- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Market Cool On Surgery Partners, Inc.'s (NASDAQ:SGRY) Revenues Pushing Shares 28% Lower

The Surgery Partners, Inc. (NASDAQ:SGRY) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

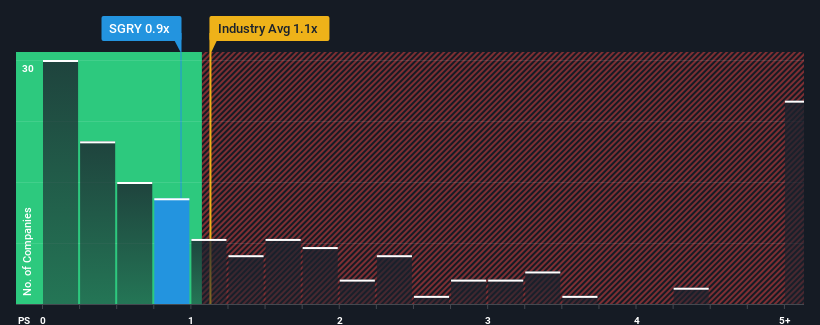

Although its price has dipped substantially, it's still not a stretch to say that Surgery Partners' price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Healthcare industry in the United States, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Surgery Partners

What Does Surgery Partners' Recent Performance Look Like?

Recent revenue growth for Surgery Partners has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Surgery Partners will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Surgery Partners.How Is Surgery Partners' Revenue Growth Trending?

Surgery Partners' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10.0% last year. This was backed up an excellent period prior to see revenue up by 38% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 10% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 7.7% per year, which is noticeably less attractive.

With this information, we find it interesting that Surgery Partners is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Surgery Partners' P/S

Surgery Partners' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Surgery Partners' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Surgery Partners with six simple checks.

If these risks are making you reconsider your opinion on Surgery Partners, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives