- United States

- /

- Healthtech

- /

- NasdaqGS:SDGR

Market Participants Recognise Schrödinger, Inc.'s (NASDAQ:SDGR) Revenues Pushing Shares 25% Higher

Schrödinger, Inc. (NASDAQ:SDGR) shares have continued their recent momentum with a 25% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.3% in the last twelve months.

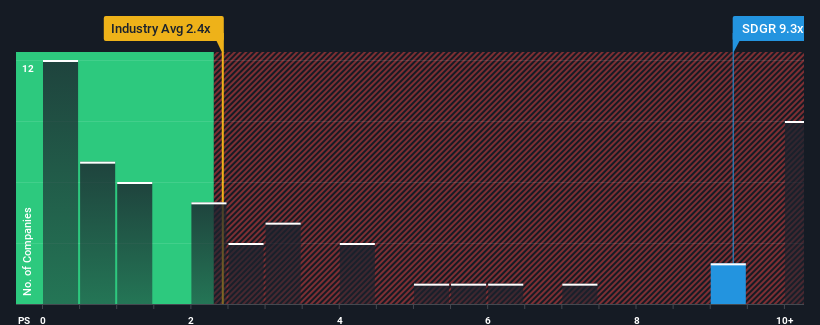

After such a large jump in price, given around half the companies in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Schrödinger as a stock to avoid entirely with its 9.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Schrödinger

How Schrödinger Has Been Performing

Schrödinger could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Schrödinger will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Schrödinger would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 3.0% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 55% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 21% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's understandable that Schrödinger's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Schrödinger's P/S Mean For Investors?

Shares in Schrödinger have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Schrödinger's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Schrödinger is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Schrödinger's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Schrödinger, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SDGR

Schrödinger

Develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives