- United States

- /

- Healthtech

- /

- NasdaqGS:SLP

Simulations Plus, Inc.'s (NASDAQ:SLP) Stock Retreats 36% But Earnings Haven't Escaped The Attention Of Investors

Simulations Plus, Inc. (NASDAQ:SLP) shares have had a horrible month, losing 36% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

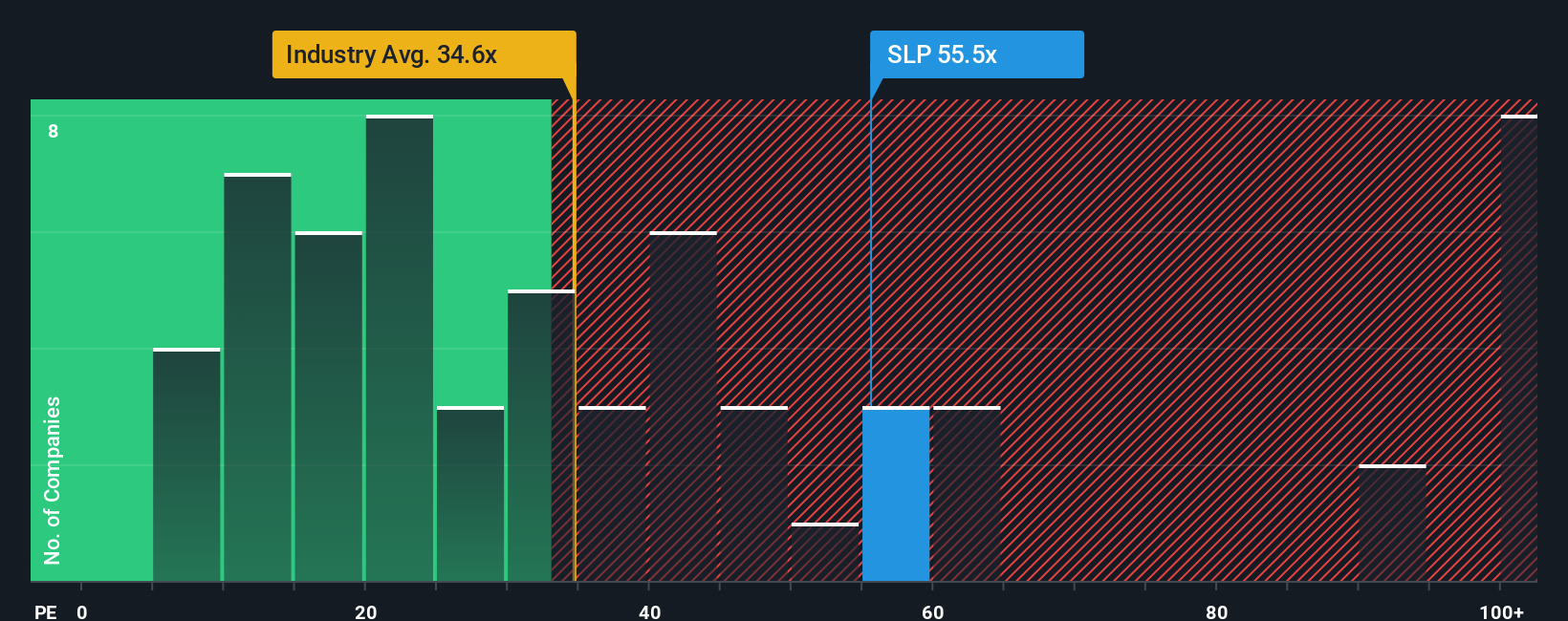

Even after such a large drop in price, Simulations Plus may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 55.5x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Simulations Plus' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Simulations Plus

Does Growth Match The High P/E?

In order to justify its P/E ratio, Simulations Plus would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 37% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 28% per year during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 10% per year growth forecast for the broader market.

With this information, we can see why Simulations Plus is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Even after such a strong price drop, Simulations Plus' P/E still exceeds the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Simulations Plus maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Simulations Plus is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLP

Simulations Plus

Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives