- United States

- /

- Food

- /

- NYSE:BRCC

Top Growth Companies With Insider Stakes In September 2025

Reviewed by Simply Wall St

As the U.S. stock market rebounds with major indexes like the Dow Jones and S&P 500 rising after inflation data met expectations, investors are keenly observing how these economic indicators influence broader market trends. In such an environment, growth companies with high insider ownership often attract attention due to their potential for alignment between management and shareholder interests, which can be particularly appealing when navigating fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 68% |

| Hippo Holdings (HIPO) | 14.0% | 41.2% |

| Hesai Group (HSAI) | 15.5% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

Let's dive into some prime choices out of the screener.

Sanara MedTech (SMTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sanara MedTech Inc. is a medical technology company that focuses on developing, marketing, and distributing surgical, wound, and skincare products and services to healthcare providers across the United States, with a market cap of $289.95 million.

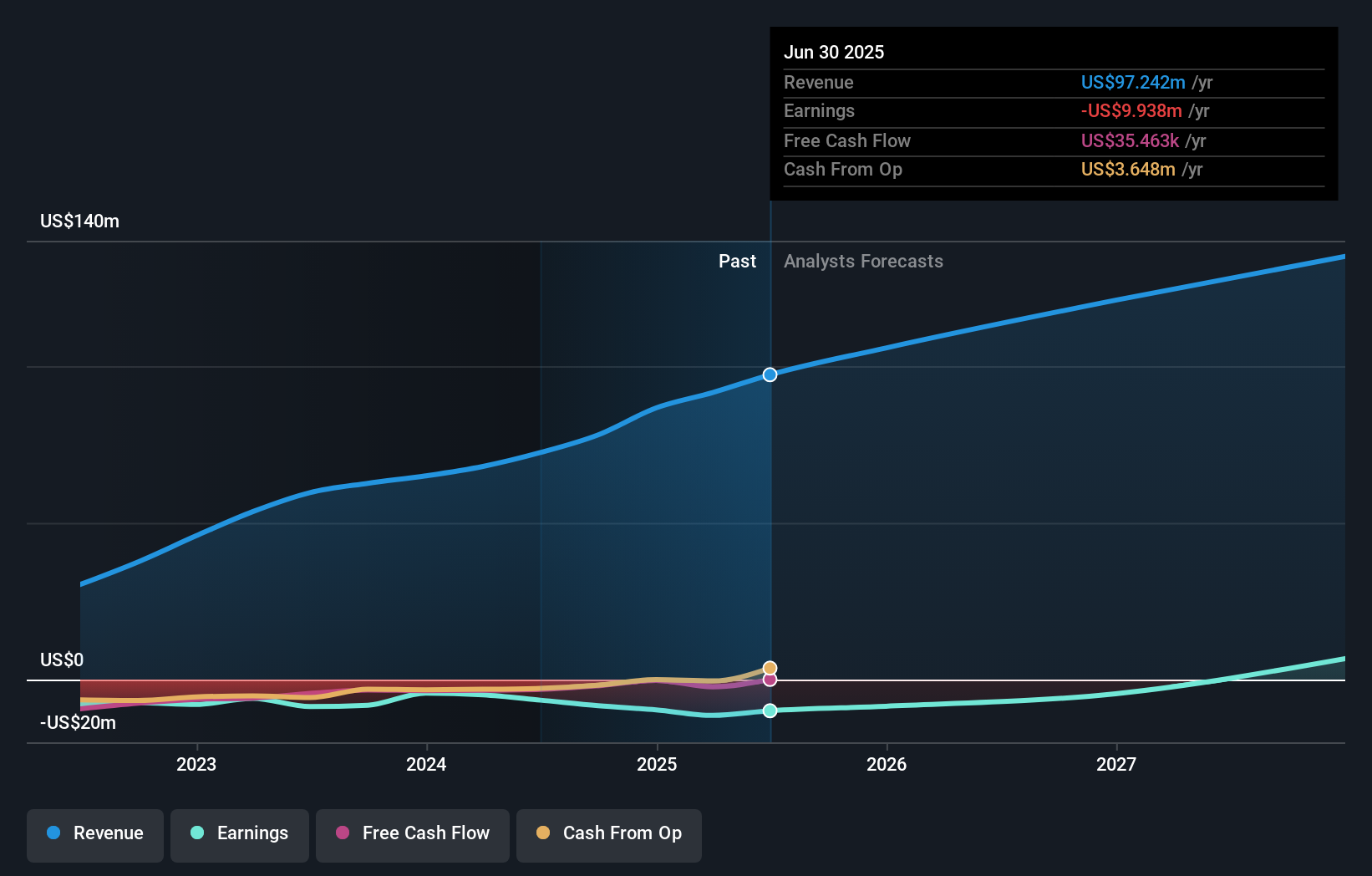

Operations: Sanara MedTech generates revenue primarily from its Sanara Surgical segment, which accounts for $97.22 million.

Insider Ownership: 31.2%

Sanara MedTech, a growth-oriented company with significant insider ownership, is projected to experience revenue growth of 13.2% annually, surpassing the US market's average. The company is trading at 18.1% below its estimated fair value and is expected to achieve profitability within three years. Recent executive changes include Seth Yon becoming CEO, succeeding Ron Nixon as Executive Chairman. Despite reporting a net loss of US$2.01 million in Q2 2025, sales increased to US$25.83 million from the previous year.

- Delve into the full analysis future growth report here for a deeper understanding of Sanara MedTech.

- Insights from our recent valuation report point to the potential overvaluation of Sanara MedTech shares in the market.

Playtika Holding (PLTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtika Holding Corp. is a company that develops mobile games across various regions including the United States, Europe, and Asia Pacific, with a market cap of approximately $1.34 billion.

Operations: The company's revenue is primarily derived from its Computer Graphics segment, which generated $2.67 billion.

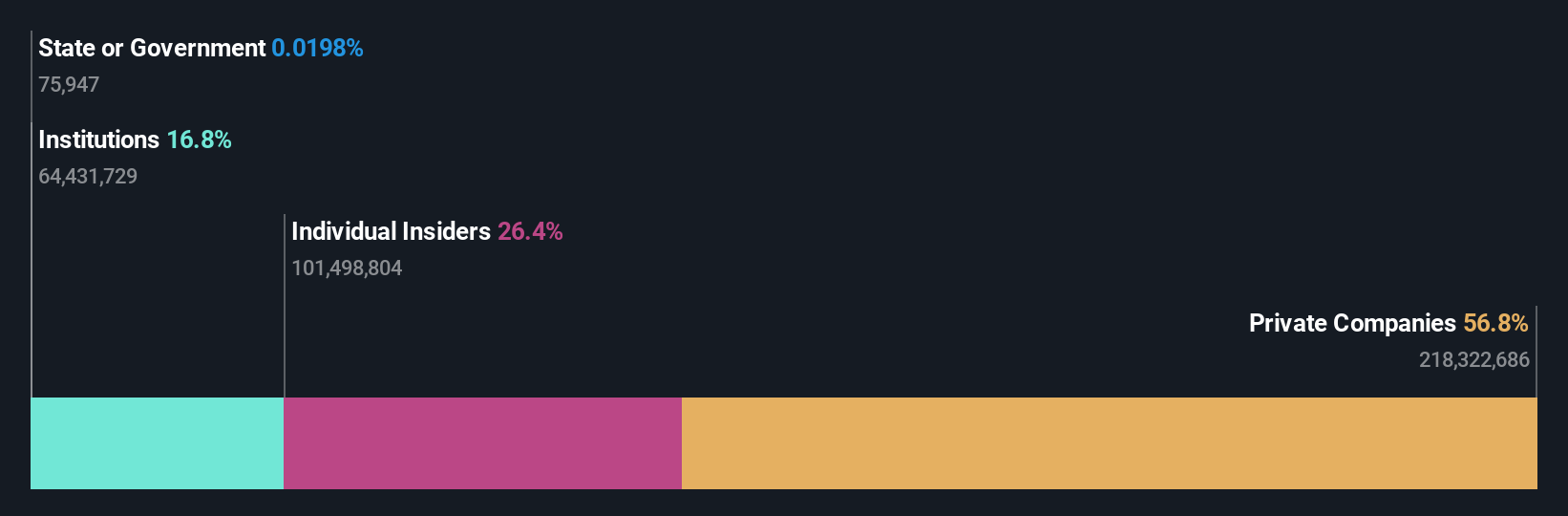

Insider Ownership: 26.4%

Playtika Holding, with substantial insider ownership, is forecasted to achieve significant earnings growth of 26.1% annually, outpacing the US market. Despite a decline in net income to US$33.2 million in Q2 2025 from US$86.6 million the previous year, revenue rose to US$696 million. The company's shares are trading at 59.9% below estimated fair value, yet its debt coverage by operating cash flow is inadequate and profit margins have decreased year-over-year.

- Click here and access our complete growth analysis report to understand the dynamics of Playtika Holding.

- The analysis detailed in our Playtika Holding valuation report hints at an deflated share price compared to its estimated value.

BRC (BRCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BRC Inc. operates by purchasing, roasting, and selling coffee and coffee accessories in the United States, with a market cap of approximately $389.71 million.

Operations: The company's revenue is primarily derived from its Consumer Products Business, which generated $388.89 million.

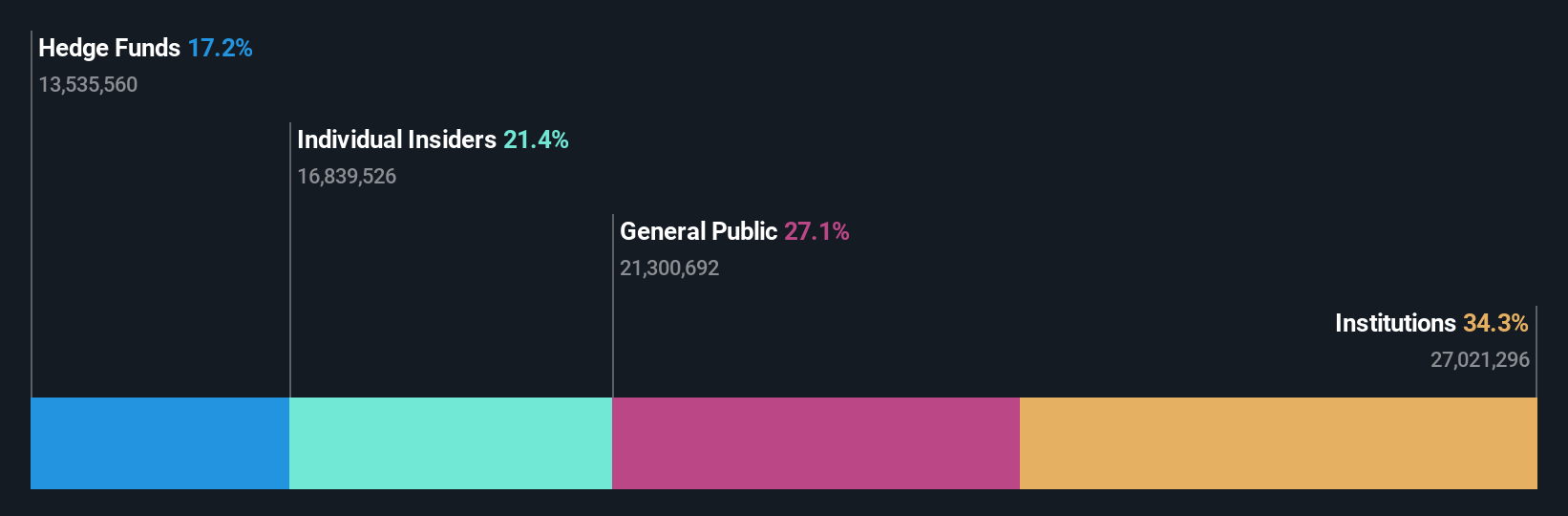

Insider Ownership: 16.4%

BRC Inc., with significant insider ownership and recent substantial insider buying, is positioned for above-market growth, expecting profitability within three years. Despite a net loss of US$5.33 million in Q2 2025, sales increased to US$94.84 million. The company trades at a considerable discount to its estimated fair value and forecasts revenue growth of 12.8% annually, surpassing the broader market's expected rate but faces challenges like high share price volatility and past shareholder dilution.

- Dive into the specifics of BRC here with our thorough growth forecast report.

- Our valuation report here indicates BRC may be undervalued.

Next Steps

- Navigate through the entire inventory of 200 Fast Growing US Companies With High Insider Ownership here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BRC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRCC

BRC

Through its subsidiaries, purchases, roasts, and sells coffee and coffee accessories in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives