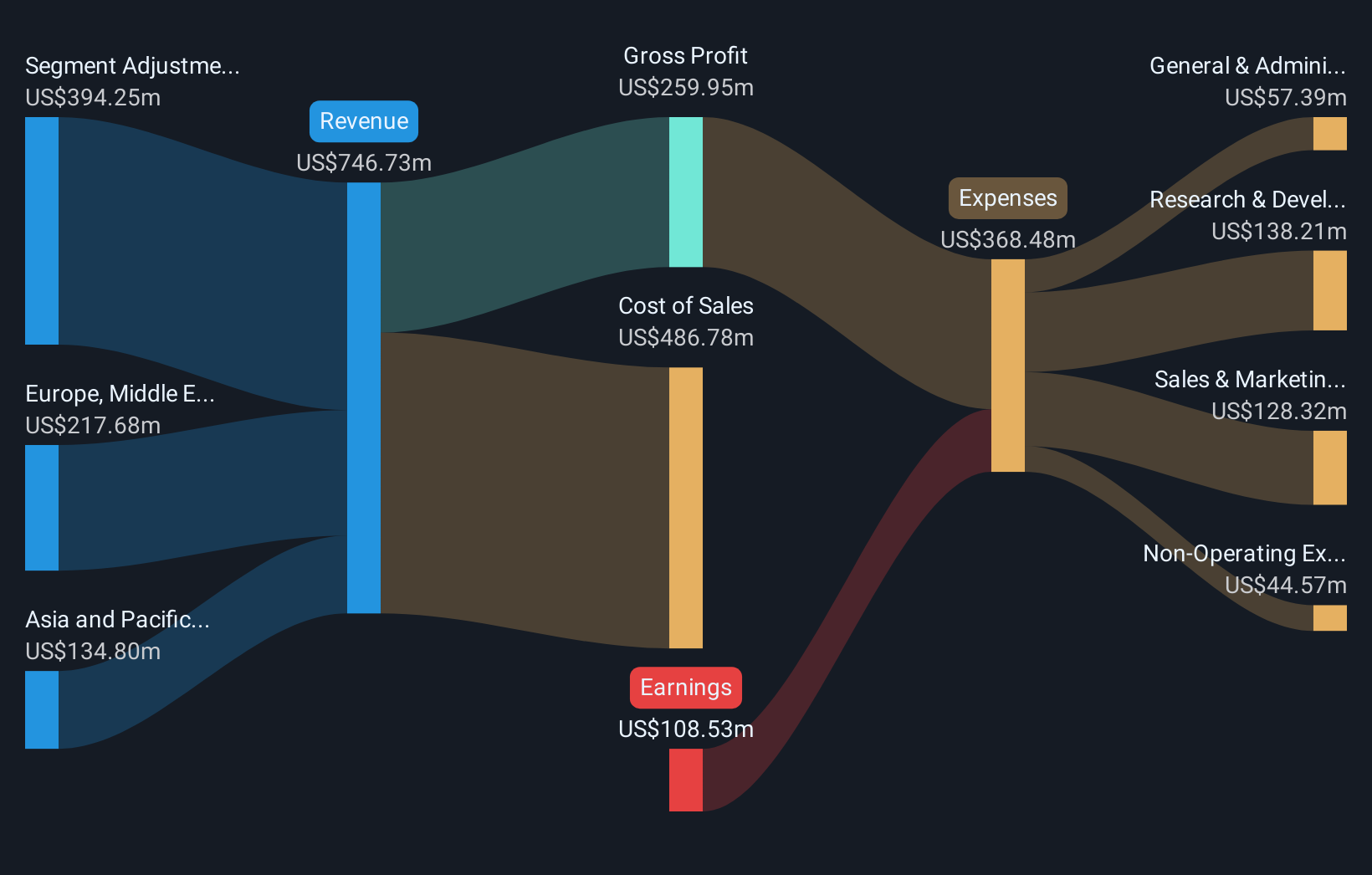

Operations: The company's revenue is primarily generated from its photographic equipment and supplies segment, which amounted to $746.73 million.

Market Cap: $455.57M

GoPro, Inc. faces challenges as a penny stock with ongoing unprofitability and increased volatility. Its short-term assets of US$255.5 million fall short of covering US$309.1 million in liabilities, though long-term liabilities are manageable at US$32 million. Despite reducing its debt-to-equity ratio over five years, the company remains highly leveraged with a net debt to equity ratio of 40.8%. Recent product launches like the MAX2 camera aim to diversify revenue streams, while recent capital raises and strategic financing initiatives bolster liquidity ahead of upcoming debt maturities, providing some runway for operational stability amidst financial pressures.

- Unlock comprehensive insights into our analysis of GoPro stock in this financial health report.

- Evaluate GoPro's prospects by accessing our earnings growth report.

RPC (RES)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: RPC, Inc. provides a variety of oilfield services and equipment for companies in the oil and gas industry, with a market cap of $982.68 million.

Operations: RPC's revenue is primarily derived from Technical Services, which generated $1.34 billion, and Support Services, contributing $89.97 million.

Market Cap: $982.68M

RPC, Inc., a penny stock in the oilfield services sector, shows mixed financial health. Despite an experienced management team and board, its net profit margins have declined from 7.9% to 3.7%. Earnings growth has been negative over the past year, yet RPC maintains high-quality earnings and forecasts a 12.44% annual growth rate. The company is financially stable with more cash than debt and short-term assets exceeding liabilities significantly. However, its dividend track record remains unstable despite recent affirmations of a quarterly cash dividend of US$0.04 per share for September 2025 payouts.

- Jump into the full analysis health report here for a deeper understanding of RPC.

- Assess RPC's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 370 US Penny Stocks now.

- Curious About Other Options? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talkspace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TALK

Talkspace

Operates as a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives